The performance of the Nigerian Equity Market returned bullish last week with the index (NSE ASI) up by WTD to close at 0.45% an index level of 35,426.17 and Market capitalization at N12.93 trillion.

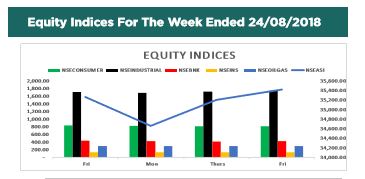

The sectoral performance was negative as bearish sentiments were witnessed in all sectors with the exception of Industrial Goods sector and Insurance that rose by 1.96% and 0.78% respectively. The Banking sector recorded the highest decline amongst NSE indices with the NSE Banking Index down by 3.04% WTD, owing to significant price depreciation in UBA (-4.19%) and ZENITHBNK (-3.94%).

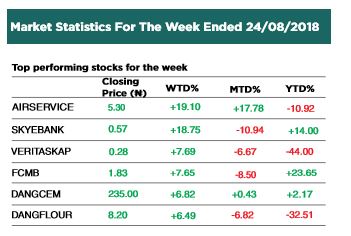

The market activities were characterised by bargain hunting on 2 out of 3 trading sessions last week. This is majorly driven by increased demand in a blue chip stock, DANGCEM despite sell offs in the stocks of Banking, Oil & Gas and Consumer Goods sectors.

In the global space, equities markets were bullish as US stock market reached an all-time high and the longest bull run in history. Also, the China Stock market closed in the green as US and China initiated trade talks during the week.

Stock Watch

Over the last five trading sessions:

SEPLAT (Seplat Petroleum Dev. Company) remained unchanged to close at N650.00.

Recommendation: We place a hold rating on this stock.

FBNH (First Bank of Nigeria Holdings) fell by 1.53% to close at N9.65.

Recommendation: We place a buy rating on this stock.

GUARANTY (Guaranty Trust Bank) fell by 1.32% to close at N37.50.

Recommendation: We maintain a buy rating on this stock.

Contact Anchoria Asset Management Limited for more information

Email: research@anchoriaam.com

www.anchoriaam.com