Data from annual report of some top commercial banks in Nigeria reveal they made a combined sum of N132.4 billion in E-business income for the year ended December 2016. This was about 41% higher than the N94.1 billion made in the same period in 2015.

E-business income

E-business income for most Nigerian banks include fees and charges earned from card usage, mobile banking and internet related transactions. Nigerian banks have stepped up their respective E-business products as Nigerians increasingly lean towards digital products. Adoption of card and online products to help facilitate transactions have soared despite the capital controls introduced by the CBN over the last two years. Data from the CBN also shows a steady rise in the volume and value of transactions of E-business related products as was reviewed in a Nairametrics post some weeks back.

See chart

[wpdatachart id=109]

We review the top 3

UBA tops the chart

From the chart above, United Bank for Africa came tops for the second year running with N30.4 billion as E-business income. In what might seem like a surprise to a lot of young Nigerians, UBA has one of the most efficient E-business platforms in the country and is considered very strong in facilitating online electronic transfers. UBA’s Africash is also said to be widely popular among traders helping hem facilitate transfers across African countries where UBA has branches. UBA earns up to 1% as fees for the transfers. Other E-business products owned by UBA are Cash Fast, UBA Remit, Western Union and MoneyGram. UBA also recently updated its mobile banking app.

First Bank maintains close lead

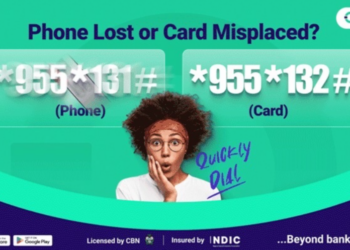

First Bank toppled GTB as number two in E-business income earning a whopping N21.8 billion which was a whopping 42% higher than the N15.3 billion earned in 2015. Despite being often considered an older generation bank, First Bank has also been in the fore front of the mobile banking revolution. The bank was one of the pioneers of the USSD platform which is used to transfer money via a text messaging application of a mobile phone. The bank also has two mobile banking app, the First Mobile which is like other banking apps, allows its users to transfer money (as much as in your account), pay bills, buy airtime, etc. First Bank also owns an app called First Monie which does not require its customers to have bank accounts to transfer money or make transactions. First Bank also uses Western Union, MoneyGram, Ria Money and TransFast for money transfers.

Access Bank

Access Bank recently launched an updated mobile banking app that includes a classic and premium offering. Information from Access Bank’s annual report also suggest most of its income came from card related transactions. Access Bank recorded the highest year on year growth in E-business income as its N21.2 billion income was about 221% higher than then N3.9 billion earned in 2015. Access Bank explains the increase was because of increase in volume of e-channel and card transactions.

See details for other banks.

Financial Year ended 2016. Nairametrics Research

Bank E- Business Products