Daily performance of major economic indicators and highlights from tradings sessions and key statistics such as Treasury Bills, bonds, FX rates, inflation, oil price.

Bond Market Turns Bearish Following Selloff on Mid-Tenors

Mobilise More Domestic Revenue, Repair Refineries Lagarde Tells Govt

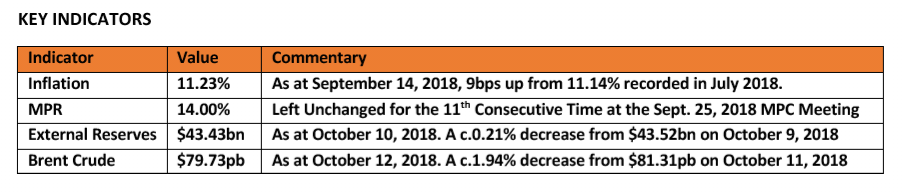

KEY INDICATORS

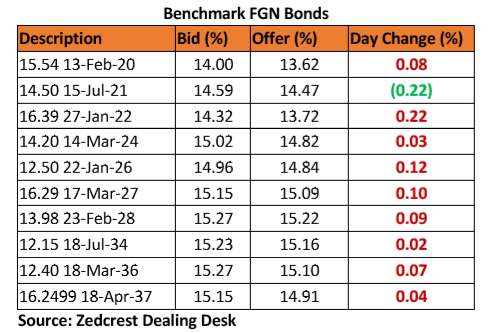

Bonds

The bond market turned bearish in today’s session, with yields trending higher by c.6bps, following slight selloff on the mid-tenors (26s – 28s). Except for slight interests on the 21s, other maturities remained scantily traded, even as their bids weakened in tune with the overall sentiment on the day. Yields consequently closed c.13bps higher W-o-W.

In the coming week, we expect the bearish sentiments to persist, as market players anticipate a further uptick in the inflation results to be published. Market players are also expected to maintain a short bias ahead of the bond auction scheduled for the 24th of October.

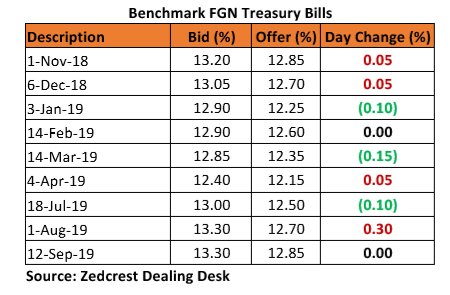

Treasury Bills

The T-bills market traded flat, with very little volumes traded over the course of the day. This was due to the constraint in system liqudity which was significantly compressed by funding for a Retail FX auction by the CBN.

We expect the market to open nextweek on a slightly bearish note, due to expected outflows for a Wholsale SMIS by the CBN on Monday, and further expectations for renewed supply of T-bills at a PMA on Wednesday and an expected OMO auction on Thursday. Investors are however expected to favour the short tenors due to the higher discounts available in the secondary market.

Money Market

In line with our expectations, the OBB and OVN rates spiked by c.10pct to 19.17% and 19.75%, as the huge outflows for the Retail FX funding (estimated at c.N350bn) sucked out most of the available system liquidity which opened the day at c.N395bn positive.

We expect rates to remain pressured opening next week due to further outflows expected via a wholesale SMIS by the CBN. We expect that the OVN rate may trend as high as 30%, with system liquidity likely to fall into negative territory.

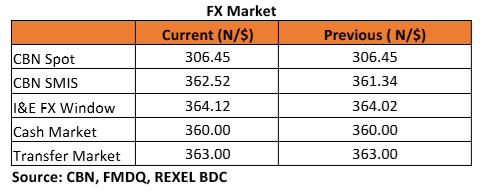

FX Market

At the Interbank, the Naira/USD rate remained stable at N306.45/$ (spot), while the SMIS rate depreciated by c.0.33% to N362.52/$ from N361.34/$ previously. At the I&E FX window a total of $295.08mn was traded in 356 deals, with rates ranging between N345.00/$ – N365.50/$, whilst the closing rate depreciated slightly by c.0.03% to N364.12/$ from N364.02/$ previously.

At the parallel market, the cash and transfer rates remained unchanged at N360.00/$ and N363.00/$ respectively.

Eurobonds

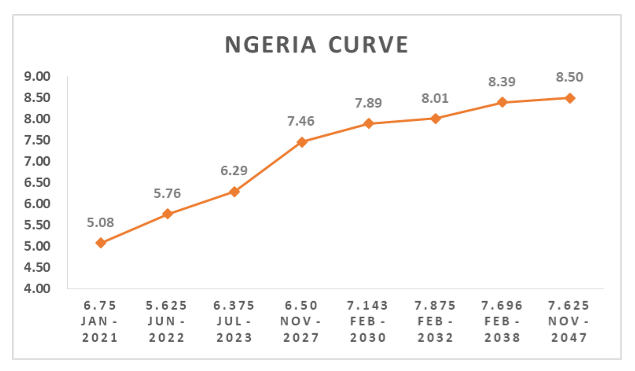

The NGERIA sovereigns pared some losses in today’s session, with yields compressing slightly by c.4bps, consequently narrowing the week to date loss to c.20bps. The most gains were on the 47s, which fell back to c.8.50%, with a c.0.75pct PX gain on the day.

We witnessed continued interests around the shorter dated NGERIA Corps; GRTBNL 18s, ZENITH 19s and DIAMBK 19s. Investors were also slightly bullish on the ZENITH 22s and SEPLLN 23s.

Disclaimer:

Whilst proper and reasonable care has been taken in the preparation and accuracy of the facts and figures presented in this report, no responsibility or liability is accepted by Zedcrest Capital or its employees for any error, omission or opinion expressed herein. This report is not an investment research or a research recommendation and should not be regarded as such. The information provided herein is by no means intended to provide a sufficient basis on which to make an investment decision.