The National Bureau of Statistics has released its 2016 third quarter capital importation report revealing that the total value of capital imported into Nigeria in the third quarter of 2016 was estimated to be $1,822.12 million, which represents an increase of 74.84% relative to the second quarter, and a fall of 33.70% relative to the third quarter of 2015.

According to the Bureau, the highest level of capital imported was in August, when $894.00 million was imported, the highest level since July 2015.

In September $649.76 million was imported, which was still more than any month in the first and second quarters. In contrast with the previous quarter, where Other Loans explained the majority of the increase, a number of investment types contributed to the quarterly increase.

Break-down of Capital Importation

Return of hot money

As expected, much of the quarterly increase in the value of capital importation came from debt financing. This follows the Central Bank’s decision in July to increase MPR to 14%, the highest on record, in a bid to attract foreign currency denominated capital.

According to the Bureau, Portfolio investment in Bonds and Money Market Instruments made up about 85% of the increase.

Money market is mostly made up of short-term funding securities such as treasury bills and commercial bills from CBN.

Strong FDI Showing

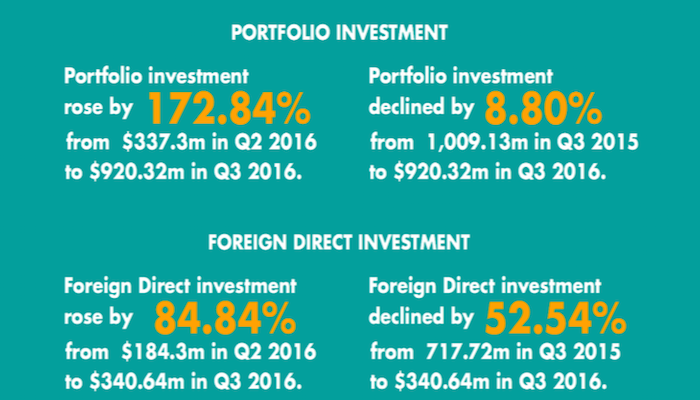

The Bureau also reported that quarterly growth in FDI equity was also strong, although Portfolio equity continued to decline. FDI, Portfolio and Other recorded quarterly increases, of 84.84%, 172.84% and 7.80% respectively. The relatively strong growth in Portfolio Investment meant it regained its position as the largest investment type, and it accounted for 50.51% in the third quarter, compared to 18.69% and 30.80% for Other Investment and FDI respectively.

Break down

Capital Importation can be divided into three main investment types: Foreign Direct Investment (FDI), Portfolio Investment and Other Investments, each comprising various sub-categories.

Portfolio Investments: Portfolio Investment was the largest component of imported capital and accounted for $920.32 million, or 50.51%. Although Portfolio Equity declined by 28.12% relative the previous quarter, this is outweighed by large increases in other types of Portfolio Investment.

Bonds increased from zero in the second quarter, to $369.00 million in the third, and Money Market Instruments increased from $57.50 million to $350.20 million over the same period, an increase of 509.03%. This buttresses the return of hot money into the Nigerian financial system.

The Bureau also reported that this is the first quarter since 2007 Q2 in which Equity was not the largest part of Portfolio investment; at $201.12 million this type of Portfolio Investment remains considerably subdued relative to previous highs of $4930.55 million in the first quarter of 2013, and $3875.35 million in the second quarter of 2014.

Get the full report here