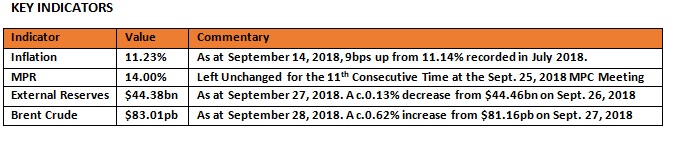

***Nigerian Oil Union Says Chevron Talks on Job Cuts Resume*** – Bloomberg

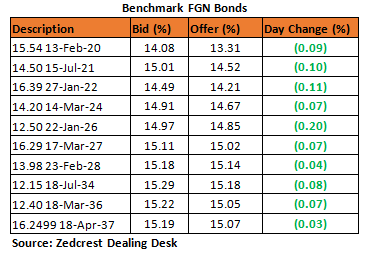

Bonds

The Bond Market remained bullish in today’s session, with yields compressing by c.9bps on average. We witnessed continued interests on the mid to long end of the curve, with the 26s, 27s and 37s breaking the 15% support to trade as low as 14.86%, 14.99% and 14.96% respectively. They however gave up some gains later in the day, with the 27s and 37s ending above 15%, while the 26s remained sub-15%. Yields consequently closed the month lower by c.9bps M/M, with renewed local interests been the major driver of the marginal gains on the month.

In the coming month, we expect yields to remain largely above the 15% mark, with the recent rally post the FGN Bond Auction expected to subside in subsequent sessions.

Treasury Bills

The T-bills market traded relatively flat on the day, as market players wound up their books for the month. Buying interests were also subdued due to the Retail FX auction by the CBN, and also because the expected inflows from FAAC payments did not come in until much later in the day.

Opening next month, we expect the market to be largely driven by the tempo of OMO interventions by the CBN. We expect slight buying interests to resurface if the CBN fails to conduct an OMO auction prior to the PMA expected on the 3rd of October, where the DMO intends to rollover a total of c.N133.50bn maturing T-bills.

Money Market

The OBB and OVN rates remained stable to close the month at 6.00% and 7.17% respectively, as inflows from Retail FX refunds and OMO maturities in the previous session, helped moderate outflows for the Retail FX auction in today’s session. System Liquidity which opened the day at c.N580bn positive, is estimated to close the month at same levels, having received a boost from FAAC Inflows later in the day.

We expect rates to remain moderated opening next week, barring a significant OMO Sale by the CBN.

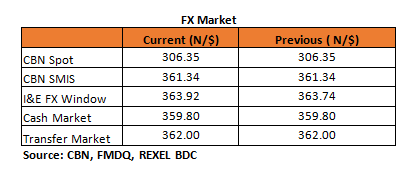

FX Market

At the Interbank, the Naira/USD rate remained stable at N306.35/$ (spot) and N361.34/$ (SMIS). At the I&E FX window a total of $289.73mn was traded in 349 deals, with rates ranging between N358.00/$ – N365.00/$. The NAFEX closing rate depreciated by c.0.05% to N363.92/$ from N363.74/$ previously.

At the parallel market, the cash and transfer rate remained unchanged at N359.80/$ and N362.00/$ respectively.

Eurobonds

The recent bullish run in the NGERIA Sovereigns flattened out in today’s session, as yields closed relatively flat on the day, with a c.1bp marginal uptick. Yields were however lower by c.50bps on the month, following the resurgent interests witnessed across EMs and in the SSAs in the later part of the month.

The NGERIA Corps were also relatively flat, except for some interest seen on the DIAMBK 19s which gained c.0.85pct on the day.