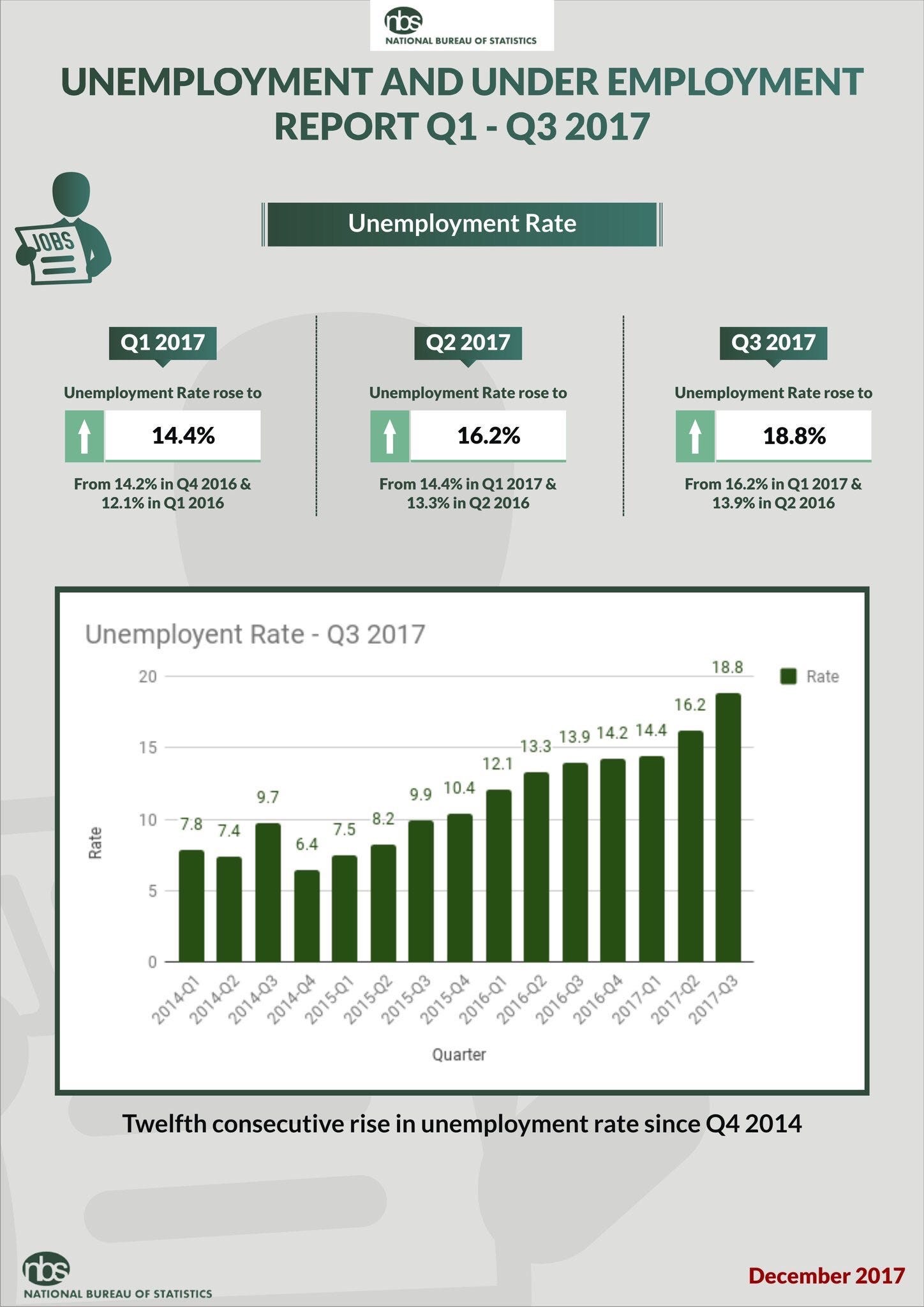

Unemployment rose from 12.1% in Q1 2016 to 18.8% in Q3 2017. Ouch!

