We have received inquiries from Nairametrics readers asking what exactly is the official exchange rate between the Naira and the dollar. You really can’t blame them for asking. A look at the CBN website, tells you it is N305. Move over to the website of the FMDQ and you will see N315. What about the BDC’s where we both buy dollars from if it is available? It’s probably N340 there. And what about buying things online? That’s probably N380.

A recent interview granted to the CEO of the FMDQ (Nigeria’s official Market for trading forex) Bola Onadele (Koko) by Businessday has finally provided an explanation for these rate disparity within an floating currency that shouldn’t have any. It’s an interesting revelation as it also revealed his frustrations.

We summarized the key details bellow;

Market 1

The first sub-market is the CBN rate (which is ₦50 – ₦60 away from the actual market). At this level, the CBN sprinkles tiny flows to the market and probably less now, where the International Oil Companies (IOCs) are forced to sell to petrol importers. We need to talk more about this.

This is the CBN rate that goes for N305

Market 2

The second sub-market is the FMDQ Close, which does not reflect the right market sentiments due to the pressure on the banks. This rate is close to the CBN rate because the closing period is dominated by CBN transactions with the banks at discounted rates!

This is perhaps the rate that the CBN is suspected of “rigging”

Market 3

The third submarket is the FMDQ NIFEX, which is suffering as the Reference Banks are bashful in advising their views of the right spot FX level. This is where the OTC FX Futures settle.

This is closer to the spot price (sort of like an official price free of “rigging”)

Market 4

The fourth sub-market is the real spot FX level which is at $/₦350 – 360. Most transactions settle here, with two (2) or more cheques flying around to support the transactions, thereby promoting unethical behaviour!

This is remarkable. He just confirmed this market is being rigged!!

Market 5

The fifth sub-market is the $/₦340 rate at which the International Money Transfer Organisations (IMTOs) buy the remittances from Nigerians in the diaspora

This is the rate you get when you get money from the likes of Western Union or Travelex

Market 6

And the sixth sub-market is the rate at which exporters desire to sell their dollars – expect this to be nearer the BDC/parallel market. You cannot blame the exporters because the pricing of their export products is benchmarked nearer the more transparent parallel market.

Well, this is the market that happens in the wires. Importers and exporters who ignore the official market and see the parallel market as too small use this market to transact. It is mostly cashless.

It was a remarkably interview and one that saw koko come out Gunz blazing. You can get it in today’s Businessday (Monday 10th October) page A 10.

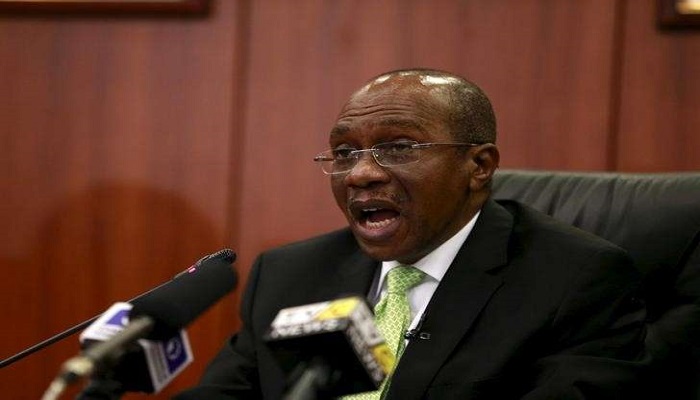

Should we tell our president or governor godwin my main man,thatt this is happening under his watch or their watch,so far all benefit that is derived from this floating,are foreigner,the governor said so far foreigners have invested 1 billion dollar in migeria,where is it ?