After a series of vague press releases, Oando Plc and its aggrieved shareholders have revealed the details of their disagreement contained in a petition sent to the Security and Exchange Commission (SEC).

Oando has recently been in the news over a petition sent to SEC by two investors who are alleged to be planning to replace its management with an interim board.

Oando has denied such rumours, stating that its Annual General Meeting (AGM) will hold as scheduled.

Here is a rundown of the parties involved and their positions;

Oando Plc

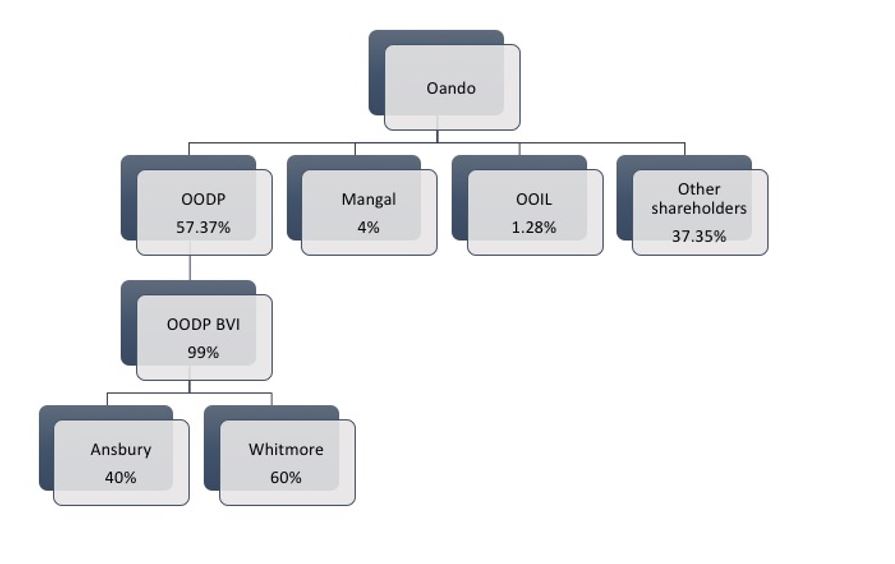

Oando Plc runs what can be thought to be a very complicated shareholding structure. Oando’s major shareholder is Ocean and Oil Development Partners Limited (OODP), which owns 6,734,943,086 (55.96% of total number of shares) shares in Oando Plc.

Meanwhile, Ocean and Oil Development Partners Limited (OODP BVI), registered in the British Virgin Islands, owns about 99% of Ocean and Oil Development Partners Limited (OODP), the direct owners of Oando Plc. Mr. Jubril Adewale Tinubu and Mr. Omamofe Boyo own 22.38% and 11.19% respectively in OODP BVI.

Another company, Ocean and Oil Investments Limited (OOIL) also owns approximately 159,701,243 (1.33% of total number of shares) shares in Oando further broken down as 0.97% and 0.29% to Mr. Jubril Adewale Tinubu and Mr. Omamofe Boyo respectively.

Gabriel Volpi

Gabriel Volpi, an Italian and owner of Intels, in 2012 invested $700 million in Ocean and Oil Development Partners Limited (OODPL) BVI through an entity named Ansbury Plc. This gave him 61.9% stake in OODPL BVI. In addition, Volpi lent $80 million to Whitmore Limited, a company owned by Wale Tinubu to acquire a stake in OODPL BVI.

Volpi believes he owns 55.69% of Oando Plc, since Wale Tinubu has been unable to pay back the $80 million that was lent to him. Ansbury Plc, also has no representative on Oando’s board.

Dahiru Mangal

Dahiru Mangal claims he owns holds a 17.9% direct stake in Oando Plc. However, Oando Plc claims he owns 4% and that the 13.9% is undisclosed.

What Mangal and Volpi are after

Going by the information above, Alhaji Mangal and Volpi claim they own nearly 70% of Oando shares, which makes them majority shareholders (at least indirectly). Both parties, have alleged that Wale Tinubu has mismanaged the firm, and are pushing for his removal from the board.

In a petition to SEC, they requested the company’s Annual General Meeting (AGM) scheduled to hold next week, be suspended.

