The shareholders of May & Baker Nigeria Plc have approved Board’s bid to raise capital for the purpose of financing the company’s refocused business model. The approval came yesterday, May 31st, during May & Baker’s 67th Annual General Meeting which was held in Lagos.

Almost all the shareholders present at the AGM voted in support of the plan to increase the company’s share capital to ₦3 billion. Hitherto, the company’s share capital stood at ₦1.9 billion; i.e., 3.8 billion ordinary shares of 50 kobo. The ordinary shares will now increase to 6.0 billion following the approval for share capital raise.

The shareholders also gave their approval to the company to either sell or lease two of its properties located in Lagos.

A proposed dividend payment of 20 kobo per share for the financial year ended December 31st, 2017 was also approved.

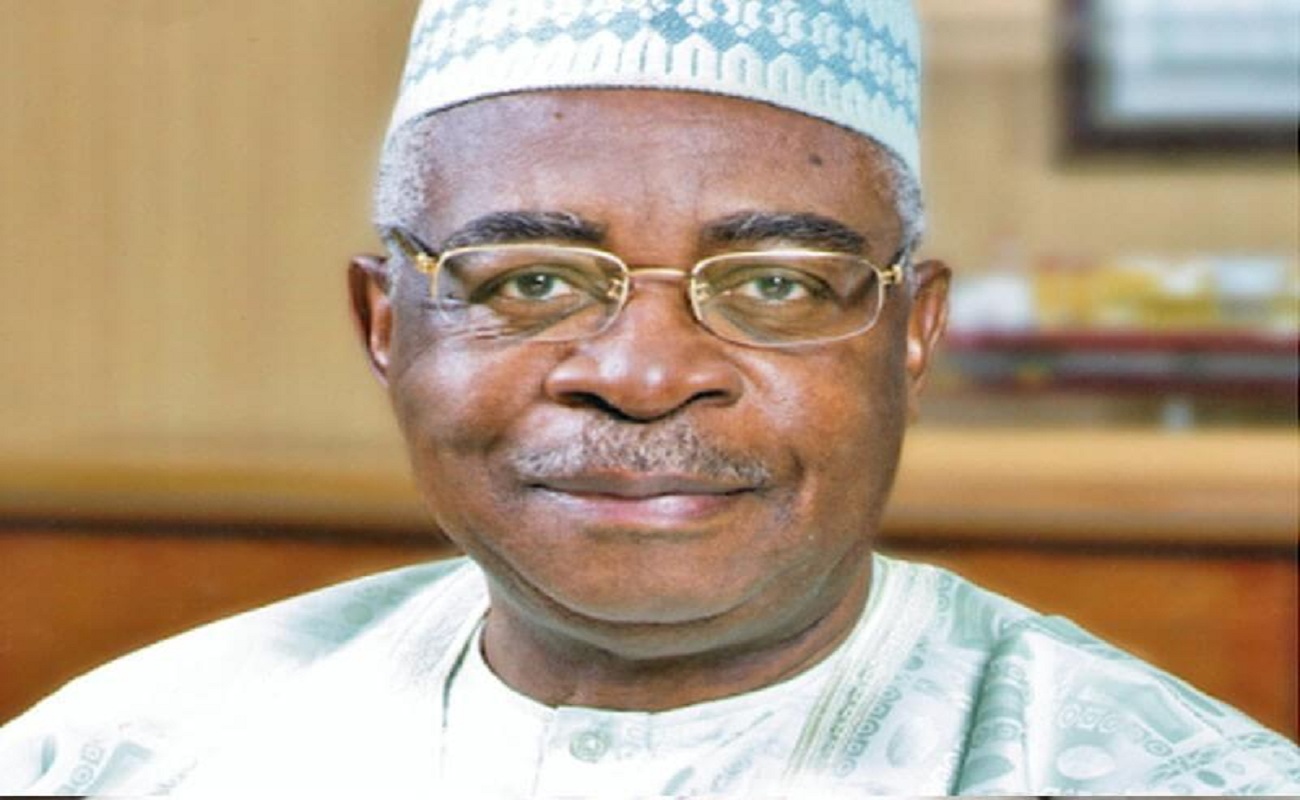

Meanwhile, speaking at the event, the company’s Chairman, Lt. Gen Theophilus Danjuma (rtd) reiterated the Board’s resolve to raise capital for expansion purposes, stating that it was high time.

He also stated that the company will soon issue new shares for sale, and he hoped that investors will take advantage of the opportunity.

According to him, the company is now positioned for growth and profitability. This is due to an envisioned strategic five year plan which will see the healthcare company expand and hopefully become the sector’s leader in the whole of Sub-Saharan Africa.

Our rights issue will soon open and I hope shareholders will take up their rights to support our company in achieving its new vision. We shall all reap the rewards in the immediate future and beyond. -Danjuma

He also gave more insight into the reason behind the company’s decision to divest its food line, stating that it was all part of the strategic plan to steer the company in the right course of growth and profitability.

Recall that May & Baker sold its food line to Dufil, for ₦775 million.

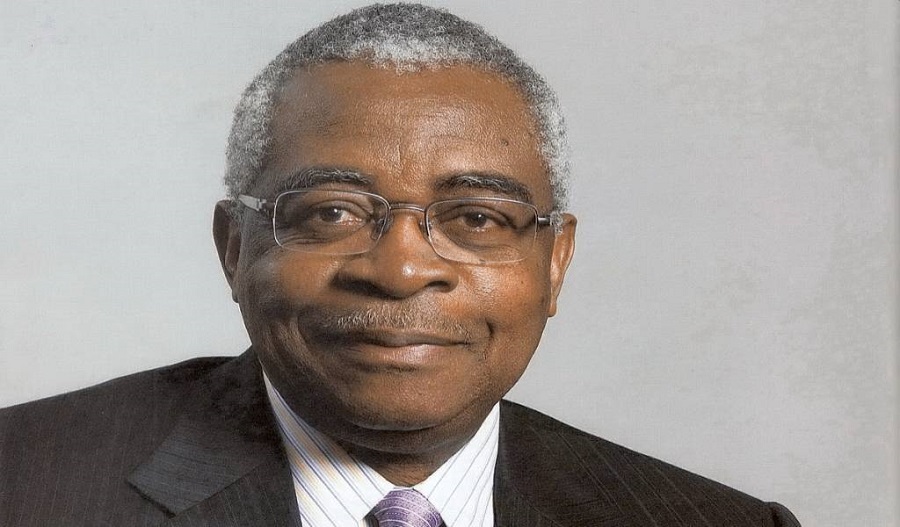

Also speaking during the AGM was May & Baker’s Managing Director, Mr. Nnamdi Okafor, who stated that the company’s decision to sell the two properties in Lagos is due to their dormancy. According to him, proceeds from the sale of the properties will be reinvested in the company’s Abuja property as well as another property in its Ota manufacturing complex.

May & Baker was founded in 1944 and it is one of Nigeria’s foremost companies and the first in the pharmaceutical industry. Its shares are listed on the Nigerian Stock Exchange, and they traded at ₦2.66 during today’s NSE session.