Reports from Stanbic Stockbrokers indicates Nigeria’s IEFX window exchanged a whopping $5bn dollars in March 2018. According to Stanbic, “this is the (2nd highest levels since the launch of the IEFX market in April last year).”

FX Windows

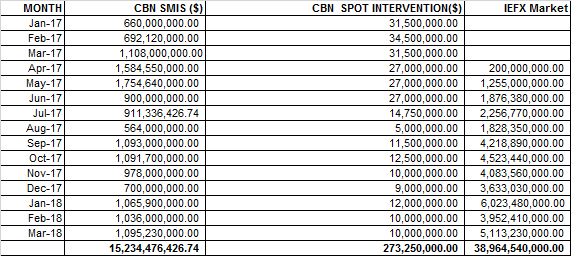

According to the data above, Nigeria’s IEFX window has traded about $38.9 billion since April 2017, when the market was launched. This compares to about $15 billion in the CBN SMIS window confirming the IEFX window as the dominant window for FX transactions in Nigeria.

The report also suggests that the CBN is selling $1bn dollars monthly at the CBN SMIS window and believes it is time that the CBN converges both markets (CBN SMIS and the IEFX Window).

“We have seen dollars in the CBN SMIS window get transacted between NGN328 – NGN340. If the CBN sells you a 75day forward at the NGN340, the time value of money and implied exchange rate is closer to NGN360 – which looks almost like a convergence. Probably time to completely converge both markets???

External Reserve hit $46 billion

Data from the Central Bank of Nigeria also indicates that Nigeria’s external reserve has risen to $46 billion, the highest in over 5 years. Since April 2017, when the I/E window was introduced, Nigeria has added a net $16 billion to external reserve. However, between December 2017 and March 29, 2018, Nigeria’s FX reserve has increased by about $11 billion. Stanbic again weighs in, explaining the increase in reserves over the last 6 months.

Stanbic on Reserves

Of the c.USD13.5bn rise in FX reserves over the course of the last 6 months, I have USD5.5bn resulting from Eurobond issuances and another c.USD5.0bn as a result of CBN buying FX from portfolio investors from the IEFX window. That leaves about USD3.0bn from oil sales, which makes some sense due to the fact that the NNPC is still subsidizing petrol imports. This means that the country is not fully benefiting from the increase in oil prices as a substantial portion of it is being lost in implicit subsidy payments.

Is this good or bad?

Starting from the downside, the economy is relying on FX inflows from Foreign Portfolio Investments and Debt to shore up its reserves. These sources have significant costs attached to them and are susceptible to capital flights. However, the fact that Nigeria is yet to benefit from the hike in oil prices suggest the economy is less reliant on oil to boost stabilize its exchange rate. If the government thus decides to take a decision on fuel subsidy, Nigeria could benefit immensely from dollar savings.