Oil price recovery positive for Nigerian Eurobond

NLNG, NNPC, Shell, Total, Agip Sign MoU to Increase Gas Production to 30m MT

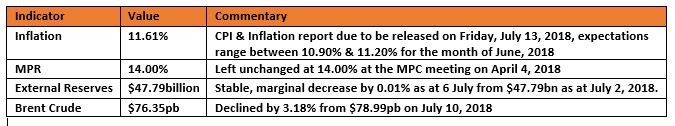

KEY INDICATORS

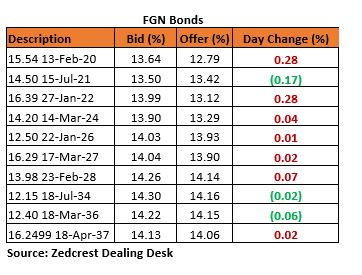

Bonds

The Bond market continued its bearish trend, with sell offs concentrated on the mid-end of the curve. This was however halted as demand support for bonds by local and foreign participants saw yields expand by c.05bps on the average across the curve. Investor interest was witnessed on the 2027s (mid-term) and 2036s (long-end).

Our expectations for cautious trading still remain as factors continue to support opposing sentiments towards the rest of the week. Expectations for a lower figure the inflation figure for June 2018 (expected on Friday) providing support for demand as current yields offer enhanced real returns FGN bonds. Fluctuating global oil prices as well as expectation for increased borrowing to fund the Nigerian federal budget providing pressures for an uptick in yields.

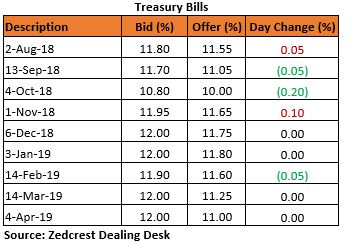

Treasury Bills

The T-bills market traded relatively flat, with pockets of demand witnessed on the January maturities. Yields compressed by c.05bps on the average.

We expect cautious trading of T-bills flat tomorrow, as market participants anticipate an OMO auction by the CBN to manage expected liquidity and this will determine the direction of rates in the near term.

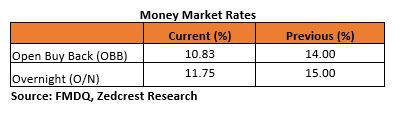

Money Market

System liquidity in the interbank market opened c.N93.18bn, lower than the previous trading day, however the OBB and OVN rates continued to fall to 10.83% and 11.75% respectively due to a lack of funding pressures on banks. OMO maturities of N313.56bn as well as current liquidity levels should spur the Central Bank to resume its OMO auction to manage the excess liquidity.

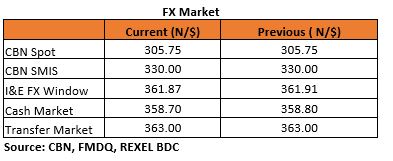

FX Market

The Naira continued its gradual appreciation at the I&E FX Window, with the NAFEX rate gaining 0.01% to close at N361.87/$. The Interbank rate however remained flat at N305.75/$.

In the parallel market, cash rates appreciated by 0.03% to close at N358.70/$ from N358.80/$ previously, while the transfer market rate remained stable at N363.00/$.

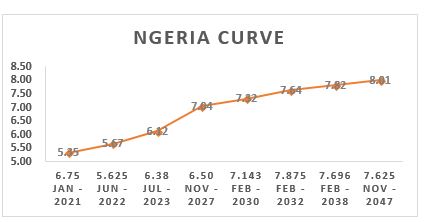

Eurobonds:

The start of the trading session saw the rally on NGERIA Sovereigns continue for a third consecutive day, with yields further dropping by c.06bps across all the traded tickers. Investor interest slowed mid-session, with this yields losing the day’s gains and expanding by c.05bps.

The NGERIA Corps also strengthened across most of the traded tickers, with yields compressing by c.03bps on average across board. The toast of investors for the day was the DIAMBK 19s, where yields dropped by c.23bps.