About two years ago, Nigerian bonds went from being a highly sought after asset to a “must avoid” country for most GEM and Frontier managers. Oil prices went south as well as oil exports, the Central bank decided to adopt strict currency controls, this saw the black market trade at a much lower value against the dollar than the official rate, sending inflation through then roof and panic in the capital markets as investors tried to sell assets and flee the country.

In September 2015, JP Morgan removed the country from its Emerging Market bond index, followed by Barclays. About a year later the county announced it had gone into a current account deficit and then a few months later, a recession.

In my view, the country is quickly becoming a turnaround story as macro-economic factors begin to improve and bearish drivers slowly turn positive and economic reforms are taking shape- Current Account balance has now moved away from a negative territory, inflation easing, positive GDP growth etc.

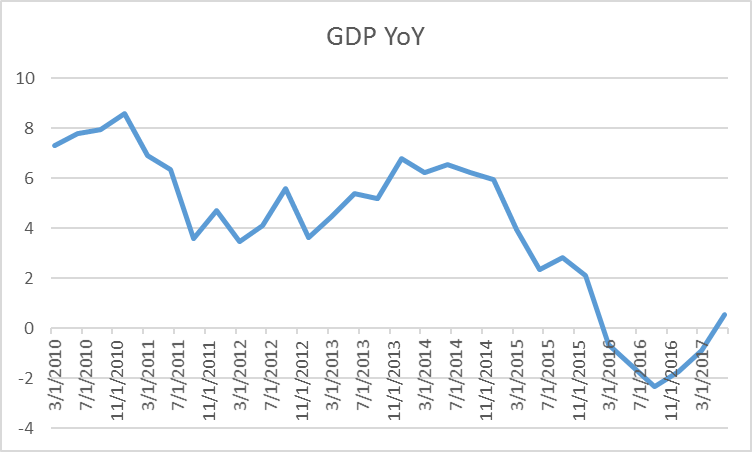

Most recent data shows Nigeria has officially come out of a recession. GDP growth showed positive of +0.55% coming from an absolute bottom in Q3 2016 of -2.34%. Although the market expected better results but was disappointed by the contribution from the oil sector.

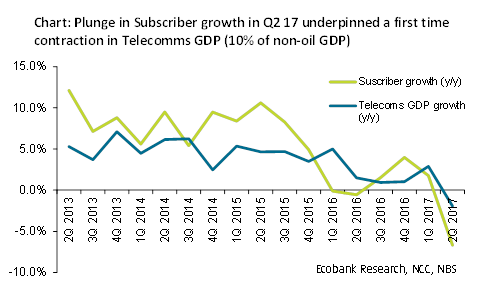

On the non-oil side, another reason for less than expected GDP growth figure was the contraction from the Telecoms Sector. Mobile subscribers dropped by 11million.

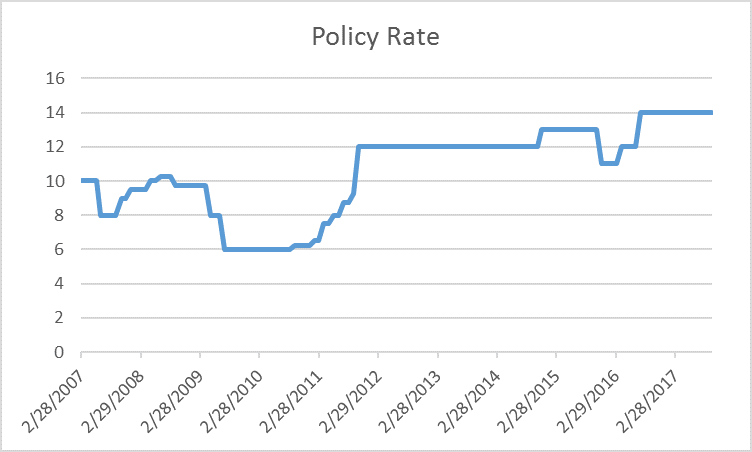

Policy rate is currently at a 10-year high. The Central Bank of Nigeria had to take a hawkish stance in order to control inflation from a weakening currency, stemming from falling oil price coupled with falling oil production due to militants blowing up pipelines in the south-south- oil producing region of the country.

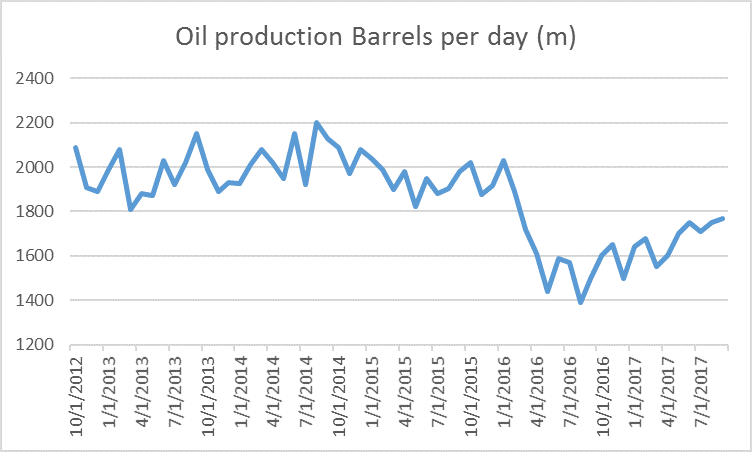

As oil price and production reduced, the central bank was forced to devalue the naira/USD. Also releasing a plethora of forex trading windows in order to accommodate different USD demands.

