I got a lot of stick from accountants from the last article I wrote so I start by tendering an apology I did not intend to belittle the noble profession. In addition, some feedback about too technical writing so I’ll try to keep this piece simple. As with everything these days, the talk is around the currency given the damage from the rout in global oil prices and the widening spread between the black market rate and the official rate. Having established that the current naira rate is out of sync with reality in the last column, I will dwell on the implications of having a mispriced currency. The exchange rate is a price which should equilibrates external demand of the goods and services a country produces with its supply of those goods and services or on the flipside its equilibrates a country’s demand for foreign goods and services with external supply. It’s the key price signal which dictates what good a country should produce or attempt to produce and what good it should import. I need you to understand this statement clearly so I will illustrate the point using a story.

Today assume a bottle of Ribena goes for N200 and then some guy opens a new shop and starts selling the same Ribena bottle at N50. Now it’s the same thing but the guy for some weird reason is selling below the going rate. Naturally everyone figures out and starts buying from this guy. Usually the arbitrage window should disappear but our guy is a muppet who appears to have deep pockets and keeps selling Ribena below the cost of making one. If two months down the line the price of a bottle goes to N300 but the guy retains his N50 price, sooner than later a few smart folks will open shop somewhere and start buying the Ribena from the obvious muppet and selling it for say 150 quid and a whole business line emerges that feed directly from the muppet. These businesses are profitable: strong sales and good profits but as you guessed rightly they have an Achilles heel – at the heart of their dodgy outfit is a supplier racking up losses and consistently selling below market price. If for some reason muppet’s supply dries up they are out of business. What has happened is that these folks have taken the price signal as cue for what to sell and are selling it.

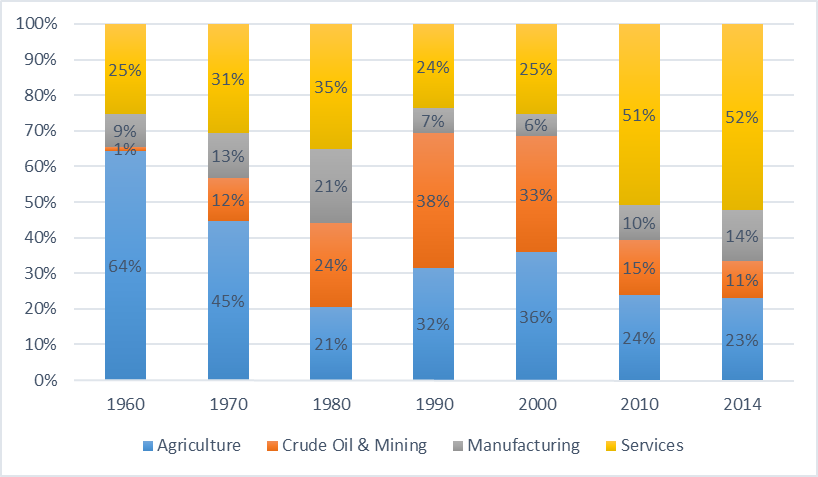

Now relating this to the Nigerian economy. A lot of folks including smart ones especially accountants like to say we need to diversify the economy but as a friend of mine would point out – the economy is diversified already as can be seen below:

Table 1: GDP Sectoral Composition

| 1960 | 1970 | 1980 | 1990 | 2000 | 2010 | 2014 | |

| Agriculture | 64% | 45% | 21% | 32% | 36% | 24% | 23% |

| Crude Oil & Mining | 1% | 12% | 24% | 38% | 33% | 15% | 11% |

| Manufacturing | 5% | 8% | 11% | 5% | 4% | 7% | 11% |

| Building & Construction | 4% | 5% | 10% | 2% | 2% | 3% | 4% |

| Trade | 12% | 12% | 20% | 13% | 13% | 16% | 17% |

| Services | 13% | 18% | 15% | 10% | 12% | 34% | 36% |

In the table above, notice at independence in 1960, agriculture accounted for 64% of Nigeria’s output. Now to make our analysis easier lets combine services (which NBS defines as transport, real estate, ICT, Finance, public administration etc) and lump it with trade (which NBS defines as wholesale and retail trade – buyers and sellers basically). Reason being that these two sectors essentially ensure that goods are distributed so they are similar and the evolving picture becomes clearer.

