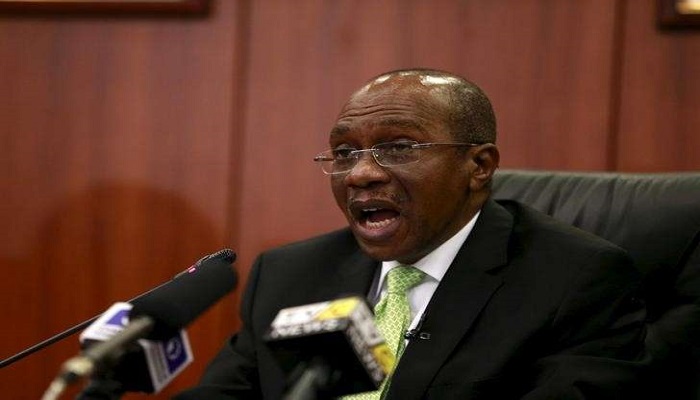

Back and forth on ‘ways and means’: Over the weekend, the former Central Bank of Nigeria (CBN) governor, Emir Muhammad Sanusi II stated that the apex bank was violating certain portions of the CBN Act 2007 which cap monetary financing of fiscal deficits at 5% of prior year’s revenues. Given the implications of unrestrained monetary financing of fiscal deficits, we examine the issue to ascertain the true picture and focus on likely implications on fixed income markets. Using data available from the apex bank, CBN claims on FG have risen steeply over the last two years to N4.2 trillion at the end of October 2016. The increases reflect sharp expansion in overdrafts and converted bonds facilities, which cumulatively account for 95% of the outstanding balance, to N2.1 trillion and N1.9 trillion, respectively.

In our H1 2016 Nigeria Strategy Report, we had highlighted that CBN financing came in handy in 2015 with Budget Office data showing that the apex bank’s advances (N616 billion) helped fund 40% of the fiscal deficit that year. Going by 2014 FGN retained revenues of N3.2 trillion, we can safely say that, in 2015, the apex bank overshot the ceiling of ‘5% of prior year revenue’ imposed in the CBN Act 2007.

Voice of Jacob but hand of Esau: Clearly, the key insight from parsing through the data is that faced with a gory revenue picture, the FGN has been reliant on the apex bank thus far in 2016. For evidence, the stated overdraft of N2.1 trillion is two-times of total net borrowings (bonds & bills) thus far in 2016 (N1.06 trillion). Importantly, where it had seemed more pristine motives of discipline and focus on long-term inflation were behind FG’s reticence to borrow at high rates, the CBN’s backhand funding clearly lessened the need for haste in fiscal borrowings, including the foreign leg, with the planned Eurobond issuance postponed at least three times in 2016.

Spotlight on CBN ‘back-door’ funding to drive policy normalisation? Going forward, with the spotlight now firmly on the ways and means funding, we think the FGN and CBN are less likely going to continue to rely on the avenue for deficit financing. Given lack of progress on foreign borrowings and the urgency regarding spending, the expected cap in CBN temporary financing should result in FG relying more heavily on domestic borrowings with limited room for cost sensitivity. All of this points to higher debt supply in 2017, further deterioration in debt service to revenue ratio, and upside to interest rates.

Monetary policy at cross purposes: In itself, the extent of the ways and means financing puts CBN’s tightening stance under scrutiny. The reduction of banking sector liquidity and raising of short-term rates (via OMO interventions & high T-bill rates) while expanding liquidity into the economy at negotiated rates via its backdoor FGN financing, also ‘short-term’ by definition puts monetary policy at cross purposes, in our view. That dissonance also reconfirms to us that, despite the inflation alibi, the raising of short-term rates is so at odd with everything else on the domestic front that the motivation could only be for attracting FPI. The question is then when the apex bank wakes up to the realities that the latter is not wooed, especially not with the whack-a-mole actions on the currency, and start to focus on what it indeed can influence.

Given that 2016 has borne out our long-held views about the inefficacy of interest rate hikes on taming cost push inflation even as FPI remains reticent to naira assets, we think a more coherent and consistent approach would be for the apex bank to adjust its policy stance in line with its intentions to support growth especially considering it’s already indirectly seeking to combat the recessionary conditions via deficit financing to the fiscal side anyway. It is that potential for a twist to an easing regime that makes higher rates from the replacement of CBN’s support to financing FGN deficit less of a foregone conclusion with full-blown stimulus mode possibly leading to contraction in yields with extent however limited by sizable fiscal paper supply.

mii,mii.it looks that this recession is affect the minds of some govt official,yesterday the british financial times said that the fed govt will pursue a 1 billion dollar bond in the first quarter of next year.NOW I AM TELLING YOUR VEIWER OF THIS FINANCIAL WEBSITE, THAT THE NATIONAL ASSEMBLY WILL NOT APPROVE THIS CHINESE LOAN UNDER ANY CIRCUMSTANCES.i tell you why on this proposed bond is thatit’s not ambitious to satisfies members of national assembly (2) it’s not powerful to the economy to bring some elements to push the economy (3) the private sector will lobby members of the national assembly to kill this loan,we have about 11 car assembly plant,maybe with the exception of innoson and the indian manufacturer of marva keke based in lagos who are engaged in full car production.

we have the germans who wants to built car manufacturer,e.g volkswagon.they will tell those members of national assembly that they can do this maglev in Nigeria,by themselves

By the beginning of next year,they will have the missing information they needed to frustrate the executive economic plan.i.e the private sector,they will also lobby the cbn to cut bank interest lower to 8 % to 5 % even 2 % within 2 years.i think the governor is doing his best,to him “where do we start in Nigeria” they were under a lot a pressure to allows the naira to float partia butl,he did giving forex directly to t some manufacturers.now,look at the un-utilized fund they proposed to govt and for the floating the economyTHERE IS A LOT OF ELEMENTS MISSING IN THE ECONOMY THAT WILL INCREASES PRODUCTION.I think the ministry of trade and commerce have in conjuction with the ministry of finance wanted to give more power to money market.i.e regulation,protecting the small investor,which will happen before the next election.

If it happens next year,it will make Nigeria great (1),the Big failure of mortgage financing,that was proposed in the johnathan govt will be a thing of the past(2)sometimes it maybe the fault of the govt,even the citizens of the country.look at this proposed of engaging gradutes in enterprenuership of about 500,000 Nigerians,the details have been released and for 10 months nothing happened,my argument is why not govt give them some free money,or give then a freezing of this bank interest,or bank interest for about 10 % of the full fund,which will give thise jobless graduate hope and incentives to participate in this scheme.the benefit of a persom working cannot be estimated in monetary benefit,,even for the nation it is more possible for this jobless graduate built a business worth 200 millions naira within 1year.how can he do it ? through venture capitalist………….how do they operate ? they shares the risks of business with the owners of the business unit by funding the business in return they gets their money back (1) having a percentage of share holding (2) taking a percentage of profit.e.t.c,.that was how facebook was financed.