Wema Bank has revealed plans to raise an additional ₦20 billion from the bond market in July this year.

This will be its second debt program after it initially raised ₦6.2 billion in the first tranche of its ₦50 billion debt programme.

Chief Financial Officer, Wema Bank, Tunde Mabawonku, revealed that the bank intends to pay dividend to its shareholders-this will be the first time in a decade, before raising equity in 2019.

He noted that the debt issue would help Wema bank boost its capital adequacy ratio above its internal guidance of 15 percent, from 14.3 percent.

The bank in his full year 2017 financial report recorded a growth in the bank’s gross earnings from ₦53.9 billion recorded in 2016 to ₦65.3 billion in 2017. While its pretax profit fell from ₦3.25 billion in 2016 to ₦3.0 billion in 2017.

The bank’s CFO also noted that the bank had recently obtained a $15 million loan from the Africa Development Bank AfDB, and another $20 million from Islamic Development Bank.

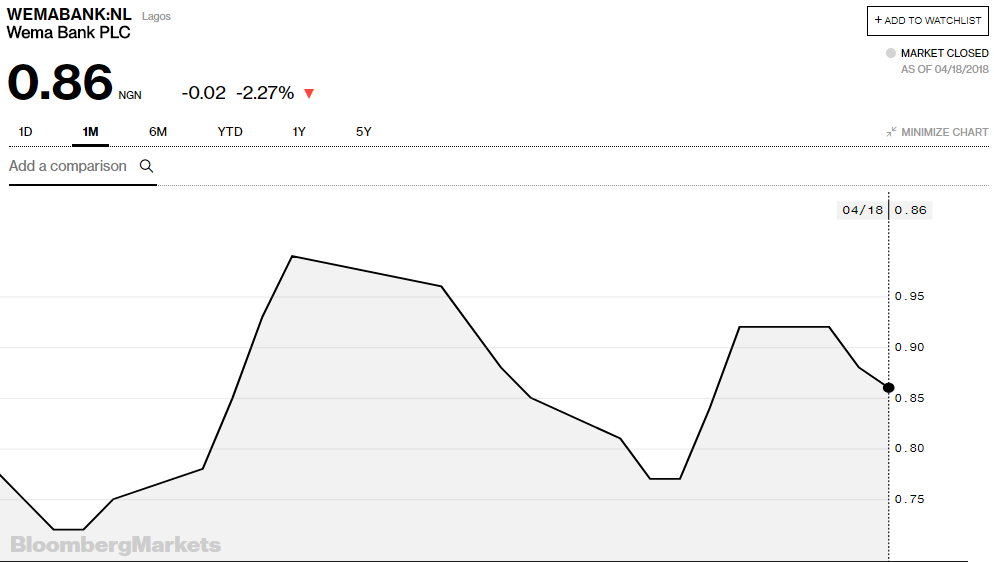

Its share price closes at ₦0.86 as at close of trading yesterday.

Wema Bank Plc, commonly known as Wema Bank is Nigeria’s longest surviving indigenous commercial bank. It was established on May 2, 1945, as a private limited liability company but granted a Universal Banking License in February 2001.