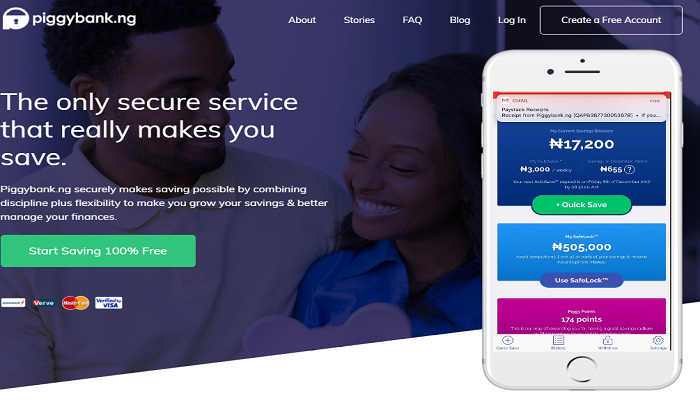

Nigeria’s Piggybank.ng, an online and mobile app savings platform targeted at African Millennials, today announces that it has closed on Seed Funding of $1.1M, from High Net Worth Individuals, led by Olumide Soyombo, Founder of LeadPath Nigeria, and with participation from International and Pan-African investors Village Capital and Ventures Platform.

The company will deploy the VC investment for license acquisition and product development. Piggybank.ng has recorded 20 – 35% m-o-m growth in user traction over the past 12 months; primarily from peer-to-peer recommendations, its referral program – Piggybank Stories, and grass-roots social media campaigns.

The startup will also invest in additional marketing spend, to accelerate its growth trajectory. Having completed accelerator programs with Blackbox, the CcHub’s Pitch Drive, powered by Google for Entrepreneurs, and Google Launchpad Africa, Piggybank.ng has built a savings community of over 53,000 registered users of which approximately 60% are Nigerian Millennials, who have saved in excess of $5M, with a savings growth of 3000% between 2016-17.

Founded in 2016 by Somto Ifezue, Odunayo Eweniyi and Joshua Chibueze, graduates of Covenant University, Nigeria, Piggybank.ng is positioned to fill a void for tens of millions of Nigerians, who have no access to credit, in a country where up to two years’ rent is often required upfront to secure a home.

![Somto Ifezue, Odunayo Eweniyi and Joshua Chibueze [l-r] PiggybankNG Co-founders_small](https://nairametrics.com/wp-content/uploads/2018/05/Somto-Ifezue-Odunayo-Eweniyi-and-Joshua-Chibueze-l-r-PiggybankNG-Co-founders_small.jpg)

Odunayo Eweniyi, Co-Founder and COO of Piggybank.ng says: “In a country such as Nigeria, almost everything has to be paid in advance. The majority of Nigerians struggle to save their income, manage cash flow and build credit, which is a huge problem as around 80% of Nigerians need to save a minimum of 40% of their monthly income, in order to survive.

This is the sheer scale of the challenge we are embracing; to actively promote a savings culture in Nigeria and act as the savings infrastructure to millions of people who want a safe, transparent and innovative platform to assist them in managing their finances, on their journeys to financial freedom.”

Joshua Chibueze, Co-Founder and CMO of Piggybank continues: “Today’s announcement allows us to expand and capitalise on the many opportunities that the market presents us with. Our growth so far has been stimulated almost entirely by peer-to-peer advocacy and our investment in the highest quality customer service, so we know the market is there, and the product has been built, modified, tested and ratified by users.

With this fundraise, we can invest significantly in our people and products, as we build a digital financial warehouse accessible to millions of Africans whose savings woes we want to put firmly behind them.”

Olumide Soyombo, Co-Founder Leadpath adds: “Piggybank.ng is a leading example of how Africans are innovating to solve African problems. In this case, the team is applying technology and innovation to solve a problem facing millions of Nigerians; how can they accrue enough money to make down-payments on so many ‘life events’, in a market where there’s little to no access to credit? Led by a solid and experienced executive team, who have recorded significant growth after two years of bootstrapping, and have built a product that is ready to scale, I’m excited to have led other local angel investors this investment round, and to now work closely with the team to grow the platform”

In addition to securing its Seed Funding of $1.1M, Piggybank.ng has recently acquired a micro-financing license from the Central Bank of Nigeria [CBN], which provides the relevant regulatory cover, allowing them independence from partnering with banks. As of June 2018, the company will also be expanding its product range to include Smart Target, a group savings tool, that can be scaled from family-size to large corporations, based on the age-long West African tradition of ajo or esusu to leverage the power of communal savings and harness the network effect of accountability.

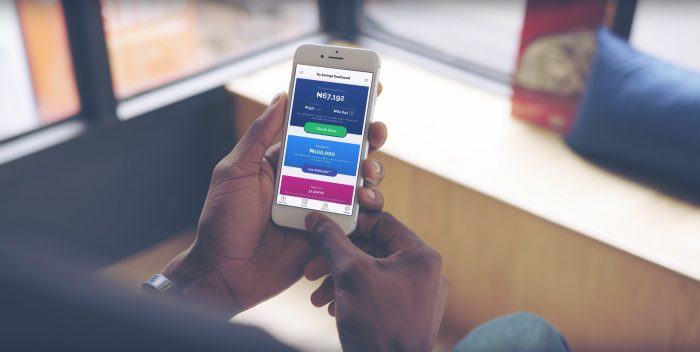

Available on iOS and Android, Piggybankers save an average of N20,000 per month [approx USD$55] and in contrast to conventional bank savings accounts, the platform restricts withdrawals until an agreed date or users can withdraw their savings on a quarterly basis, whereby savings drawn outside of the agreed day attract a 5% early withdrawal fee.

A recent survey conducted by Piggybank.ng, which saw 5,000+ responses, revealed that the top 5 areas Nigerians are saving for include investments, starting a business, rent and unforeseen circumstances e.g health and vacations.

Co-founder and CEO, Somto Ifezue concludes, “The research reveals that our savers are hard working, focussed, and serious about reaching their savings goals. Already, we are seeing thousands of our users reaping the benefits of addressing their financial future by weaving Piggybank.ng into their daily lives, making it a savings ritual. We’re looking forward to helping thousands more in the coming months and years reach their financial goals”.

The Piggybank.ng app is available for free download on Google Play or iTunes Store.