Funding Rates rise above 10pct as CBN Resumes OMO Auction

CBN Says FED Tightening is no Threat

Bonds

The Bond market opened the week on a bearish note, with yields rising by c.5bps on average, following some sell on the 2034s and 2036s. We only witnessed slight buys on the 2024s, which did not have a significant impact on the general market trend. We expect bond yields to remain slightly pressured ahead of the bond auction scheduled to hold Wednesday, with N20bn each of the 2023, 2025 and 2028 bonds on offer.

Treasury Bills

The T-bills market traded on a relatively flat note, with yields compressing marginally by c.4bps on average. This was as the CBN resumed its OMO auction in the market, selling c.N207bn of an 87– and 213-day bill to moderate the excess liquidity in the system. We expect yields to trend slightly lower in the near term, as system liquidity remains relatively buoyant, and market players anticipate renewed inflows from Possible FAAC payments and expected OMO maturities later in the week. This should however be moderated by a continued OMO intervention by the CBN, most likely Thursday.

Money Market

The OBB and OVN rates trended significantly higher by c.9pct to 11.33% and 12.83%, following a resumption in OMO auction by the CBN and funding by banks for their wholesale FX bids. System Liquidity is consequently estimated to compress to c.N200bn from c.N450bn previously. We expect rates to trend lower tomorrow, as there are no significant funding pressures expected.

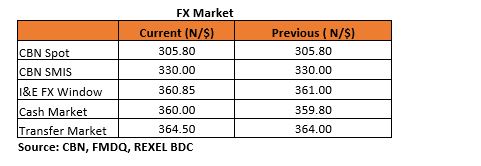

FX Market

The Interbank rate remained stable at its previous rate of N305.80/$. The I&E FX rate appreciated further by 0.04% to N360.85/$. In the parallel market, cash rates fell back by 20k to N360.00/$, while the transfer rate also depreciated by 50k to N364.50/$.

Eurobonds:

The NGERIA Sovereigns traded on a relatively flat note, with few trades mostly on the longer end of the curve. We witnessed slight sell, mostly on the 30s and 32s which took yields marginally higher by c.2bps on average.

The NGERIA Corps were also relatively quiet. We however witnessed some buys on the Zenith 19s and 22s, while investors sold off on the GRTBNL 18s, DIAMBK 19s and ECOTRA 21s.