Minority shareholders of First Aluminium Plc at the company’s Annual General Meeting (AGM) held recently, expressed outrage at plans to voluntarily delist from the Nigerian Stock Exchange (NSE).

The AGM, which had gone on smoothly till then, became rancorous when the motion for voluntary delisting from the Nigerian Stock Exchange (NSE) was moved.

A poll vote was eventually requested by the Chairman (relying on section 224 of the Corporate and Allied Matters Act).

At any general meeting, a resolution put to the vote shall be decided on a show of hands, unless a poll is (before or on the declaration of the result of the show of hands) demanded by –

The chairman, where he is a shareholder or a proxy.

At least three members present in person or by proxy.

Results of the poll will be published in two national newspapers and on the company’s website. The shareholders, in anger, destroyed plates meant for the serving food.

Reasons behind the planned delisting

Vice Chairman of the company, Tosa Ogbomo, during the meeting, stated that the company had considered the move as it would enable it to pursue other means of raising funds for capital. Bank charges are currently taking up a huge chunk of the company’s earnings.

For the financial year ended December 2017, the company made N1.2 billion as operating profit but paid N733 million as bank charges.

For the half year ended June 2018, the company made N211 million as operating profit but paid N128 million as finance costs.

A public offer would not be feasible, as the current low share price would mean issuing a large volume of shares. This would severely dilute the shareholding of current shareholders. The company already has 2.11 billion shares outstanding.

A rights issue could also result in the squeezing out of retail investors, as they typically do not take up their shares.

Alucon of SA holds 75% of the company’s issued share capital.

Mr. Ogbomo, however, assured the shareholders that they would still own their shares post-delisting.

Why shareholders are angry

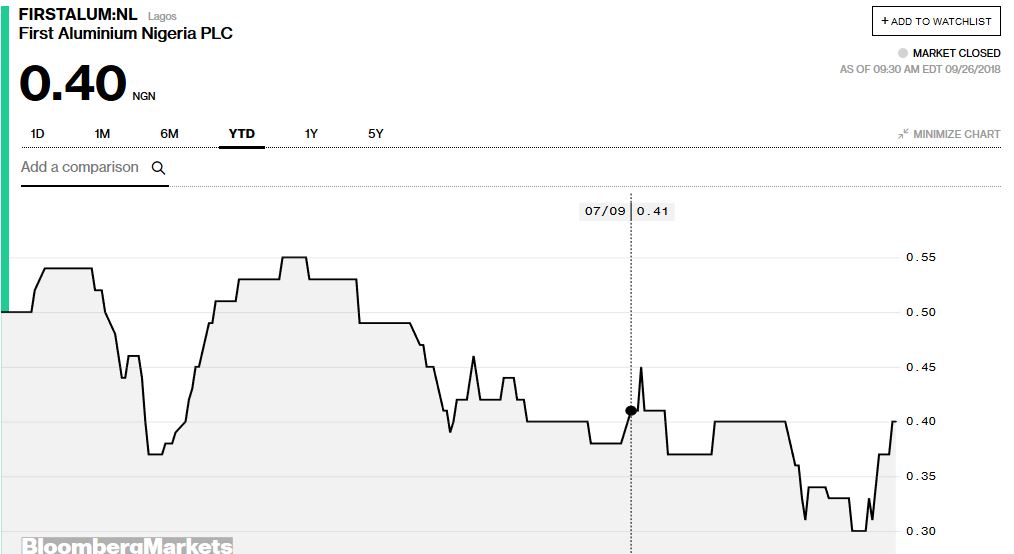

For retail investors, the situation could most likely lead to a mandatory tender offer (MTO). Under NSE rules, the tender offer would be at the highest price in the last six months before the MTO was announced. This would most likely be in the region of N0.55 per share.

Many of the shareholders had bought the stock when it was trading at N5, some at a much higher level. This would amount to a huge loss.

Year to date, the stock is down 20%.

The shareholders are also of the opinion that the move is an ill-timed one in view of the company’s return to profitability.

Fighting a losing battle

Minority shareholders are fighting a losing battle, as the majority shareholders outnumber them, and will eventually carry on with the delisting. Failing that, they could opt for a mandatory takeover.

the regulatory should make show that first aluminum management conduct another meeting because the last AGM IS an embarrassment to nigeria investor and the action will have a negative effect on the capital market and the investors are going to lose confidence on the market

we the shareholders of the company want efcc,icpc to investigate the investors bringing in money for the company a company that have not been paying dividend

the regulator should not aspect the listing process because the meeting is and embarrassment to nigeria investors and to the capital market. the board should call for another meeting the meeting is a show of shame