The Price Club: The New Nigerian Naira

I feel like the last year has been one maddeningly long and unending conversation about the exchange rate of the Nigerian Naira. In all that time, I always found it difficult to argue for a full float of the naira. That’s what I wanted but it felt like asking for too much. So devaluation seemed like a halfway house that would ease things a bit. The main thing being that the fixed rate of N199 to $1 was completely ridiculous and untenable.

But look at God.

Today, the CBN jumped the shark and went for a float. To be clear, nobody ever floats their currency willingly — you are always forced into it. An example was ‘Black Wednesday’ which forced the UK to float the Pound in 1992. It was painful and embarrassing but you won’t find anyone who wants to go back to pre-1992 here anymore.

So what did CBN just do? Let’s get into the meat of the matter based on what was in their circular.

Inter-Bank Foreign Exchange Club

Let’s be honest here — this is nothing new in particular. We’ve had Inter-Bank markets before but the CBN shut it down last year when it didn’t like the rates the market was giving it. But given that the last year has been so abnormal, the mere presence of something so normal…my goodness. It feels like clean fresh air after being locked inside a damp house for years.

The gist of the ‘new’ market is pretty straightforward — it’s a market where people can buy and sell dollars. Think of it as a pool. All the forex coming into the country will be dumped into that pool. From there, those who want to buy will buy at whatever the price is. Before you put your forex in the pool, you will get a price from people who are waiting to buy it.

Inter-bank Foreign Exchange Market

2.1.1Participants in the inter-bank FX market shall include Authorised Dealers, Authorised Buyers, Oil Companies, Oil Service Companies, Exporters, End-users and any other entity the CBN may designate from time to time.

2.1.2Authorised Dealers shall buy and sell FX among themselves on a two-way quote basis via the FMDQ Thomson Reuters FX Trading Systems (TRFXT- Conversational Dealing), or any other system approved by the CBN.

2.1.3Authorised Dealers may offer one-way quotes (bid or offer) on all products and on request to other Authorised participants via the FMDQ Thomson Reuters FX Trading System (FMDQ TRFXT – Order Book System), or any other system approved by the CBN.

2.1.4The maximum spread between the bid and offer rates in the inter-bank market shall be determined by FMDQ OTC Securities Exchange (FMDQ) via its market organisation activities with the Financial Market Dealers Association (FMDA).

2.1.5Proceeds of Foreign Investment Inflows and International Money Transfers shall be purchased by Authorised Dealers at the inter-bank rate.

Previously the CBN only allowed banks to buy and sell forex at N197.50 and N199 respectively. Nobody was allowed to trade outside of these prices (at least not legally). This meant that a lot of the people who would normally have poured their money into the pool decided not to do so. As such, CBN was the only one filling the pool from time to time.

That’s gone now. First of all, the spread between buying and selling will be determined by the market (Point 2.1.4). Feel free to charge a N4 spread to win market share if others are charging a N5 spread. What will be the new spread? We shall see when the market kicks off next week.

Last time I was in Nigeria, I wrote about how I made a card payment and the money got converted at N288 to £1 when I had gotten N450 to £1 the same day at the airport. This was because the banks were only allowed to buy £s at the official rate (although they found ways to sell it at the unofficial rate). That too is gone now. If you visit Nigeria from abroad and you use your card, you will get a market rate i.e. the rate at the interbank determined by the market. Same goes for Western Union. I doubt anyone has been sending money to Nigeria using Western Union and MoneyGram lately. Now you can — your money will be converted to naira at the interbank rate.

This is all good stuff.

The VIP Section

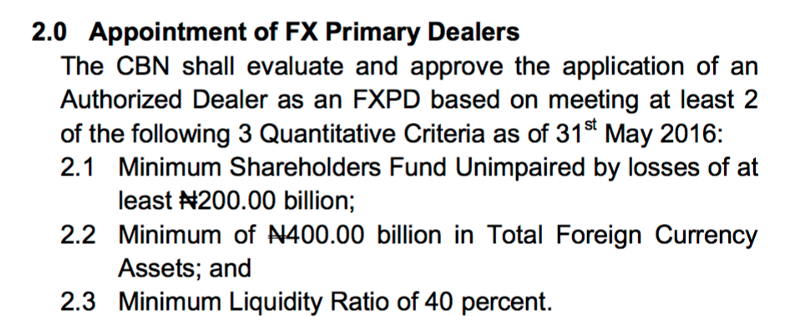

The CBN has introduced something ‘new’ to the market, however. A new creature to be known as Foreign Exchange Primary Dealer (FXPD) has been created. CBN released a separate set of guidelines for these creatures.

