Nigerian Vice-President Yemi Osinbajo spoke to Bloomberg Television on location in Abuja, in an interview airing on Countdown on 21th October. The Vice President discussed the Setting up an infrastructure fund, the Government’s plan to spend to avoid recession, planned investments in agriculture and the decline in oil prices.

Here is the official transcript of the interview

On setting up an infrastructure fund:

I want to set up a fund, an infrastructure fund, which will benefit from both public sources, which is government sources, and concessionary funding, a mix of funds, and then of course private sector funds. A lot of those projects will be bankable projects, because we’re looking at projects that will interest private sector investors as well. But they are strategic for us.

We’re looking at a $25billion infrastructure fund. That’s the size of the fund we are looking at.

On looking for important investments in agriculture

In agriculture especially, we’re looking at quite substantial private sector input. Because you know that our agricultural sector is possibly, you know, one of the… the second largest contributor to GDP, which means that millions of farmers will be employed, so we get some leverage with job creation, which is a major policy objective as well. So we think that overall we’ll do well with GDP especially if we are able to invest in agriculture as well.

On spending to avoid recession

The way out this, of what some have described as impending recession, is actually to spend rather than to cut back in any way – especially spending on ways of diversifying and also on infrastructure. We’re going to be investing quite massively on infrastructure, especially power, roads and rail, and of course we’re going to be investing in agriculture as well.

On the decline in oil prices

We’ve seen that the central bank had to produce some short-term foreign exchange controls because largely the oil prices have plummeted. And we think that that has been reasonably successful in the short term.

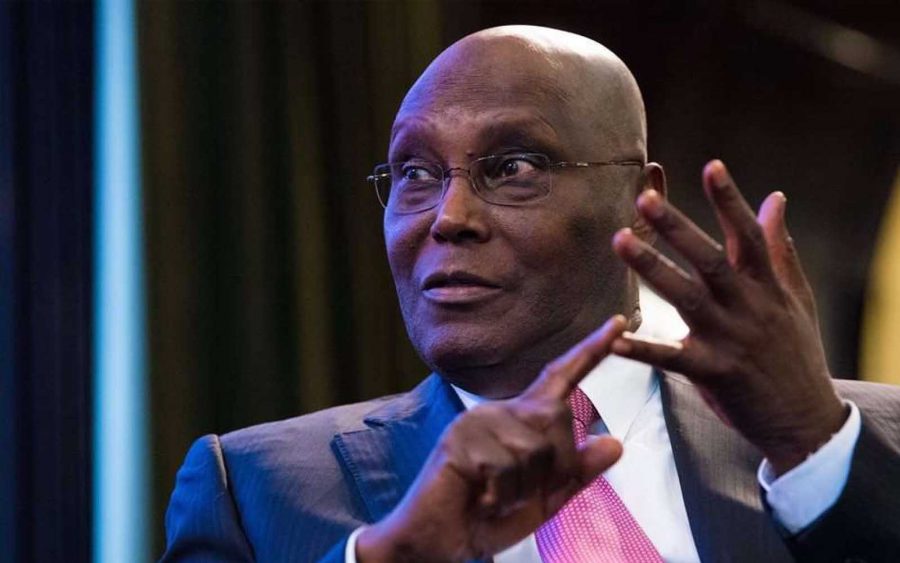

![[“We Will Spend To Avoid Recession”] Transcript of Osinbajo’s Interview With Bloomberg](https://nairametrics.com/wp-content/uploads/2015/10/Yemi-Osinbajo-1.jpg)

Good for my excellency my Mr vice president.The problem in Nigeria,we knows that.the solution to our problems in Nigeria ,we knows that,we have a highly trained civil servant,that is un-equaled in our plant.the v.p have a masters degree in law from university in London,the I.G of Nigerian police force have a masters degree in criminology.the former national security adviser as well a trained soldier under president Obasanjo attained the rank of a major general is a trained lawyer,as well as a forensic trained scientist from an American university.

we cannot control or stop boko haram.

This administration in almost 12 months,we still do not have a cabinet,with assigned position,WHO DO WE HOLD RESPONSIBLE FOR THE MESS,WE HAVE IN NIGERIA.the v.p. said they will avoid recession by spending more,which money ?.if you spend money in an economy that have been grinded by inflation.is this economic sado-monetary theory joined together by the American economist Milton friedman ?

The Nigerian Govt must proposes an original idea like a TWIST, (1) control or suck-up inflation by any means{the supply of money without harming the economy},if you use lower or increases bank interest will still harm Nigerian economy because there is still excess liquidity in the economy now(2)wether true or not,some commentators said the c.b.n save some money by banning some products.why not the c.b.n uses their forex currency buy up some Nigerian banks i.e. deposit or some of their assets,as a lien or security, to create new liquidity because the naira is very weak due to devalution or purchasing power (to supports the naira)(3)spending outsides the national annual budgets,by investors/enterprenuer pushing the economy sideway by incentives,soft loan,now a possible bank interest cut,to creates business confidence.grants,This will have an impacts in a months