In its bid to raise the awareness on tax payment and generate more revenue from the non-oil sector of the economy, the Federal Government had last year launched the Voluntary Assets and Income Declaration Scheme (VAIDS).

Figures from the proposed 2018 budget put projected non-oil revenue at N4.16trillion and this will be driven by tax and import duties.

The scheme which is to last for nine months will provide a window of opportunity to allow those who owe taxes to voluntarily declare their Asset and Income from within and outside Nigeria, and pay taxes due on them.

According to PWC, as at May 2017, the total number of taxpayers in Nigeria is just 14 million out of an estimated 69.9 million who are economically active.

Currently, Nigeria’s tax to GDP ratio is put at just 6%, which is one of the lowest in the world (compared to India’s of 16%, Ghana’s of 15.9%, and South Africa’s of 27%). Most developed nations have tax to GDP ratios of between 32% and 35%

Has the scheme been able to meet its target

8 months into the scheme, how has the program fared? What is the level of compliance by defaulters? How serious is the government about prosecuting offenders? Do we have a reliable and fast judicial process to prosecute offenders? How does the government intend to spend money realized from this scheme?

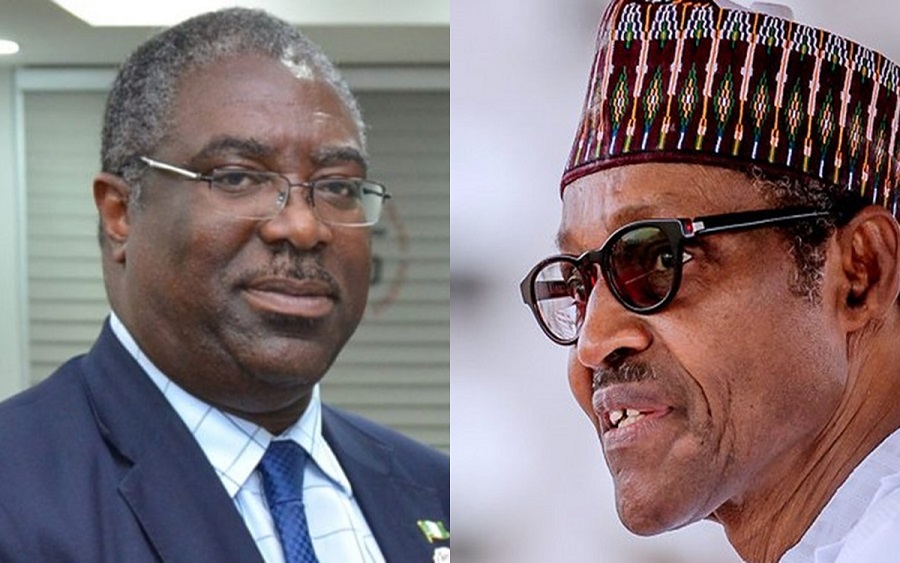

According to the Chairman Federal Inland Revenue Service (FIRS) Mr. Babatunde Fowler over 2,000 properties in Abuja is now in jeopardy. The chairman also revealed that over N17 billion had been raised under the scheme, adding that the scheme will generate more before the expiration of the deadline in March.

In terms of numbers, the scheme has not gotten the type of crucial numbers is expected. It is however worrisome that many corporate organizations are yet to take advantage of this window to regularize their tax payments.

According to Fowler, “When we gave the tax amnesty last year, we had 2,700 corporate accounts that filed for it. Now we are talking of fewer than 10 companies that have come under VAIDS.”

He noted that there more to be done, many companies are asking the question and talking to consultants.

The New Unexplained Wealth Order

However, there seems to be a cheering news from the U.K Government as it launched the Unexplained Wealth Order.

This simply means

- The UK Government can query “Unexplained Wealth” and seize assets whose funding source cannot be explained.

- This will allow them to confiscate U.K. assets of foreigners suspected of possession of ill-gotten wealth.

- The UK courts are now empowered to grant Unexplained Wealth Orders and forfeit property for which the owners are unable to prove the source of fund.

- The properties will then be transferred to the UK Government and sold to fund their law enforcement efforts.

The United Kingdom in recent times have been tagged as a safe haven for illicit funds. The UK has one of the best performing property markets in the world and this can be attributed to massive inflows by Nigerian politicians and some other countries most of who prefer to hide their assets in a safe haven to evade tax.

However, the ongoing Voluntary Assets and Income Declaration Scheme’s tax amnesty provides a potential escape. Minister of Finance, Mrs. Kemi Adeosun advised Nigerians resident in the UK to take advantage of the VAIDS and declare their foreign income and assets to escape the hammer of UK’s new Unexplained Wealth Orders.

2/ It's essential for Nigerians resident in Nigeria to declare all their U.K. assets correctly under @VAIDSNG to avoid the U.K.'s new Unexplained Wealth Orders (UWOs). The @VAIDSNG Amnesty Window is open until March 31.

— Kemi Adeosun (@HMKemiAdeosun) February 3, 2018

In conversation with a legal practitioner (who has elected to be anonymous), he argued that the country has enough laws to prosecute tax defaulters. Despite assurances by the Government to fight corruption, many corruption cases still litter our courts even many years after the commencement of trial. The trial of some politicians allegedly accused of not declaring their assets have been ongoing in the past five years with no major conviction.

Alleged offenders connive with their legal counsel by employing different tactics to either evade or perpetuate their trial in court most times securing frivolous injunctions from courts.

Perhaps, the new UWO will boost government non-oil revenue through VAIDS and the government would be responsible enough to channel funds generated from this scheme to fund basic infrastructure and build on existing infrastructures in the country, create employment for teaming youths.

The money realized from this scheme must not end in private pockets. This must not be a case of money gotten from a thief ending in the pocket of another thief. Nigerians are watching what becomes of defaulters after the expiration of the deadline and hopefully, their names will be made public and their prosecution can commence.