In the club, these FXPDs are the guys who will sit in the VIP section with CBN. If forex is champagne, these creatures will be served first before anybody else. But don’t panic, this is a good thing.

These guys are not going to be dealing in small small stuff. Minimum is $10m to sit in this club. That is, to buy dollars from the CBN, they will have to quote in batches of $10m. But remember CBN is no longer going to be the sole source of dollars — so these creatures will also get to buy from oil companies and exporters.

What will they do with all that money? From the FXPDs, the money will flow downwards till it gets to you or anyone else who needs it. Not every bank will qualify for this FXPD creature status — the VIP section can only take so many people. So banks who are not FXPDs will get to buy from FXPDs.

What of Bureau De Change? They are not even allowed in the club talk less of sitting in the VIP section. Having said that, I’m told that people sometimes jump the fence to enter clubs in Lagos. Or stand outside the gate hoping to be let inside at some point. Ultimately, they will get money but only after it has flowed down from CBN to FXPDs to Non-FXPDs. Don’t cry for them — they will be ok.

These FXPD creatures can be kicked out of the VIP section by the CBN if they misbehave. I imagine no one wants to leave the VIP section to mingle with the sweaty masses on the crowded floor so hopefully, they behave. But there will always be that one fly who is not satisfied just watching the dead body being lowered into the grave…

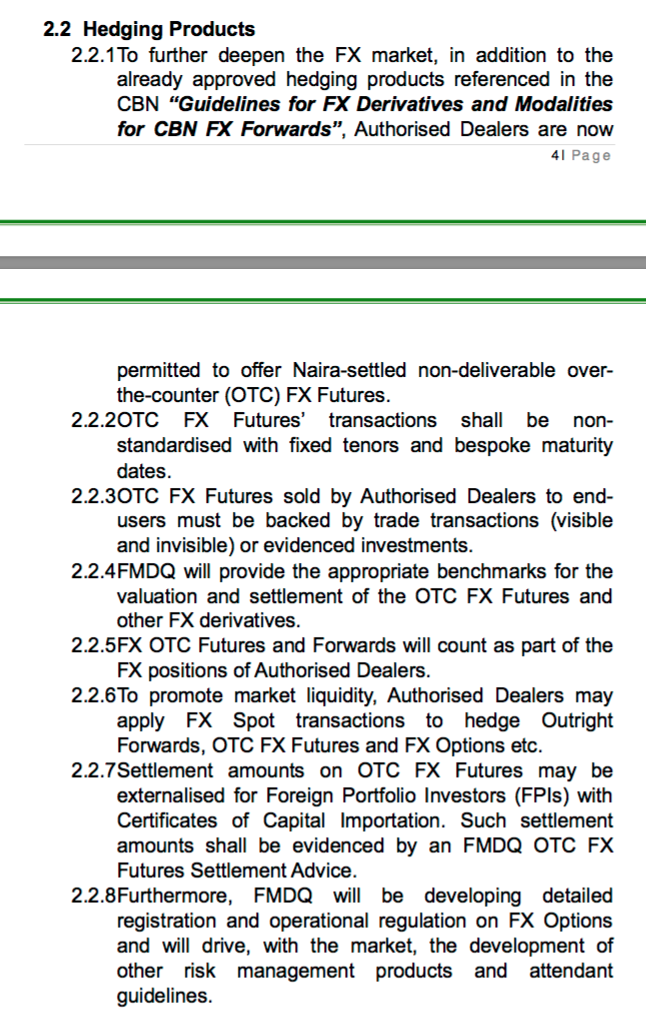

Hedging As A Product

How do people in countries with a floating currency cope with wild swings? I mean, if you leave the currency to market forces, in theory, you can just wake up one morning and the currency has dropped by 50% ke? In theory, yes, in practice, no.

When a currency moves about wildly, that is a risk. This risk brings up different opportunities for risk management products. Imagine you’re a guy who needs to order a container from America in November this year. You know the exchange rate today but you don’t know what it will be in November. You can leave it in God’s hands and take whatever the rate is in November when you need to pay.

