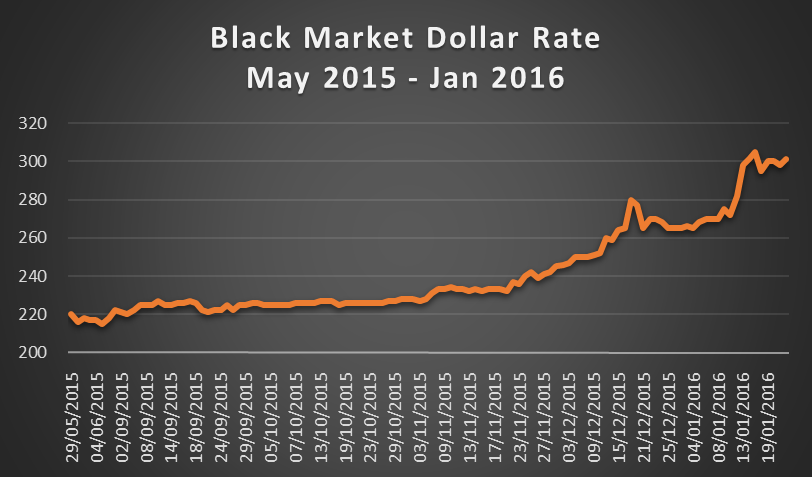

The Naira is currently going through one of its darkest times in the parallel market. Above is the path the naira has taken since Buhari was sworn in as President of Nigeria. As the chart depicts, the naira has gone through several stages of depreciation culminating in its current price of N308. From when we got kicked out by JP Morgan in September to the realization that our external reserves can no longer support our yearnings, its been a journey of change. The situation further deteriorated sometime in November after the CBN introduced a rash of policies that further reduced access to the dollars by the BDCs. It got worse this year after the CBN kicked the BDC’s out of its forex markets and after the President affirmed it has not seen any reason to devalue.

The Change president believes he was voted in to protect the economy from foreign and local scavengers who he feels are only out to take blood from the economy at the expense of the masses. To him, the exchange rate should probably be 1:1, after all he calls the shot.

In response to the President’s wishes, the CBN has refused to devalue the naira for the third time since 2013. The parallel market on the other hand has continued to depreciate the value of the naira following demand by speculators and those who genuinely need it for transactions. Things are unlikely to change even if the CBN decides it wants to devalue today. The pent-up demand cannot be met especially if oil prices continue to dip. For anyone looking for a sign of relief, just keep a close watch at the Brent Crude price.

lol

Do not blame government for the high exchange rate of the naira against the dollar. The government is not the one chasing the dollar. Why are Nigerians rushing to exchange naira for dollar? Because they have plenty of naira which they intended to use for luxury abroad. The appetite of Nigerians for foreign goods is crazy. The funny thing is that most of the things they crave for in foreign lands are available here. Again, most of the naira chasing the dollar is stolen, Nigeria being a corrupt country. The owners of stolen fund can afford to exchange it at any rate in the black market. If the government can make dollar available for essential items at the official rate of 197 naira to the dollar and there is stability in the Foreign Reserve of Nigeria, I have no qualms.