The National Electricity Regulatory Commission (NERC) has revealed that the Ibadan Electricity Distribution Company (DISCO) gave a N6 billion interest free loan to its parent company Integrated Energy Distribtion and Marketing Limited (IEML) from the N11.3billion it received from the Central Bank of Nigeria (CBN) Electricity Market Stabilization Fund. The CBN had in February 2016 released N120 billion to the DISCOs through the NEMSF to expand their networks and metre customers. NERC made the discovery during an open audit of Ibadan Disco’s books. iEML has repaid just N300 million of the sum

What happens to the money?

NERC fined the DISCO N50 million and asked it to refund the loan at an interest rate of NIBOR (Nigeria Inter Bank Borrowing Rate) + 10%. NIBOR is the rate at which commercial banks lend to each other.

Following the outcome of an open book review conducted on the financial records of Ibadan Electricity Distribution Company plc (IEDC), the Nigerian Electricity Regulatory Commission found the company wanting on two grounds of inappropriate financial transactions and was subsequently fined a sum of N50 million.

The commission has also commenced an investigation into how the fund was utilized by other DISCOs.

Poor corporate governance

Ibadan DISCO’s actions show poor corporate governance may be one of the reasons operators that bought the privatized entities are struggling. Why did the DISCO lend its parent company such a huge sum, and why has just N300 million being paid back ? Actions similar to the steps taken by the Ibadan Disco could be prevalent in other operators. The action also puts to rest claims by one of Ibadan Disco’s owners that the firm was struggling.

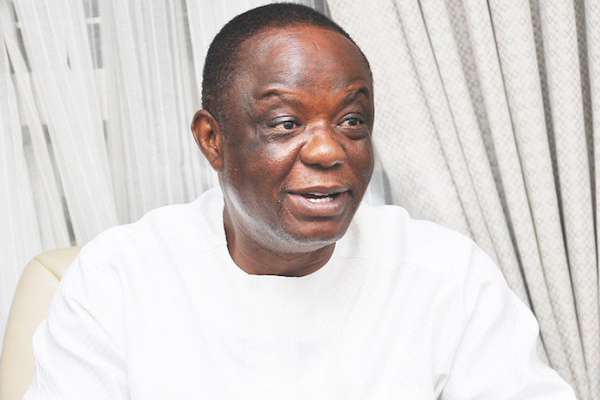

Captain Hosa Okunbo, one of the investors in the Ibadan DISCO had recently accused the Federal Government of not meeting the conditions under which they should operate as a distribution company (DISCO). Okunbor also called for a reversal of the privatization programme

“the best thing that can happen today to us or to me is for government to take back the assets and pay us back our money”

Ibadan Electricity Distribution Company (IBEDC) is the largest DISCO in Nigeria, made up of –Oyo, Ogun, Osun, Kwara and parts of Niger, Ekiti and Kogi states. IBEDC was established in November 2013, after the privatization programme and has its headquarters in Ibadan, Oyo state.