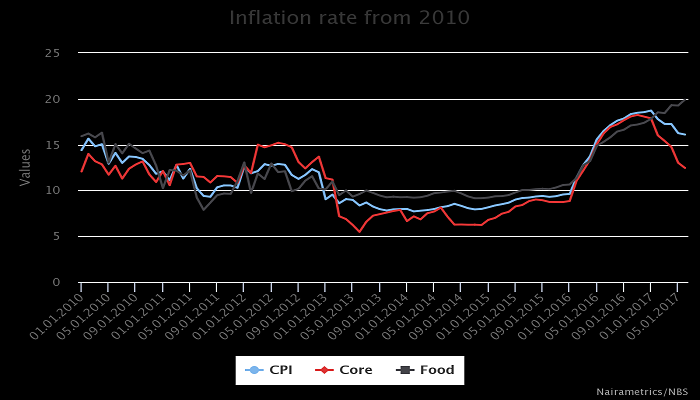

Nigeria’s inflation rate rose 16.05% year on year for the month of July 2017. This compares to the 16.10% rise reported in June 2017. It also represents the 6th consecutive decline in the rate of headline year on year inflation since January 2017.

On a month on basis, the Headline index increased by 1.21% in July 2017, 0.37 percent points lower from the rate of 1.58% recorded in June.

Core Inflation

Core inflation which excludes the prices of volatile food produce eased by 0.30 percent in July to 12.20% points from 12.50% recorded in June. Core inflation similar to overall/headline inflation has declined consecutively since January 2017.

On a month-on-month basis, the Core sub-index increased by 1.00 percent in July, 0.32 percent points lower from 1.32 percent recorded in June

What this means

Analysts had expected a faster decline in year on year inflation rate for July, believing that inflation rate could come under 16% for the first time since May 2015. However, at 16.05% it thus suggest the prices of goods and services is still high relative to last year’s base prices, signaling that Nigeria still has a long way to go, if we are to achieve price stability.

The impact of a slow inflation rate also means, interest rates, which the government has been trying to bring down, will remain stubbornly high, especially for government securities such as treasury bills and bonds. Lending rates which has remained north of 20% will also remain at these levels except the CBN decides to withdraw some of its monetary policy tools that have been geared towards tightening money supply.

This week is also the last week of treasury bills sales for the quarter (according to CBN’s treasury bills calendar) suggesting that rates could reduce a bit as investors scramble to purchase one of the most lucrative securities around. Also interesting to note that government failed to achieve full subscription on its bond offering last week suggesting that the market still expects interest rates to remain high.