But maybe the rate is N350 to $1 today and you think it will rise to N400 to $1 by November when you need it. To avoid that, you buy a hedge for N350 to $1 to pay out on the day you need it in November. This service will not be free —you will have to pay a fee for it. But it guarantees that one the day you need the dollars in November, you will get it at N350 to $1. Remember that you can’t see the future (well, maybe you have ‘washed’ your eyes sha) so on the appointed day in November, it might be that the dollar is actually N320. Sorry. You still have to pay the N350 you agreed to and you have lost money. But it might also be N400 on the day as you guessed. More power to you — you have saved money.

The risk in you people’s country is too much. Your container can be on the high sea on the way to Nigeria minding its business when some attention seeking militant decides to blow a pipeline just for fun. You have not finished paying for the goods when this happens. The market hears it and decides that this means that oil income will drop in the next few months, as such the price of the dollar goes up by 10%. Now, something that does not concern you at all will cost you 10% more.

All the grammar in the screenshot above is describing products that will protect against such unforeseen risks. For foreign investors, this will be a good thing. They know you can’t really trust Nigerian policymakers not to misbehave from time to time so products can be designed to reduce the kind of wild swings that cause painful losses.

I only ever check the £ to $ rate when I am about to make a trip to America. Beyond that, I don’t really care even though I have some $ exposure in some of my investments. I trust that the people who manage my small investments have protected it against wild swings. This is why countries with floating rates have the most stable exchange rates over the long term. It sounds counterintuitive but when you know the rate is determined by the market, it forces you to innovate in ways that reduces risks to manageable levels.

Friends, this is another very good thing that the CBN has done.

10 Things About The New Normal

Given the above, what will the future be like? In no particular order

- This is good for governors and states. For April, the 3 tiers of government shared a total of N281.5bn. We know that this money was changed from dollars at around N199 so working backwards, this gives us $1.4bn that was available to share (some of the money is VAT which is in naira but let’s keep it simple). States and LGs got N144.2bn of that money or $725m if we work back to dollars. Now we know that the ‘real’ rate was around N350 at the time. But let’s say the interbank market settles at N310 when it opens, this means that the states and LGs would have gotten N225bn instead of N144.2bn they got. This is a big difference given that these states have been running around begging for money.

- That said, a lot of these states are owing money in foreign currency for the foreign loans they have taken. To repay those loans, they have been converting their naira at the official N199 rate. Now they will also have to pay the interbank rate of N310 to buy their dollars. A state that has a lot of foreign currency loans will not see much of a difference from the new rate. But if you notice that your governor starts ‘carrying shoulder’ it might mean that your state doesn’t have too many foreign loans and is now ‘liquid’ as Nigerians like to say.

- Unless you have not been reading this blog closely, you must have noticed that Alhaji Putin is my guy. As I’ve been saying, he has been getting roughly $15m per week at N199 for months now. That party is now over. He too will now be buying at the interbank rate like everyone else and there will no longer be a special rate. Glory be. At the post-MPC press conference where CBN trailed the new ‘flexible’ policy, Godwin Emefiele hinted that there would be a ‘critical’ rate for ‘critical’ people. No mention was made of that today. Thank God.

- What of the federal budget? This will help the FG in the way it helps states above. If nothing else, it will be easier for it to pay salaries now and spend money on anything else that does not require imports. Last week, the government announced the Home Grown School Feeding Programme. An initial N93bn has been budgeted for the programme. Given that this is a priority programme for the government and most of the costs are in naira (if not all), there should be more funds available for the government to pursue programmes like these.

- Petrol nko? When the N145 price was announced last month, it was said to have been calculated using a rate of N285 to $1. This is Nigeria’s biggest forex expense so it will be sensitive to whatever the exchange rate is. So what if the interbank rate goes above that? It’s an interesting question. But, until foreign investors return from their holding formation outside Nigeria, CBN will still be the biggest source of dollars in the market. I suspect (this is just my guess) that the CBN will keep one eye on the fuel price when selling its dollars to those FXPD creatures. At any rate, a few days ago, the petrol marketers cabal were wailing in the papers that petrol demand has dropped by 40%. There is only so much Nigerians can take so any further price increase will be met by reduced demand by Nigerians. I imagine that everyone is now watching their petrol usage more closely. Very good. The business of smuggling petrol across the border to Cameroun and Benin Republic is also now dead as the dodo bird. As long as the government holds its nerves and minds its business, Nigerians should be able to deal with the marketers themselves.

