The Nigerian Stock Exchange reports that Foreign Portfolio Investments (FPI) into the country for the month of September was N29.26 billion. The NSE typically reports FPI figures in Naira as foreign inflows would have been converted to Naira before it is injected into the market.

Domestic vs. Foreign 2015

- According to the report, Monthly FPI transactions at the exchange decreased to N69.33 billion (about $0.35 billion) in September 2015 from N81.13 billion (about $0.41 billion) at the end of August 2015; representing a decrease of 14.54%. Transactions on the bourse includes both inflows and outflows.

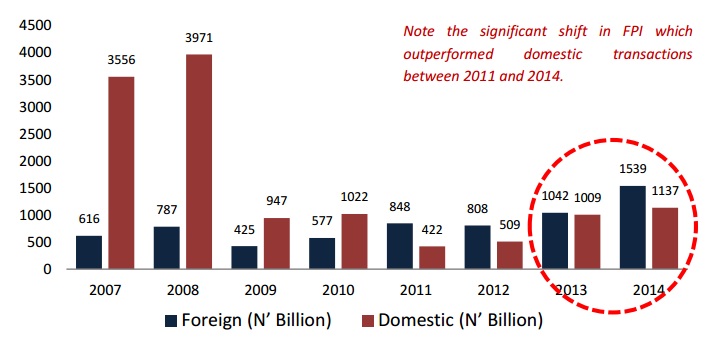

- Domestic investors conceded about 6.72% of trading to foreign investors compared to the 11.38% they conceded in the previous month as Domestic transactions increased from 44.31% to 46.64% while FPI transactions decreased from 55.69% to 53.36% over the same period.

- Foreign portfolio investors’ inflows accounted for 22.52% of total transactions while the outflows accounted for 30.84% of the total transactions in September 2015.

- In comparison to the same period in 2014, total FPI transactions decreased by 69.42%, whilst the total domestic transactions decreased by 79.53%.

- FPI outflows outpaced inflows which was not consistent with the same period in 2014. Overall, there was a 75.15% decrease in total transactions in comparison to the same period in 2014

What this means?

The data confirms that foreign investors have continued to full funds out of the country and have also reduced inflows. N29 billion is the smallest inflow we have had in any given month this year and is 78% lower year on year. The total transaction value of N129.9 billion is also the smallest this year and 75% lower than the N522 billion transacted same period last year.

It is likely that October will be worse considering the level of sell-offs that had occurred. The All Share Index closed at -6.53% at the end of October 2015.

![[The Nigerian Economy Daily] FG has approved the closure of five foreign missions and embassies](https://nairametrics.com/wp-content/uploads/2017/05/nigerian-economy-today-1.jpg)