Sources suggest, both parties are upset that they may have been short changed by the board as they do not have direct control of the management of the company, a situation made possible by the complex shareholding arrangement in place.

Wale Tinubu fights back

JAT, as Wale Tinubu is popularly called, in his defence has stated that the disagreement between himself and Volpi over the $80 million lent to him to acquire a stake in OODPL, is currently before an arbitration panel.

He claims the move by both parties is a ploy to takeover Oando and remove him from office. A company he ostensibly founded years ago. He also claims Ansbury Plc, had a representative on Oando’s board who approved the company’s 2015 financial statement, which Volpi alleges were cooked.

Oando Plc, in a letter to SEC alleged that Mangal has not disclosed the vehicle through which he holds a 13.9% stake in the firm. Failure to do so is a violation of Section 95 of Company and Allied Matters Act (CAMA) since the stake is a significant one.

SEC’s position

An interim report by SEC has given the company a clean bill of health. SEC claims the petitions by the aggrieved parties do not warrant the suspension of the company’s AGM.

SEC further advised the parties to seek a court order restraining Oando from holding its AGM. The regulator also advised Ansbury Plc, to write to Oando seeking representation on its board. SEC claims it can still reverse any decision taken in the AGM, if further information that can instigate such is brought forward.

Why is the AGM significant?

The AGM is significant because Oando Plc represented by its direct shareholders (and not indirect as represented by Volpi and Mangal) could take decisions that are not in the interest of the petitioners. Decisions could dilute the indirect ownership of the petitioners in the company, directors’ fees, debt repayment and capital restructuring etc.

This can be very difficult to reverse after it is voted for by shareholders. Mind you, Mangal and Volpi cannot vote because they are not direct shareholders or have a seat on the board to influence decisions. Mangal’s 4% and maybe 13.9% only gives him that much vote, which is not controlling.

JAT who represents OODPL on the board will surely vote in the favour of whatever request to put forward for vote. The interesting part here is that Volpi invested in a company that owns a company that owns Oando.

Risk to retail shareholders?

For retail shareholders of Oando, corporate battles, especially with major shareholders hardly turnout well. This is especially when the company is undergoing a turnaround amidst a battle for survival. It’s usually a landmine for future financiers, banks, potential investors and even government.

People who do business with Oando will also be worried by all the negative press this is creating and will also ponder the long term viability of their business partnership. This is not all good for business.

However, JAT is not new to such controversies and will likely steer the ship. Oando survived a major debacle after in reported record losses in 2014. It’s share price has bounced back, albeit volatile and have been able to pay down some of their loans. They have also been able to restructure some loans too. The survival of this company will probably lies on factors beyond business.

The parties to this current conflict all have connection with political big wigs and how the politics of this all play out will be a hugely determinant factor. It’s either politics eventually settles them or ruins them.

Volpi for example is a close ally of former Vice President Atiku, who is rumoured to be mulling a presidential campaign in 2019. JAT is a close associate and relative of Political grand master, Bola Tinubu who was pivotal to electing President Buhari. Ahlaji Mangal is also a major force in the North and wields political influence.

SEC is Mute

Through this all, the Securities and Exchange Commission (SEC) has maintained a stoic silence, issuing no press release.

Note: A tweet thread on Oando, featuring @ugodre will be live on twitter on Friday, September 7th 2017.

Nor be small thing dey happen for Lagos State

“This can be very difficult to reverse after it is voted for by shareholders. Mind you, Mangal and Volpi cannot vote because they are not direct shareholders or have a seat on the board to influence decisions. Mangal’s 4% and maybe 13.9% only gives him that much vote, which is not controlling”. However, they can communicate their voting pattern through whoever manages their indirect holding. They just need to indicate they are calling for a poll 48hrs before the AGM

@ Peter, Oando is not Lagos State, it is a public limited liability company.

Why can’t Vopil simply use Ansbury to initiate processes to remove JAT as OODP’s rep?? If JAT IS replaced as such Vopil will thereafter exercise the control he desires.

Lol. Did you not see that part where JAT and one Wole guy are said to be the major controllers of OODP? With JAT still controlling majority vote there. There’s hardly any way that kind of backroom attack can work. Plus I’m sure the key decider in all this won’t be shareholding structure or who represents who but the politics of it as was mentioned above.