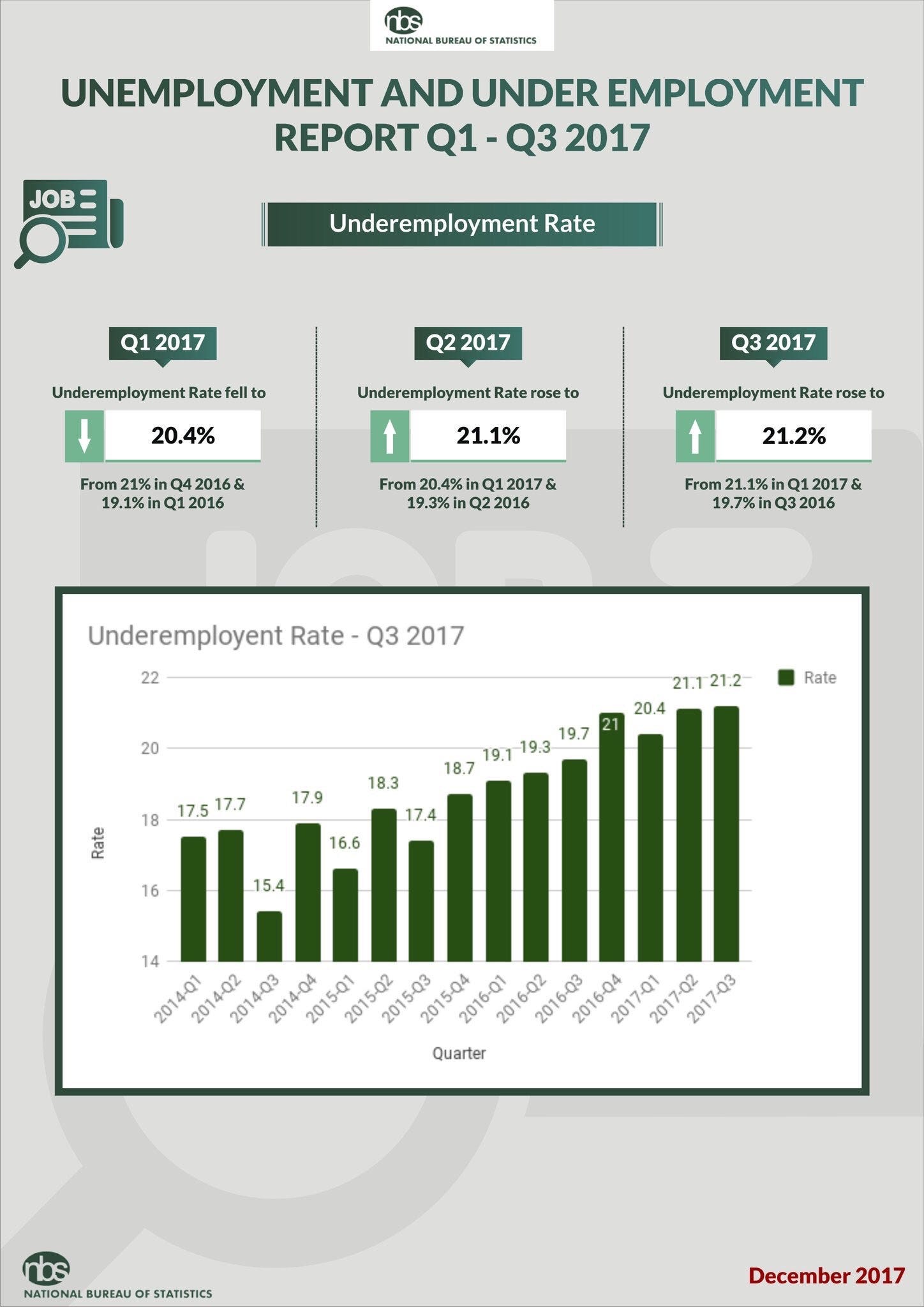

Underemployment, also not wanting to be left out of the party, rose from 19.1% in Q1 2016 to 21.2% in Q3 2017.

Now, what does this mean? Let’s look at the first set of numbers. You can see underemployment is not really the problem. The movement here only worsened by about 2%; the real problem is the almost 7% movement in unemployment.

The first problem the data tells us is that Nigerians were having too much unprotected sex almost two decades ago. How do we know this? The working population grew from 101.7 million to 111.4 million people between Q4 2014 and Q3 2017. That’s 9 million people coming into the working population in roughly 3 years. When you add another 4million people who were not previously looking for work that are now searching for jobs within the same period, that’s a total of 13 million new people, who have entered the labour force since 2014.

