Revenues from a list of about 53 companies listed on the Nigerian Stock Exchange show a total revenue of about N9.6 trillion for the financial year ended December 2017. This list contains some of the biggest companies quoted on the Nigerian Stock Exchange, with revenues exceeding N10 billion per annum.

Some of the companies on this list include the likes of the Dangote Group of Companies, major Nigerian Banks, Seplat, Oando, Nigerian Breweries, Nestle, Unilever, Okomu Oil, Presco, etc.

Total revenues of N9.7 trillion represent an 11.4% increase from the N8.6 trillion reported a year earlier. When adjusted for inflation, total real revenue growth is slightly over 1% annualized. According to data from the National Bureau of Statistics, Nigeria recorded a GDP of 0.83% for the full year ended December 2017.

Nigeria clawed its way out of a recession at the end of the second quarter of 2017, following about 5 consecutive quarters of negative GDP growth rate. Businesses recorded marginal improvements as the economy picked up amidst rising oil prices and the peace deal reached by Niger Delta militants in early 2017. Since then, major indicators such as the Purchasing Managers’ Index, have risen to as high as 57% from the lows of 41% recorded as at June 2016.

In terms of profits, the 86 companies in our report have recorded a combined N1.39 trillion in profits, representing a 23% increase year on year.

Total taxes payable by these companies were about N232.9 billion for the year, compared to N162.5 billion in 2016.

Government borrowing buoys banking sector

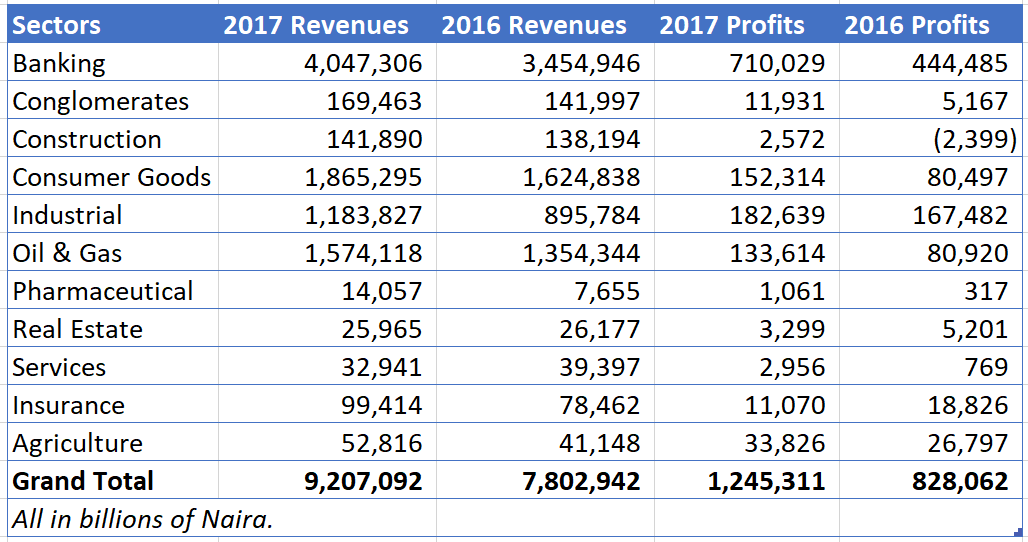

The banking sector led the way with about N4 trillion revenues in 2017, compared to N3.45 trillion a year earlier. Banking profits also soared rising from N444.7 billion in 2016 to N710 billion in 2017, representing a whopping 60% rise.

Nigerian banks reaped massive profits by lending to the government via treasury bills and corporate bonds. In a bid to finance government revenues and stabilize the currency, the Nigerian government increased borrowing to as high as N3 trillion, offering generous interest rates as high as 17% per annum. Most banks poured hundreds of billions of customers’ deposits into these debt securities, helping generate record gross earnings and profits.

In terms of taxes, the sector also contributed about N140.7 billion in taxes, compared to N134.7 billion a year earlier.

Source; Nairametrics Research.

Businesses rely on price increases

For companies in the manufacturing sector, particularly the Industrial and Consumer goods sectors, revenues also rose year on year. They relied on price increases to shore up revenues as Nigeria crawled out of a crushing recession.

For example, the Industrial sector made up of the likes of Dangote Cement, and Lafarge, recorded revenues of about N1.2 trillion during the year, compared to about N918 trillion in 2016. Profits for companies in this sector were about N182 billion, compared to N167 billion a year earlier in 2016. Dangote Cement dominated revenues and profits in this sector, posting N805 billion and N204 billion respectively during the year.

The cement giants raised prices in 2017 to make up for lower inventory turnovers and higher costs of production.

Nigeria’s Consumer goods sector, made up of companies like Nestle, PZ, Nigeria Breweries, Flour Mills, Unilever etc., reported revenues of about N1.8 trillion, compared to N1.6 trillion the year earlier. Most consumer goods companies also relied on price increases to shore up revenues during the year as they recovered from a recession.

In 2016, consumer goods companies recorded declines in revenues and profits, leading to job cuts and inventory pile-ups. Apart from suffering the effects of an economy in recession, most had to deal with stringent government regulatory pronouncements that impeded access to forex and import of badly needed raw materials.

However, to recover, most had to raise prices, and source locally for raw material inputs, shutting down unproductive lines.

Oil and Gas companies on the list include Oando, Seplat, Forte Oil, Mobil, Total etc. Total revenues from some of these companies were N1.5 trillion, compared to N1.3 trillion reported a year earlier. Profits also rose to N133.6 billion, compared to N81 billion a year earlier. Oil and Gas firms enjoyed a positive year as oil prices rose during the year and Nigeria increased oil output to pre-2016 levels. The result was a spike in revenues and profits.

Growing economy

Higher revenues for some of Nigeria’s biggest companies is a positive development for investors and the government, considering the disaster that was 2016. Consensus analysis indicates that the Nigerian economy is expected to grow by 2.5% in 2018, as the business activities pick up around the economy.

In addition, as companies report higher revenues and improved volumes of sale, investments in key sectors of the economy are expected to improve considerably. In 2017, Nigeria recorded total Capital Importation of about $12.2 billion, compared to $5.1 billion a year earlier, indicative of a return of confidence in the economy by foreign investors.

Though foreign direct investments remain a meager portion of total Capital Importation, most foreign owners of quoted companies in the country have injected hundreds of millions of dollars in several recapitalization drives. Most of the funds are now being funneled into repaying local debts, local capacity to source raw materials, and other major factors of production.

[wpdatatable id=489]

Note: Guinness, Honeywell, International Breweries, Flourmills do not have December as their year ends. As such we used their most result results.