As a result, we saw inflation increasing towards the end of last year and spike up to 18.7% at the beginning of the year, the highest since 2005. Also worth noting that last year fuel prices increased by 70% and electricity tariffs went up by 45%. All of these contributed to the sharp rise in inflation.

On the turn-around side, Oil production is now picking up from currently at 1,750m bpd from a low of 1390m bpd, as the issues with the militants in the South of Nigeria calm down I see oil production continue to increase to the usual levels of +2,000m bpd. Bear in mind OPEC did not give Nigeria a cap on production.

The naira has been stable in the parallel market for the past 3 months, trading around 363/US$, and the current account now in the surplus, I think inflation will continue to ease for the rest of the year going into next year ceteris paribus.

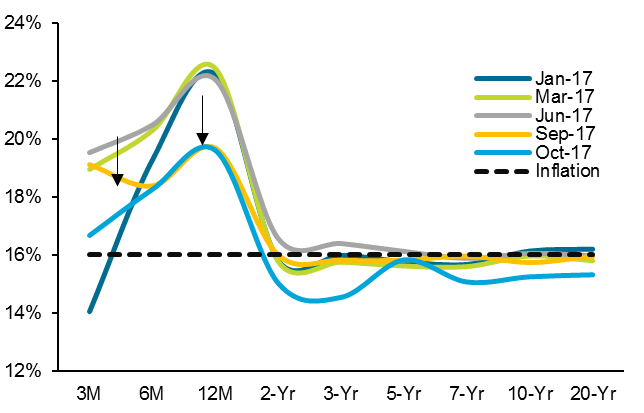

Below is the graph from the BNGRI- Bloomberg basket of Nigerian local sovereign bonds, with an average life of 9.6 years and duration of 4.3. The index shows a downtrend in yields from H2 2017. Yields start to fall, as the market sees the turn-around macro effect in the country.

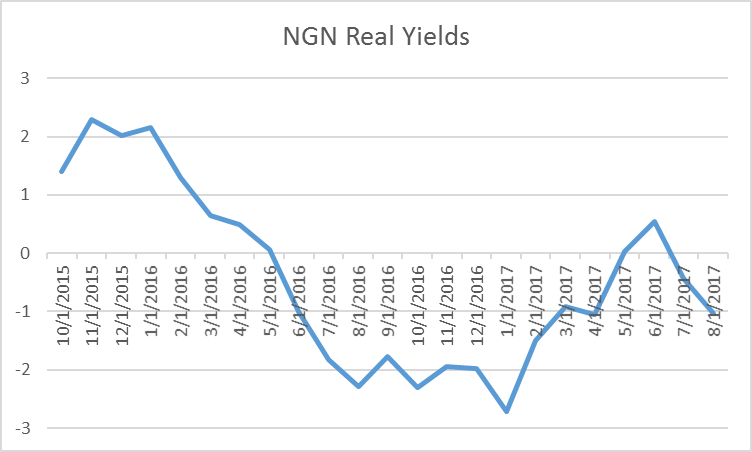

Real Yields however are still near and around the negative territory. In recent MPC publications, the tone is reversing from hawkish to a dovish stance and I suspect that policy rates will start to ease as real yields turn from negative to positive. Declining inflation and a current account surplus will allow the CBN to drop rates further.

In the market Yields dropped on average 90bps, as concerns over re-investment risk drove renewed pension fund buying of longer dated instruments. The strong demand was visible at the monthly bond auction where bid-cover ratios jumped to 3x (August: 0.5x).

One very interesting point to note, In September the Central Bank of Nigeria announced that they have decided to change the debt profile of the country by weighing heavier on USD debt. Following this announcement, they stated that they plan to borrow $5.5bn worth of Eurobonds in Q4 2017 with the first tranche of $2.5b this month. This will likely reduce the NGN local bond issuances and shows why the Q4 2017 issuance calendar has a 19% cutback in planned bond sales. This will likely reduce the yields offered in auctions.

Against a backdrop of slowing inflation, improved macro outlook, reduction in supply of local bonds and domestic pension funds going into long duration in a bid to avoid re-investment risk, I see an uptrend in prices for the rest of the year, with the odd profit taking trades. I think it is time to put on the long Nigeria trade again.

By Arnold Dublin-Green