Just to be clear, 13 million people. That is the population of Rwanda, Sweden or Cuba. There lies our first problem. It means even if APC met its target of 3 million jobs per year, unemployment would still have worsened. This one sounds simple to solve, promote FAMILY PLANNING. Or not.

The NBS will release its Employment Report later this month, which will provide more insight on the QUALITY of jobs being created, but the unemployment report already gave us a clue. Between Q4 2014 and Q3 2017, we created 5 million more time-related (some call this part-time) jobs. That’s a good thing, and I will add some propaganda here, that it shows the effect of the Government’s focus on agriculture, even though 5 million temporary jobs in 3 years suggests those hundreds of billion could have been better spent. But the real worry is how we performed with full time jobs. Here, we bled, wait for it…4.1 million jobs. Ouch!

The rest is simple arithmetics. Your workforce grew by 13 million people, but you only managed to create a net of 1 million new jobs, which means 12 million more people are unemployed. If you add migration and other economic factors into the mix, you’ll find that number rising to 16 million people. Now remember those people in time related jobs? Let’s assume they all prefer full time jobs, and throw all 18 million of them in the mix, that gives us a whooping 34 million people.

Just to be clear, 34 million out of a labour force population of 85 million are either unemployed or underemployed. That’s 40%. Not 4%, 40%.

How do we solve this massive problem?

Capital Formation

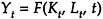

This is all you need to know:

That equation shows output (which some smart people equate to GDP) is a function of capital, labour and time. If you have nothing better to do at Christmas, you can read this piece on the role of capital formation in economic growth, though I’ll advise you should dig into some roast turkey and wine instead, but read the portion below.

Moreover, capital and technical progress combined account directly for more than 95 percent of the economic growth of the industrialized countries except the United States. In the United States, where labor grew much more rapidly than in the other countries during this period, capital formation and technical progress still account directly for approximately 75 percent of economic growth.

Why is this important in Nigeria? The awful policies of the Central Bank in artificially controlling the exchange till oil prices started rising (Thank God!) did incredible damage to Nigeria’s economy. Egypt (GDP growth forecast: 4.5%) and Argentina (GDP growth forecast: 2.5%) have shown the effect of taking the right policy decisions compared to Nigeria (GDP growth forecast: 0.8%). If investors cannot trust your exchange rate, then you cannot expect foreign direct investment. Anyway, I don’t want to bore you, some smart people have already done a lot work showing what the Government needs to do, for capital formation to improve: cut recurrent expenditure to focus on capital projects, drive export discipline and incentivize increased national savings (Nigeria’s Savings/GDP ratio is 15.6% vs the global average of 25%) . You can read their paper here. Oh, as long as we keep the ancient Land Use Act where only a few states actually issue proper title documents, our biggest chunk of domestic capital will remain as dead as Egyptian mummies. Perhaps, Nigeria is a ripe destination for using blockchain technology to unlock the dead capital in untitled land, and dry bones shall rise again!

Export Discipline

This is something many policy makers in Nigeria don’t like to admit — self sufficiency cannot deliver the jobs needed to lift millions out of poverty. Nigeria’s GDP per capita of $2,200 is 128th in the world and only screams one thing — NIGERIA IS A POOR COUNTRY. What can we learn from this? Our domestic consumption power will not drive the growth needed to create better jobs for over 30 million people. To achieve this goal, we need to look outside Nigeria for buyers of Nigerian goods and services.

If you ever need to understand why export discipline is a critical driver of growth, please read Joe Studwell’s How Asia Works. If we execute this as well as Korea, and let private enterprises run the businesses, then the sky’s the limit in the words of the Notorious BIG. However, if we do it like Malaysia and insist on public enterprises as implementing agents, then maybe my son will be writing a similar post in 30 years.

The difference between General Park in Korea and our leaders in Nigeria is very easy to spot. Chung Ju Yung, the Hyundai founder, was the king of crony capitalism before Park’s coup; he had a made fortune without exporting anything, largely from construction using domestic business concessions (sounds familiar?). Now, when Park became Korea’s leader, he didn’t throw Chung Ju Yung in jail, instead they had lunch every Thursday, and Chung became a major exporter of first his construction business, then semi-conductors and cars. The next two paragraphs will explain how those Hyundai cars ‘flooded’ the Nigerian market.

