Unilever Nigeria Plc finally released details of its N58.8 billion rights issue on Wednesday, June 28. 2017. The company is offering 1.96 billion shares at a price of N30 per share, just as we had suggested in this article.

Dealing Members are hereby notified that Unilever Nigeria Plc (the “Company”) has through its Stockbroker; Stanbic IBTC Stockbrokers Limited, submitted an application to The Exchange for approval and listing of a Rights Issue of 1,961,709,167 Ordinary Shares of 50 Kobo each at N30.00 per share on the basis of 14 new ordinary share for every 27 ordinary share held.

The Qualification Date for the Rights Issue is today, 28 June 2017.

Unilever share price closed on Friday at N40 per share thus the rights issue will be selling at a discount of about 25% to the current share price.

The company also said it will be offering 14 new shares for every 27 currently being held which means Unilever will be creating a whopping 52% new shares just to accommodate the N58.8 billion it plans to raise.

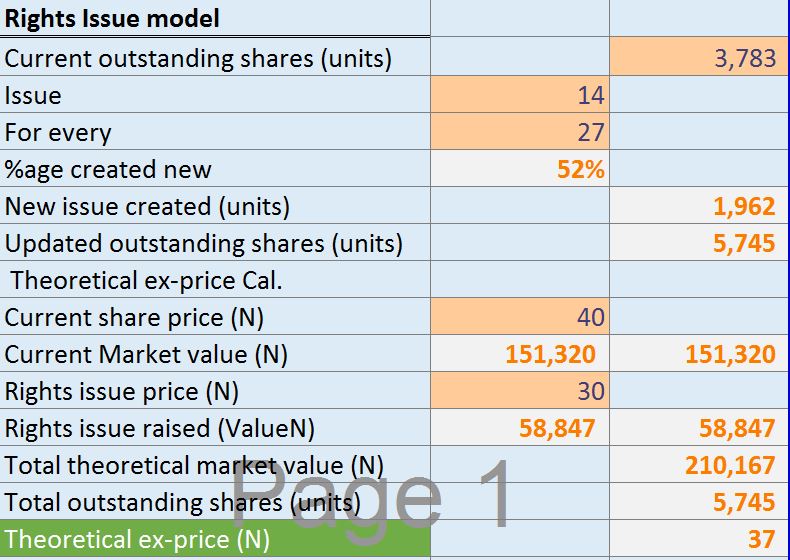

This snapshot can help explain what this means in value

What will be the share price of Unilever after this offer.

According to our estimates, Unilever will open at a share price of about N37 at the end of this rights issue assuming the share price remains at N40. However, the exchange no longer freezes the suspends trading of the shares of a company during a rights issue or public offer so we expect the price of Unilever to converge to the rights issue price. The theoretical ex-price which is the price Unilever will trade at when the right issue is over will by our estimates be N1 to N3 lower than the market price provided the stock does not trade below N32 at the end of the offer period.

Do I sell or just wait?

As far as we are concerned Unilever is over priced at even N30 if we are to rely on its fundamentals. However, Unilever is a defensive stock so we do not expect the share price to drop below N25 in the next 3 months at least. If we have a long-term outlook and require a defensive stock for our portfolio then maybe we will hold, other wise we will be selling the stock in a blink of an eye.

Do I buy Unilever?

It is probably too late for you to buy the stock if you need to buy to take part in the rights issue as the qualification date is June 28th 2017. The company was also smart by placing the stock at a 25% discount to market price giving itself a margin of safety of some sort. We believe that the aim is to ensure that the market price does not drop below the rights issue price resulting in a theoretical ex-price that is above N30. Unilever also has a shallow liquidity so it is likely that the share price could hold at a support of N35.

As a non shareholder looking at this stock, best bet will be to look away at the current share price till it drops to at least N30. This is because buying the stock at a price above 30 leaves you at risk of taking a major hair cut in the event that the share price converges with the rights issue price which we believe will happen soon. As such, any price above N35 is a risky proposition.

I am not recommending anything Any unemployed graduate that have bought .a mobile phone which cost a minimum of lowest price cost about 20,000 naira,and according to ncc,we have on connected lined 170 million mobile phones in Nigeria.

At 30 naira per share,this graduate can afford this risk,if you are lucky,you can make a million naira within a week, IF YOU INVEST WITH THE AIM TO HAVE A STRATEGIC AIM,RAISES FUND FOR YOUR NEW BUSINESS,AND YOU CAN GET A BRIDGING FUND FROM ANOTHER SOURCES,POSSIBLE A BANK.A shares that is floated settled to it’s affordable market level on the same,it may go up or down that day.

You can ask your broker if they uses derivation e.g leverage,With this leverage you can enhances your initial capital to invests in this shares,a leverage means adding value to your share capital,in some ratio,which is called in some countries “contract for difference” or” spreadbetting”,which come in some ratio i:100, 1:200,1:400 e.t.c.i.e your 10,000 times 400.it is not a joke,you do the maths yourself and you find your rich but you do not know.if your broker does not do this,you should write your complaint and your petition to,your broker office asthey does not want you to be rich buT is parasiting on your money,which is evil in the eyes of the Almighty. God. or Mr Magu of efcc even president Buhari

You write your complain and petition to the nse and the Nigerian security commission and finally you write to your representative in the national assembly.it will get in.those young Nigerian who uses foreign broker to trade forex ,know what i am talking about