Nigerian Stocks are in a free fall this November with about N500 billion wiped out in a space of 17 brutal days. The All Share Index has posted negative for 11 out of the 13 days of trading culminating in a month to date loss of 6%. In fact all the major indexes have all lost ground.

We’ve also seen multi year lows for stocks like Transcorp, Forte Oil, Diamond Bank and Skye Bank with billions wiped out of their market value. Investors are reeling as those who can’t sell loss making stocks can’t do nothing but watch as their investments filter a way to the brutal devoir of the bears.

No one knows precisely what is the cause of this sell-off. A lot of the macro economic indices currently out there have been with us for months now. The inflation story is nothing new and the gyration in the forex market is also not recent. Some however believe that the alleged forex manipulations by the CBN could also be a major reason why stocks are sliding. It is believed in most circles that foreign investors who are the lifeblood of this market have no cogent reasons of coming back any time soon, especially with the dollar scarcity still biting hard and oil prices still stuck below $50.

Some even point to the Trump presidency as a major factor. With a populist approach to the presidency, it is believed that Mr Trump could favour policies that reward investors for investing in America rather than extending support to African countries.

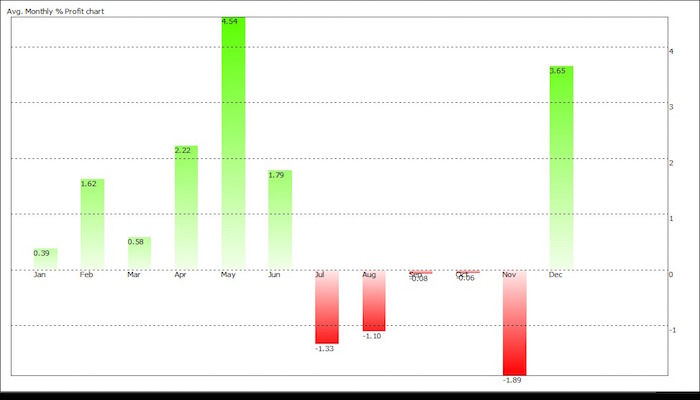

One other reason however does seem quite plausible and it has to do with history. According to the monthly performance of the Nigerian Stock Exchange over the years, November has always been the worst month for stocks. See below;

For 12 out of 19 years of the trading in the Nigerian Stock Exchange, stocks have lost in the month of November. In fact, stocks have post end of month losses for 8 out of 9 years and 11 of our 13 years in the month of November. No other month shares this record with November. It’s a remarkable trend that makes our analyst call the month of November, “nevermber” for stocks.

Analysts believe this is probably because most fund managers like to sell-off and book profits before the end of the year to avoid booking lower asset values by year end. Another November analogy has it that “smart money” typically leaves the market in November ahead of the December rally. Smart money by their definition refers to investors who quickly cash out before a major stock market downturn. The theory continues that as the smart money exits the building, weak money goes into panic mode ensuing in a major sell-off. By the time the market is down and almost out, smart money reenters for the December rally hoping to close the year on a high. This theory corroborates with the theory that fund managers also like to exit so they can come their funds on a high.

The Nigerian stock market is one crazy place at the moment and like we have often opined, passive investors ought to stay out. It’s a market for the savvy and brave. For those wondering why stocks are in sell off mode, we may not have the answers you crave, however you’d probably be a sucker to ignore the wrath of Nevermber.