Figure 1: GDP Sectoral Composition

Overtime crude oil output, supported by Services, basically ate into agriculture’s share but observe that manufacturing remained basically small until 1980 before reclining back. But beyond that look at 2010 when we had rebasing, Services GDP basically ‘bounced’ everybody in the room. The normal development track is agrarian/extractive – manufacturing – services/tertiary; Nigeria it would appear seems to be de-industrializing i.e. going directly to services . Now Nigeria has been a net services importer using available data from 1981 i.e. we import more services than we export. Since 2008, the net figure is a negative $20-22billion per annum implying another drag on foreign exchange reserves.

Therefore the question is why is a sector of the economy whose productivity is dodgy on dollar basis allowed to expand continuously? Furthermore, services is by nature is not labour intensive but capital intensive which is out of sync with Nigeria’s reality — large population and low aggregate savings using proxies like credit to private sector/M2-GDP. Thus a segment of our economy which does not use our most abundant resource, is not tradable hence our net import status, and requires a lot of capital, which we do not have, has been allowed to expand without any attempt at correction.

Why is this happening? Now the story I told earlier becomes illuminative. Services is expanding because it has taken a misaligned signal like those sharp guys because the FX rate tells them they can make money here even though they are running at a loss to our current account. Even worse, the services sector makes the bulk of formal employment, often located in urban centres implying its beneficiaries, who are a vocal segment of the populace, are in direct contact with our dodgy political class. Thus this group, which is most likely to be impacted by a weaker naira are in position to always resist it leaving policy makers in a fix. Devalue and this group will be out on the streets, don’t devalue the only people who suffer are the farmers/manufacturers who are far away.

Call it whatever name you want – Dutch Disease is a favourite among economists- a strong naira has incentivized an expansion in services which is not efficient due to the inadequacy of cheap economic overhead capital.

What must we do? First like in that story: fix the original sin – correct the anomaly, adjust the price to its true value. However I can see political scientists accusing me of being idealistic as the implication is politically suicidal. So the politically correct word would be inducing greater naira flexibility. This is a conversation that the government has got to start – it is bad ideas to think the nominal value of the naira is a sign of economic strength. Just as with deregulation in petrol, the debate should begin over whether to devalue the naira, float it or otherwise let’s get people talking

Secondly, as accountants will likely accuse me – devaluation is not a silver bullet. On its own it does not change over 50years of a misaligned FX peg. To ensure Nigeria’s labour intensive sectors like agriculture and manufacturing pick up the gauntlet we must provide the necessary support.

No country stumbles into development moreso in an increasingly competitive global landscape. It must be a deliberate policy. The path to follow is one which sets a goal to diversify exports using value-added product. The buzzword should be value-added export diversification.

Again economics provides clear ideas on how this could evolve. The first Blackman to win a Nobel Prize was Arthur Lewis and he proposed a 2-sector theory which we all know in a simpler format. Most countries start with an agrarian background then as surplus output is generated, its feeds into the industrial sector either as capital from reinvested export proceeds or as raw material inputs. Across the agriculture value chain: Nigeria is dominant in producing cassava, cereals, palm oil etc but not much goes into domestic manufacturing input or export. Government Policy must target these value chains and deliberately seek to set up processing zones where infrastructure projects (transport and power) will be routed through.

A direct route to global export markets and domestic factories must be drawn-up. Accord priority to infrastructure projects around this export route – farm, processor and export ports—of course weakening the currency will make this process faster. And for the services sector: identify the worthwhile segments where you can still salvage some value and degrade the rest through brutal taxation. Again before the blind economic folks argue blindly about unemployment I provide examples. ICT and Real Estate account for 52% of services GDP. ICT is telecoms which are a necessity but real estate which is 22% of services GDP is of debatable value to the economy. We have a mass housing deficit but real estate would rather build princely villas and high rises nobody lives in? Government should tax the wasted capital vengefully and use the proceeds to support other sectors in need of capital.

The folly of stumbling into strong GDP growth rates as we have seen in the last decade is that such growth is inequitable and on shaky footing. It takes only a commodity crash to expose this, let’s not waste this crisis, Nigeria’s economy is diversified, government revenues and exports are not. That’s what we need to fix.

All data in table and chart obtained from CBN and NBS

this guy is brilliant. I wonder a person like you in government.