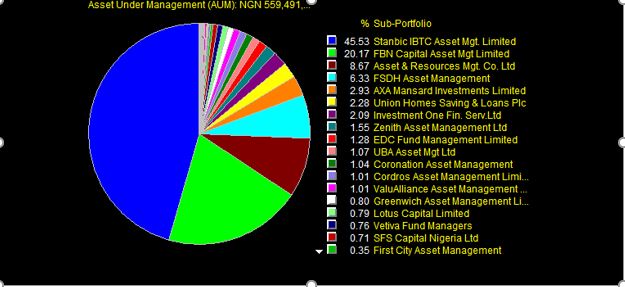

Asset & Resource Management Company Ltd (ARM) has overtaken FSDH Asset management as the third largest fund management company in Nigeria by asset. Analysis of the latest available data indicates that the continuous inflows to ARM Money Market Fund have paid off. FSDH has had a roller coaster ride in the league of who is who in the Nigerian mutual fund industry.

In February 2017, FSDH Asset Management overtook FBN Asset Management Company to become the second largest fund manager by asset. However, that honeymoon did not last as FBN later regained the second position just a month later, in March 2017. Since then, FSDH had been occupying the third place but that position has now been lost to ARM Asset Management who now controls 8.67% of total mutual fund assets in Nigeria.

Stanbic IBTC Asset Management Company still occupies the enviable first position with 45.53% of the total mutual fund assets under its management while FBN Asset Management consolidates its second position with 20.17%. FSDH is now managing just 6.33% of mutual fund assets, a far cry from the 15.5% it oversaw in February 2017.

Data from Quantitative Financial Analytics shows that the first two largest asset managers, Stanbic IBTC and FBN Asset Management now control about 66% of mutual fund assets, while the first four largest asset managers have 81% of mutual fund assets under their management.

A common characteristic of the first three largest fund managers is that they manage the first three largest money market funds in the industry. The largest individual funds by assets are Stanbic IBTC Money Market fund – 38.4%, FBN Money Market Fund –18.3%, ARM Money Market fund – 7.2% and UPDC Real Estate Investment fund – 5.5%. This implies that the sizes of fund managers’ assets under management are being driven by the money market funds under their management. This trend is a reflection of the popularity or love for money market funds in Nigeria.

Figures from Quantitative Financial Analytics indicate that investors have been gravitating to money market funds over the past five years which acts to the benefit of fund managers that manage money market funds.

Asset & Resource Management (ARM) began the year with an AUM of N35.4 billion and has attracted about N12.5 billion of net inflow to bring its current AUM to N48.5 billion. All the N12.5 billion net inflow is attributable to flows into the ARM Money Market Fund. The fund manager (ARM) manages four funds made up of one money market fund, two equity funds and one ethical fund, but its flagship seems to be the ARM Money Market Fund which is the third largest mutual fund by asset in Nigeria.

By contrast, FSDH Asset management had an AUM of N35.6 billion by the end of 2017 but after generating a net inflow of N534 million, its current AUM stands at N35.4 billion (thanks to a slightly poor performance from UPDC Real Estate Investment Trust Fund). FSDH Asset management manages three funds – an equity fund, an income fund, and a real estate investment fund.

Unlike the time FSDH overtook FBN in February 2017, when analysts at Quantitative Financial Analytics predicted a quick reversal of positions, that scenario does not seem likely to play out any time soon. With investors’ increased interest in money market funds, and the fact that FSDH does not have any money market fund under its management, the gap between them (FSDH and ARM) can only but widen. We are watching.