- Quite a number of Nigerian companies (mostly oil and gas) borrowed from Nigerian banks in foreign currency. It is one thing to borrow money when oil is $100/barrel, it is quite another thing to repay that same money when oil is $50/barrel. At the end of 2015, CBN said the total amount of bad loans in the banking system — where the borrower is not making repayments — was N650bn. A few days ago, CBN released updated figures up to the end of April 2016. The bad loans in the system are now a shocking N1.38trn. If CBN is openly confessing to N1.38trn, do you think the actual number is higher or lower? Don’t forget that banks have already written off some of these bad loans. First Bank reported an 82% drop in profits for 2015 mainly because it had to put N119bn worth of loans on standby to go bad. It has promised to sack 1,000 workers to balance the books. Some of these bank debtors with foreign currency loans were still managing to get dollars at N199. Now that they will have to pay market rate, the bad loans in the system can only rise. Which means more job losses at banks. You have to feel sorry for people who will lose their jobs. But some of these banks need to learn a hard lesson and there is no other way to do it than this way.

- And inflation? Latest numbers from the Nigerian Stats agency shows that inflation is running at 15.6%. If the exchange rate goes up officially, surely this can only mean prices of things will go up further stoking inflation right? Well, it’s not that straightforward. The truth is that hardly anyone was getting dollars at the N199 rate anyway. Most imported goods are already priced at the black market rate. My hunch is that the dollar will settle at a lower rate than it currently is so this new rate might even lead to slightly lower prices. Nigeria is also a poor country so you can’t keep increasing prices and expect people to take it. At some point, people will find alternatives or just eliminate that demand. I will stick my neck out and say inflation will go down from here.

- There is a huge backlog of forex demand that remains unmet. This amount has been growing for a while now and some say it is now between $6bn — $9bn. The most ‘popular’ group in this constituency are the foreign airlines who now have around $600m trapped in Nigeria. Once the market opens next week, it will be like opening prison doors for prisoners — these guys will inundate the market and increase pressure on the naira. Unless CBN has some special plan to meet this likely demand head on (sauces tell me they have), the exchange rate may spike before it settles later. Keep calm. Once the mess is cleared, things should settle down.

- Even though CBN will be in VIP section selling dollars to the FXPD creatures, from time to time, it will wander out into the main club and sell dollars if it feels the rate is doing wan kain. What is a Nigerian forex policy without a new acronym? We now have something the CBN calls Secondary Market Intervention Sales (SMIS). That is, it will sell dollars directly to the main market where FXPDs and Non-FXPDs trade just to keep things stable.

- If you need dollars, just go to your bank. If you want PTA or BTA or whatever you call it, just go there with your ticket and ask for it. If you need to pay school fees, just fill whatever form you need to fill. Those 41 items are still banned so if you want to import them, you will need to buy from the black market. But the days of dollar scarcity where you wanted PTA and couldn’t get it should be over. Whatever the supply of dollars is, the price will now reflect it. You will also see that export proceeds will ‘shoot up’. Those exporters who have been avoiding bringing back their export proceeds will now do so. So those export proceeds that have supposedly been collapsing, according to CBN, will be mysteriously revived now.

I’m Warning You

I’ve been telling a friend that President Buhari’s second coming to power was for him to learn economics and how markets work. One by one his shibboleths are tumbling down. Fuel subsidy has been forced out of his hands and now his beloved N199 to $1 has been taken away from him, too. The sad part is that this his education is quite expensive and Nigerians are the ones footing the bill.

We have now had 1 year of experiencing what government can do when it claims to have powers to control prices. We have seen what its like when one person is picking and choosing who should get dollars and who should not. President Buhari travelled the world speaking to the price of oil to rise. The price ignored him. Some of us ‘market fundamentalists’ have been calling for the government to let markets do their magic not because markets are perfect but because they are the best system we have to allocate resources fairly.

But some people never learn. So if and when exchange rates start to spike, you will start hearing these people making noise asking for government to come and ‘intervene’ to ‘control’ or keep market forces ‘in check’. The government has no such power and as such, it can only make a mess of things. You have my permission to issue such people a good and proper slap when they start calling on government. Let the slap ring and leave your hand on their face for good effect. Nigeria is marching towards a serious market economy. Anyone who looks back will turn to salt.

