The National Bureau of Statistics reported on Monday that Nigeria recorded a Real GDP Growth rate of 1.4% for the 3rd quarter of 2017, solidifying Nigeria’s exit from recession.

The report also revises Nigeria’s second quarter GDP to 0.72% from 0.55% previously reported. By all account, things seem to be moving in the right direction, until you dive into the details.

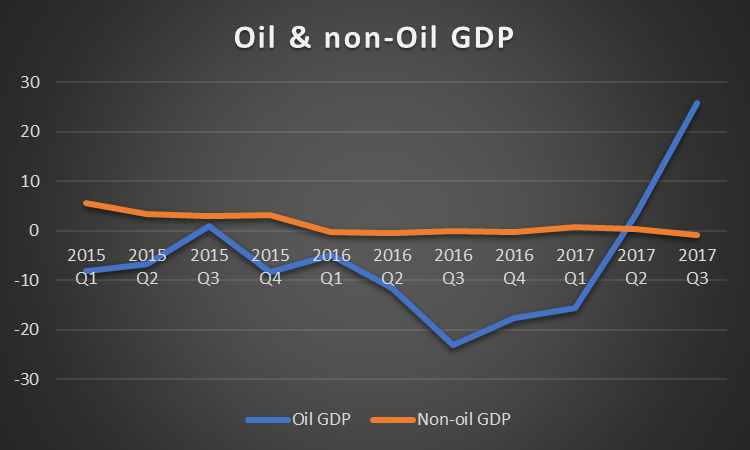

Oil and Non-Oil GDP

The Bureau of Statistics typically divides Nigeria’s GDP into Oil and non-Oil in line with the sectorial representation of the Nigerian Economy. In terms of Oil GDP Nigeria recorded a growth rate of about 25% in line with most expectations as Nigeria’s crude oil production continued to ramp up after the massive declines recorded in 2016. However, the non-Oil sector, which constitutes about 90% of GDP is where the problem lies. According to the report, Nigeria recorded a real GDP contraction of 0.76% which is lower by -0.79% point compared to the rate recorded same quarter, 2016 and -1.20% point lower than in the second quarter of 2017.

Tripple Dip Recession

Based on the latest contraction of the non-Oil sector, it is now obvious that Nigeria has recorded a triple dip recession in a sector that constitutes about 90% of its GDP. Economists define a triple dip recession as a third slide back into negative growth rate after one or two quarters of growth. As the chart above depicts, Nigeria’s non-oil sector was in a recession in the first and second quarter of 2016 before recording growth in the third quarter. It recorded a double dip recession, when it contracted to -0.3% in the fourth quarter of 2016. The first and second quarter of 2017 experienced two consecutive quarters of growth of 0.7% and 0.45% respectively before sliding back into negative GDP growth rate in the third quarter.

What is causing this contraction

The reason for the contraction being recorded in the non-oil sector point to the following sectors; Trade, Telecommunications and Information, Construction and manufacturing.

Manufacturing

The Manufacturing sector which includes Oil Refining; Cement; Food, Beverages and

Tobacco; Textile, Apparel, and Footwear; Wood and Wood products; Pulp Paper and Paper products; Chemical and Pharmaceutical products; Non-metallic Products, Plastic and Rubber products; Electrical and Electronic, Basic Metal and Iron and Steel; Motor Vehicles and Assembly; and Other Manufacturing, recorded a negative GDP Growth rate of -2.85%.

A key component of this sub-sector is oil refining which recorded a massive drop of 45% in the third quarter of 2017. The sub-sector recorded three previous quarters of growth. The contraction recorded in the third quarter of 2017 is attributed to the drop in production of Nigeria`s refineries. For example, capacity utilization for Nigeria’s refineries dropped to just 9.5% in August 2017, compared to 11.9% in July 2017. Of the three major refineries in the country, only the Warri refinery was functional in the August, and even so at a paltry 1.87%.

Construction Sector

This sector also recorded a negative GDP of about 0.46% partly attributed to the lack of implementation of the capital expenditure included in the 2017 budget. Nigeria’s construction sector is largely dominated by government activity and relies heavily on capital expenditure to grow.

Trade

This sector contributes as much as 17.96% to Nigeria’s nominal GDP in the third quarter of 2017. However, it has been in recession since the third quarter of 2016 making it one of the worst performing sectors in the economy in the last two years.

Growth in the trade sector has been largely marred by government policies which has favoured local production of goods and services as against importation. Traders in Nigeria are largely import dependent for their inventory and have been hampered by government policies towards foreign exchange and duties. Traders have also found it difficult to secure lending from commercial banks worsening an already bad situation.

Information & Communication

This sector contributed about 8.7% to Nigeria’s nominal GDP in the third quarter of 2017 and is one of the largest in the economy. However, it slid back into recession after recording a negative growth rate of 4.48% in the third quarter of 2017. GDP for this sector contracted by 1.15% in the second quarter of 2017. The data reveals the main reasons for this is the 5.68% contraction recorded in the telecommunications and information services sub sectors. This is largely dominated by GSM Companies and Internet service Providers. Analysts opine that the recent clamp down on unregistered SIM Cards by the NCC, which has dropped active subscriber numbers to about 140 million from about 153 million last September. It is believed that this has impacted negatively on sector growth.

Self Inflicted government policies pushes non-oil sector into triple dip recession

A look at some of the reasons above reveal a worrying pattern. The contraction observed in these sectors are not due to market forces but mostly influenced by government policies. For example, the contraction in the construction sector is due to the slow implementation of the 2017 budget. The contraction in the telecoms sector is due to government insistence on SIM card registration.

The contraction in the trade sector is due to higher import tariffs, ban on 41 items and restriction of access to foreign exchange, all due to government policies. The Manufacturing sector is also reeling from higher cost of borrowing, largely influenced by government borrowing which has pushed borrowing cost beyond the means of the private sector.

The culmination of all of this is that, Nigeria’s services sector which is about 48% of GDP this quarter, has now contracted to -2.66%, representing 7th straight quarter of contraction.