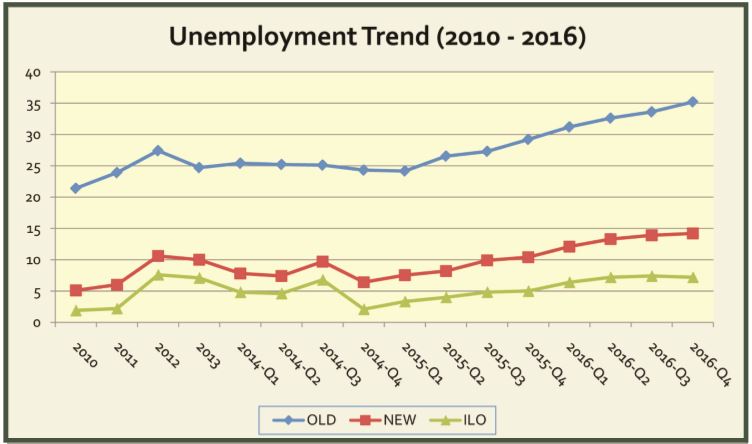

The effects of the recession were once again brought to the fore as the National Bureau of Statistics (NBS) yesterday released the fourth quarter 2016 Underemployment/Unemployment report.

Here are key highlights from the report:

In percentages

- Unemployment rose by 14.2 % in Q4 2016, showing an increase for the third consecutive quarter. Nigeria’s unemployment rate stood at 10.4% at the end of 2015 and 7.5% when the government of Buhari came into power.

- Unemployment rate for Nigerian youth’s rose to 25.2%

- Underemployment rate, which measures the number of Nigerians who are employed in positions lower than their qualifications rose to 21% from 19.7% in the third quarter of 2016.

- About 61.6% of Nigerian Youth were either unemployed or underemployed.

- 61.1% of Nigerians aged 15-24 were unemployed as at Q4 2016 compared to 59.9% in Q3 2016.

In absolutes

- In actual numbers, the number of unemployed people increased from 11.1 million in Q3 2016 to 11.59 million in the fourth quarter of 2016.

- The number of Nigerians who were unemployed before the Buhari administration were about 8 million Nigerians. Thus we have added about 3.5 million people to the unemployment pool.

- The economically active population increased 0.5% quarter on quarter from 108.3 million in Q3 2016 to 108.59 million in Q4 2016.

- In the fourth quarter of 2016, the labour force population( those within the economically active population that are willing and able to work) increased from 80.67 million in 2015 to 81.15 million.

- Data also shows that about 2.9 million graduates in Nigeria are out of jobs and another 5 million who attended either primary or secondary school education.

- About 3.4 million uneducated Nigerians are also unemployed

- About 6.8 million of the unemployed population reside in the rural areas.

The statistics show the government will need to redouble its efforts to get the economy going again. The 2017 budget which is key to the country recovering from recession is yet to be passed.

Source: NBS

Below is a copy of the report.

hip hip well done my young friend onome.2.9 million graduates in Nigeria.THERE IS A LOT OF WORK TO BE DONE IN NIGERIA DUE TO CRIMINAL GROSS NEGLEGENCE AND MIS-MANAGEMENT OF NIGERIA ECONOMYnow what is production or happiness index in Nigeria.now you look at inflation in Nigeria,there have no attempt to control inflation in Nigeria for 30 yrs.look at the cbn plan to control inflation ,they deregulates bank interest,and the next thing to do is to give us high bank interest.

we thought that this govt will give hope with this graduate a self-employment scheme,instead they start to humiliate then,by give THEM an advising scheme paying pocket money.IN NIGERIA ON THE BANK OF RIVER NIGER,THIS GOVT IS FORCING THIS JOBLESS GRADUTE TO BE WASHING THEIR FACE WITH SPITTLE.

The list is endless if they want to have a mentoring scheme through this gradute scheme,why not you fund local govt area,if deficit to fund local library.local primary healthcare.you cannot force somebody to love another,which he do not wants to do.when I was in my teen,my old man uses to force me to borrow books from our local library,he also uses to import books from abroad.i uses to visit Enugu city library or Onitsha library,as when where we locates.

some of my comment,you find I made in nairametric,did not come from Nigeria educational system,but from books i read in Nigerian local library,and some of those books did influenced my thinking