There are also those people who have turned twitter and facebook into a ‘live’ bureau de change — all they do is ask for the exchange rate everyday. You also have my permission to slap these people if they continue talking about the exchange rate everyday. I am not in Nigeria or else I would have done it myself. All those lies of ‘someone I know just changed money outside Iga Iduganran in Lagos for N400 to $1’ need to stop. You should now be able to see rates on your bank’s website or FMDQ’s website. Anyone who is worried about what the rate will be on 29th of August, is free to invest in a derivative to put their mind at rest.

All of this means that the government can now spend its time worrying about other problems aside the fx rate. Buhari’s ear problems should subside as well. You too have now been freed from spending your whole day watching exchange rates. You’re not a bureau de change. Face your work. What will be the price of the dollar next week when the market opens? I don’t know. The price will be the price. It will be what the market says it is.

The Nigerian economy is still in a terrible shape. This government has done real damage with their experiments in the last 1 year. But, at all at all na him bad pass as Uthman Dan Fodio famously said. Maybe the worst is now over (God, please don’t let this country make me eat my words, again).

Even if you are on a diet or just watching your weight closely, tonight, I give you permission to indulge in a small bit of Hope Ice Cream.

FF

P.S To the people who put this together for the CBN and have been fighting to have a better market system for a long time, you have done well. Thank you.

This article was obtained with permission from Feyi Fawehinmi, follow him on twitter @doubleeph and visit his blog https://aguntasolo.co

This is a really comprehensive analysis. Thumbs up!

Brilliant clarity especially for us, nonfinancial types…

I doff my hat for this expository cum comprehensive analysis. It’s quite educative and well explained. Nairametrics writers never disappoints, always a notch ahead. cheers…!

excellent work. I love the way you simplify finance. Kudos

excellent work. I love the way you simplify finance. kudos

Doubleeph is the bomb! This is Flex Forex 101 for dummies. You did real good bro. Keep it up,(and down sometimes).

At about 01:29am…i no fit sleep until I finish this article. Oga Troy u b love @first sight! Brilliant job!

Nice and simple just the way i like it. One does not need to be an economist to understand the Nigerian economy

Nice and simple, just the way i like it. I believe that people don’t need to be economist to read and understand Nigerian economy. Keep, keeping it nice and simple. Kudos

Good write up, really threw light as to what to expect Ceteris Paribus

If it is in,it is in.if it’s not there,it’s not there.the truth can be relative and conceptual.therefore when you see a writing,one tried to see things through reason,you try to see what is it..since this article appeared since yesterday.all reaction do not agree on any issues.Amongst us the igbos,we says when we speaks is like eating a yam,you must uses oil precisely palm oil.you can use water but if you uses oil,your yam will taste better.

I have read this piece and follows down.i got lost,to be honest.the question that came to my mind,is the writer,writing in his private capacity,or as a C.B.N official capacity.A CBN statement carries weight.now what is the fuctions of the cbn.we are dealing with the activites of Nigeria,is this analysis a sum of microeconomic of Nigerian economy ?.LETS NIGERIAN GOVT SOLVE THIS LITTLE AND BIG PROBLEM THAT HAVE BEEN EATING NIGERIAN ECONOMY SINCE 1999.it will take care of all or an problem that will surfaces in the future.we do not have a broad and a robust money and capital market,as long we Nigerians do not have this financial system installed.nigeria will continue to have problem.IN MY VIEW THIS PRESENT ECONOMIC TEAM HAVE THE INTELLECTUAL CAPACITY TO DRIVE NIGERIAN ECONOMY GNP GROWTH ATLEAST A MINIMUM GROWTH OF 12 % ANNUALLY.

I tell why,the minister of commerce and trade uses to trade in forex and stocks in south Africa from his base in south Africa he did trade from any stockmarket in any country.so the minister uses to work as an investment banker,the governor of the cbn was the managing director of zenith bank.so ignorance is not an excuse.they all knew that the essential I factor that will drive Nigeria economy is freedom, and access to credit facilities,so all of them knew,that Nigeria can access credit facilities and forex independent of this present Nigerian financial system

In war,when an enemy capture the commander of opposition army,the battle stops.if the commander deputy is wise and have time,he can reorganises his army.so when a king is killed in a battle the war is lost.when the capital of nation in war is captured the war endslets the govt solve the big problem,all the rest is bullshit.