Though mutual funds are not as popular in Nigeria as stocks but a sizable amount of investors have purchased and still hold mutual funds in addition to or instead of buying individual stocks.

For those wondering why they or any one should invest in mutual funds, there are good reasons to do so as mutual funds provide the benefits of diversification and professional asset selection and management. When one owns a basket of securities instead of an individual security, he/she is exposed to much less individual stock risk, although the ownership of mutual funds does not insulate an investor from non-diversifiable risks, otherwise called market risk.

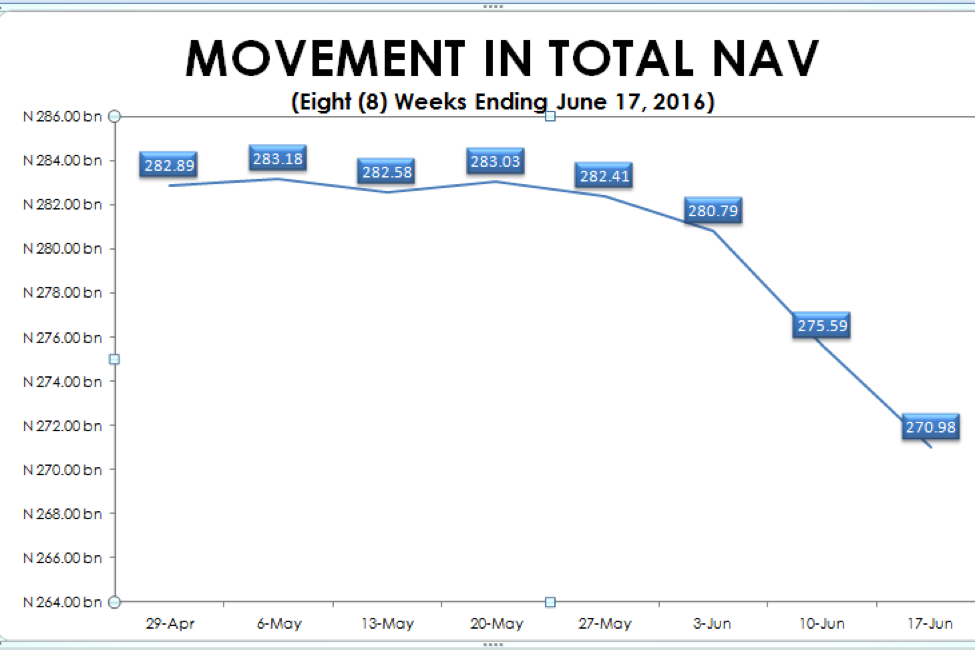

Good as the benefits of mutual funds sound, it does not look like many people are taking advantage of those benefits. The Net Asset Value of mutual Funds has been decreasing week after week since the beginning of the second quarter, not so much due to underperformance but as a result of “massive outflows”

One of the ways to decipher the state of the mutual fund industry is through fund flows. Fund flows is a metric or statistic that analyzes whether investors are putting money into, or taking money out of, mutual funds over the course of a specified period. Research and analysis conducted by Quantitative Financial Analytics shows that the first quarter of 2016 was quite good for mutual funds as the NAV grew from N265 billion at the beginning of the year to N296 billion as at March 31. Within that period, a total of N46 billion was injected into mutual funds with N27 billion going to FBN Money Market fund while about N13 billion was the combined withdrawals suffered by the mutual funds.

Since the beginning of the second quarter, the story has changed. Mutual fund Net Asset Value (NAV) has gone from the March 31 N296 billion to N275 billion, going by the NAV summary released by the SEC on June 17th. This represents about 7% decrease. Within that same period, mutual funds generated a combined profit of N4.13 billion, attracted a combined contribution (new money) of N5.7 billion and withdrawal of N29.5 billion. Now you know why total NAV dropped.

A more granular analysis indicates that much of the withdrawals were in the Money Market category, which saw N26.9 billion being withdrawn while N1.6 billion was withdrawn from Bonds/Fixed Income Funds

But Why

All over many discussion forums, Nigerians have been complaining about falling yields across all fixed income products. (Some countries have even recorded negative yield). It is therefore not surprising that such complaints may have been followed up with withdrawals. It is often said that flows follow returns. Again, the free fall of the Naira during the early part of the second quarter may have added to the disenchantment with money market funds by foreign as well as local investors. The recently released inflation data which had put the rate of inflation at 15.9% may have exacerbated the pull out, as investors, who think in terms of real returns, would have felt that they were receiving negative returns from asset classes whose returns are less than the rate of inflation. The equity market has started bouncing back, beginning from May, it is likely that more investors may reallocate their assets from money market to the equity market so as to partake in the surge. No one is, however, certain how sustainable the surge in the market will be given the recent BREXIT vote, the continued volatility in the global oil market and the Nigerian currency market volatilities.

Be that as it may, Mutual funds are still a good pick for those investors without the time and technical knowledge to search for alpha in the most unlikely places.