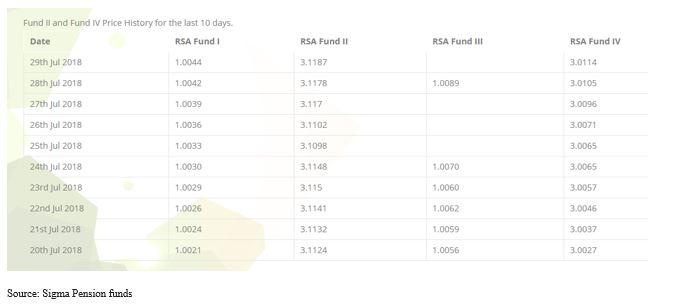

Almost a month after Nigeria’s National Pension Commission, PenCom, introduced the multi fund structure into the Nigerian pension fund investment landscape, the only pension fund Administrator to comply with the daily publication of funds’ last 7 days’ prices on its website covering all four funds are NLPC and Sigma Pension Fund Administrators Limited.

A look at the websites of the various pension fund Administrators indicates that there is no doubt that they have all embraced the new dispensation in the industry, but what is obviously in doubt is the extent to which they had prepared for the change as evidenced by the conspicuous lack of historical prices for the newly added funds. Every pension fund Administrator’s website is decorated with images and information on the new multi fund structure but none of them shows how much each of the newly introduced funds are valued at, at least, for the past 7 days as required by the relevant regulation.

Pension Administrators like AIICO Pensions, Stanbic IBTC, PAL Pensions, Crusader and Premium Pension fund administrators displayed one day price for the new funds and efforts to get more prices from the drop-down menu on the sites yielded no results for funds 1 and 3, although prices for the old and continuing RSA and Retiree funds, (Funds 2 and 4) are readily available.

Another fund that has been seemingly proactive in its reporting is the Veritas Glanvills Pension Administrators (formerly Future Unity Glanvills Pensions) which shows the investment portfolio asset allocation for the four pension funds, although it failed to show the mandatory 7-day prices for funds 1 and 3.

It will be recalled that the National Pension Commission, PenCom, had issued an addendum to the “Implementation Guidelines on RSA Multi-Fund Structure” detailing how the funds are to be valued based on the asset classes involved. PenCom had instructed that the Funds 1 and 3 be valued at N1 on July 2, 2018 and thereafter, the funds would be valued according to the NAV of their constituent assets, but the prices are yet to be displayed or reported by majority of the pension fund administrators.

Pension Fund Administrators Are Transparent than Mutual Fund managers

Though NLPC Pension Fund Administrators Limited is being credited for taking the lead in implementing and ensuring reporting and valuation transparency, it is worthy of note to mention here that Nigerian pension fund managers have been forthright with reporting daily and historical prices of pension funds in the past. That forthrightness still continues for the RSA and Retiree funds, meaning that the only areas they have been found wanting is with the reporting of the prices for the newly introduced Funds 1 and 3. Regrettably and comparatively, mutual fund managers have rather been quite opaque with daily prices and other aspects of mutual fund reporting.

It comes as a surprise however, because most of the Pension Fund Administrators are only but subsidiaries of the mutual fund management companies. It is therefore surprising that the pension fund information can be reported timely and promptly (except for the new funds) while mutual fund information is not reported with as much timeliness, if at all. The best explanation or reason could be just one word, enforcement.

While it appears that PenCom is at the heals of pension fund administrators with a view to ensuring compliance with regulations, it does not seem that the SEC or whoever regulates or monitors Nigerian mutual funds does the same with mutual fund managers. Investors, -be they pension fund investors or mutual fund investors- desire and require equal transparencies and as such, the regulatory authorities should be up and doing to ensure compliance with relevant regulations.

After all, of what use are those regulations if they are not complied with. Nigerian investors need more transparency than what they are currently getting, and it takes the efforts of the likes of NLPC Pension Fund Administrators Limited, Sigma and Veritas Glanvills and the stoic audacity of regulatory authorities to achieve this. All hands should be on deck.

Pensions Alliance Limited has all four fund prices published.

https://www.palpensions.com/

Thanks for your comment

Yes, Pension Alliance Ltd has prices on the website for just one day, Jun 30, we tried retrieving the prices for the new funds but to no avail. I can send you the screen shot

Thanks