The reasons Federal Inland Revenue Service (FIRS) failed to attain its tax revenue projections under former Executive Chairman, Babatunde Fowler, has been disclosed.

On the factors that caused the shortfall during a senate interactive session with revenue-generating agencies, the present Executive Chairman, Muhammad Nami said, “Nigeria loses a lot of revenue through tax waivers granted to big companies which otherwise would have been taxed to buoy up government revenue.

“Also, illicit financial flow is a major cause of revenue loss to Nigeria. Coupled with this is the operational cost of the FIRS which is also high compared to the statutory provisions for the running of the organization.”

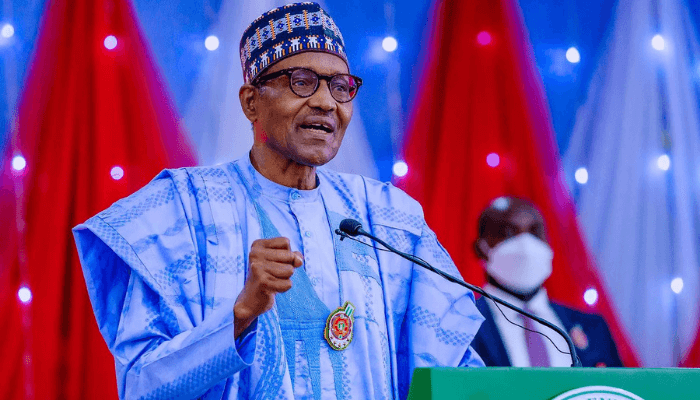

Nairametrics had reported that failure to meet tax projections for four years could have informed President Muhammadu Buhari’s decision not to retain Fowler for a second term.

What caused a shortfall in revenue? Non-discretionary tax waiver grants, illicit financial flows abroad and high overhead costs have been attributed as the factors that prevented the FIRS from achieving its revenue projections under Fowler, who led the tax administrator from 2015 to 2019.

Findings disclosed that Fowler failed to meet his collection target in 2015, 2016, 2017, 2018. For instance, in 2015, it set N4.7 trillion target but was only able to make N3.7 trillion in the actual collection. In 2016, 2017 and 2018, the target collections were N4.2 trillion, N4.8 trillion and N6.7 trillion but the actual collections were N3.3 trillion, N4 trillion and N5.3 trillion, respectively.

This led to the Federal Government issuing a query to Fowler although the shortfall had been on before Fowler’s appointment. The FIRS recorded a revenue shortfall of N4.88 trillion within a 10-year period, from 2010 to 2019.

[READ MORE: FIRS moves to stop tax evasion with newly launched intelligence system)

Nairametrics had reported that under Fowler, findings of the National Audit Report disclosed the following:

- 545 companies had not remitted their Company Income Tax (CIT) to the FIRS valued at a total of N26 billion.

- Companies, Federal and State MDAs, Local Government Councils and State Government within the Southwest Zone were yet to remit about N8 billion being their Value Added Tax.

- Withholding tax from companies, government agencies and local government councils valued at about N5 billion were also yet to be remitted to the FIRS.

- About 318 companies were said not to have remitted their Education, tax which is 2% on profits of Companies valued at N697 million.

- Two companies are yet to remit N99 million, being their Capital Gain Tax of 10% from the disposal of these companies’ assets. All these unreconciled taxes were said to have been communicated to the FIRS chairman.

- Out of 28,237 duly registered Companies, 11,221 failed to submit their annual returns to various tax offices. These contradict the provision of the Company Income Tax Act, which requires a company to render an account of its operations within six months of its accounting year-end.

- This number of companies who failed to render its returns represents 39% of duly registered companies with the FIRS.

It was also revealed that, under Fowler, the tax agency failed to collect taxes worth about N41 billion in Lagos.

You also failed to report that targets were raised to the highest levels under Fowler.

Has the profile changed under this new chairman? Bunkum!

IF BUHARI could sack Fowler for not meeting his target, why hasn’t he sacked his service Chiefs? Or have they performed up to his expectations? I am sure Buhari had his reasons to sack Fowler aside this flimsy excuse. This new guy will know that getting ppl to pay is not as easy as he tut

We are keenly watching that the new Chairman will surpass targets set for him.