Last week, Thomas Wyatt Nigeria Plc was suspended alongside 5 other firms by the Nigerian Stock Exchange (NSE). The suspension was placed due to the companies’ failure to release their financial statements when due. The company eventually submitted its audited results for the financial year ended March 2018.

While revenue increased from N64.4 million in 2017 to N86.3 million in 2018, loss before tax jumped from N40 million in 2017 to N139 million in 2018. Loss after tax also increased from N41 million in 2017 to N98 million in 2018.

Close to the redline

Though the company’s auditors, BBC Professionals, noted that its most recent statements were prepared on a going concern status, they, however, issued a note of caution concerning three items which could cause that to change in the nearest future.

Pending litigations

Shareholders in 2010 took the company to court over the sale of its head office to Leadway Assurance Plc.

Inadequate Top Management

The company has yet to appoint an acting Managing Director since the demise of its previous MD, Emma Obinyan in October 2013.

Fiddling while the ship is sinking

While the company’s board stated that it was addressing the issues, there was no mention of a concrete plan. The finance and strategy committee met just once during the year. The company’s website still lists Emma Obinyan and Tony Anenih, who are deceased, as directors.

Continuous loss over the years

The company has consistently made losses in the last five years, despite increasing revenue. Turnover increased from N54 million in 2014 to N86.3 million in 2018. Loss before tax, however, increased from N9.4 million in 2014 to N98.5 million in 2018.

Costs are weighty

While the company has steadily increased its revenue, costs are weighing down its operations. In 2018, the company made N89 million as revenue, but incurred a finance cost of N93 million, essentially wiping away revenue. The firm provided no break down of the finance costs into short and long-term loans.

Equity and retained earnings are negative at N286 million and N567 million respectively, meaning that the company is surviving on bank loans.

Going Forward

The firm is in dire need of raising capital, and if it fails to do so, its ability to continue as a going concern may be in jeopardy. The company’s share price has been on a downward spiral in the last 5 years, so an equity raise is out of the question. From N0.83 in 2014, the stock last traded at N0.23 on the 5th of October, its last trade before the suspension.

An out of court settlement of the case filed by retail investors should be pursued, and more funds injected by the core investors, Moorehouse Management Limited.

About the company

Thomas Wyatt and Sons (formerly known as Thomas and Sons West Africa) was incorporated on the 18th of March, 1948 as a private limited liability company and commenced business in 1979. It became a public company in 1978.

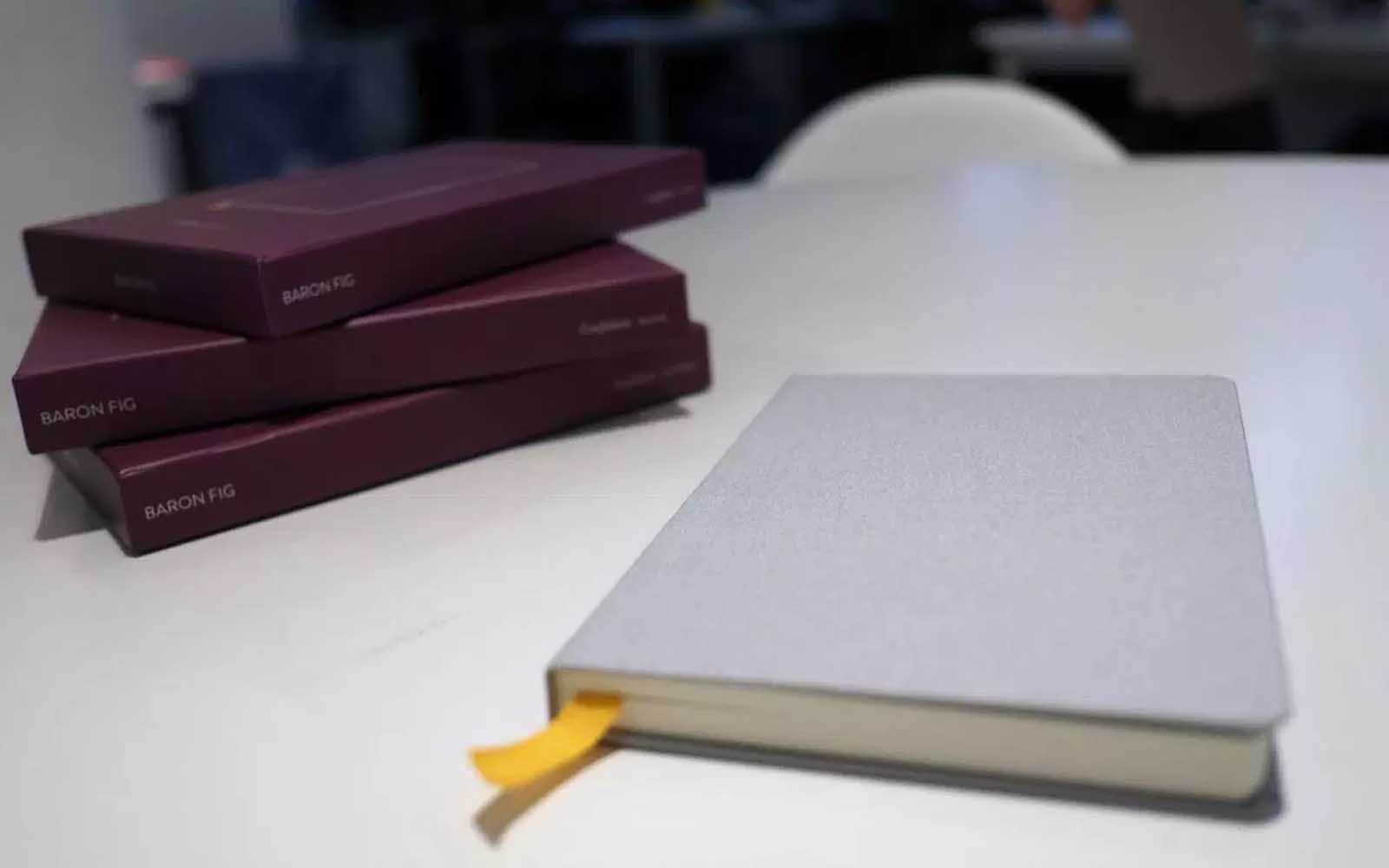

The company’s principal activities include the school exercise books, hardcover notebooks and other paper materials.