The quote below is a lesson for Nigerian Government. You should send it to every Government official you know 🙂

Government needs to take a realistic view of entrepreneurs. Rather than plead with them to make some voluntary move to a higher moral plane, it is better to acknowledge the existence of the entrepreneur’s animal spirit, and use his desire to make as much money as possible to control him.

Preach.

Now, back to Park and Chung. Guess how Chung moved from crony capitalist to a major exporter? The answer lies in a place called Seodaemun. It was a small prison where Park locked anyone who didn’t adhere to his development plans for Korea. And since Chung didn’t want to be separated from his harem of mistresses, he quickly pivoted his business from being a lazy beneficiary of Government concessions to a solid enterprise that went on to grow market share in many international markets like Nigeria.

You can read an excerpt from How Asia Works here, but I still recommend you buy and read the entire book.

Special Economic Zones

Type “miracle of Shenzhen” in a search engine and click on the results. This is what happens when a Government is serious about transforming its economy. Shenzhen was a rural fishing village with a population of 30,000 in the 1979 when Deng Xiaoping (let’s take a moment to recognize the maestro) created China’s first special economic zone. Today, Shenzhen’s has a population of over 10 million people and a GDP of $280 billion, 70% of Nigeria’s GDP.

What makes SEZs work:

Focus — The best ones are focused on export markets, but SEZs are like a laboratory that can be used to test different models, so the best ones are scaled while the dud ones are quickly killed.

Location — They could be sited anywhere, but try avoiding landlocked areas.

Infrastructure — Tax breaks are great, but the real work is providing proper infrastructure that drives costs down. In Nigeria, those will be uninterrupted power, cheap broadband access and transport (which is why proximity to ports is a critical factor in selection locations).

Results Linked Incentives — Being allowed to operate from the SEZ can be linked to job creation, which can be verified through payroll and tax filings. If incentives are not linked to the expected outcome, the impact of SEZs will be limited, as our free trade zones in Nigeria have shown.

For anyone willing to read a detailed publication on SEZs, please click here.

Policy Coordination

There are certain policies that show we are not ready to put people in jobs, like the discussion on a minimum wage increase. Stay with me. This is an extract from the National Minimum Wage Act, stating those exempted from compliance with the agreed minimum wage at any time.

An establishment in which less than 50 workers are employed; an establishment in which workers are employed on a part time basis (those working for less than 40 hours per week); an establishment at which workers are paid on commission or on piece rate basis; workers in seasonal employment (as agriculture); and seamen or crew members of an aircraft.

Now let’s compare our law with what my homeboy, Thomas Sowell famously said:

Unfortunately, the real minimum wage is always zero, regardless of the laws, and that is the wage that many workers receive in the wake of the creation or escalation of a government-mandated minimum wage, because they lose their jobs or fail to find jobs when they enter the labor force.

If you are a large employer of labour, what will you rather do, employ more than full time employees and risk compliance with a wage bill increase you didn’t determine, or just hire fewer, keep your employees working part time, and keep your wage bill within acceptable limits.

That’s one example of how policies contradict our expected outcomes, just to make the point.

Education

Now to the elephant in the room. The Nigerian educational system is not designed to develop a skilled workforce, either for employment or entrepreneurship.

I have spent the last few months working on a technical and vocational training program, and two things struck me.

- We have limited training capacity across the country, both in terms of facilities and trainers.

- In developing the curriculum, there has been limited interaction between the educational bodies and employers.

Now that’s just vocational training. But even with our secondary and tertiary institutions, we are not offering any job readiness or entrepreneurship training that ensures we deliver competent employees and a pool of successful entrepreneurs. This is purely anecdotal, but it seems Covenant University is doing something (deliberately or not) that is creating a decent pipeline of talent. Maybe there’s something there we can develop as a nation. But the one thing we certainly need the Minister of Education to review is the national curriculum at all levels. At the end of the day, the economy can only achieve inclusive growth if a competent workforce is developed.

Finally, at various levels of leadership, Nigeria must be ready to make money moves without having it all figured out. As Deng Xiapoing said, “cross the river by feeling the stones.”

![[NEW POLICY] FG is Cutting Down Trees in Abuja to Discourage Black Market Operators](https://nairametrics.com/wp-content/uploads/2015/08/Sad-trees.png)