Presco Plc. (6 months ended June 2015)

· Presco Plc reported a 15.4% YoY rise in revenues to N4.7 billion for the 6 months ended June 2015. PBT declined 7.5% YoY to N1.6 billion whilst PAT was 9.6% higher YoY at N1.2billion.

Robust volume sales drives top-line growth

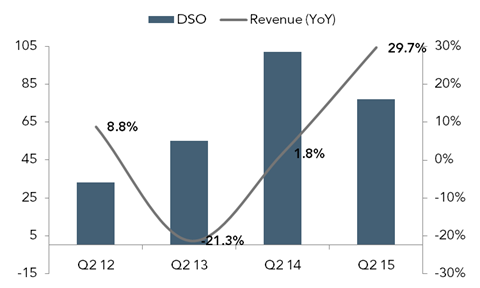

· Despite continued downdraft in global CPO prices (YoY: -22%, QoQ: -4%) and largely flat trend in domestic CPO prices, Presco reported 29.7% YoY jump in revenues to N2.5 billion (Q2 14E: N2.2billion) reflecting higher volume sales. We believe the strong numbers partly reflects management’s guidance to volume driven gains on major on-streaming of previously immature plantation areas over 2015. In addition, USDNGN depreciation over the period and CBN proscription of FX access for CPO imports adversely impacted importers (who constitute ~36% of domestic CPO supply) and bolstered demand for locally produced CPO.

Figure 1: Q2 Revenue Growth and Days of Sales Outstanding

Source: Company’s financials, ARM Research

Pull-back in cultivation activity supports margin expansion

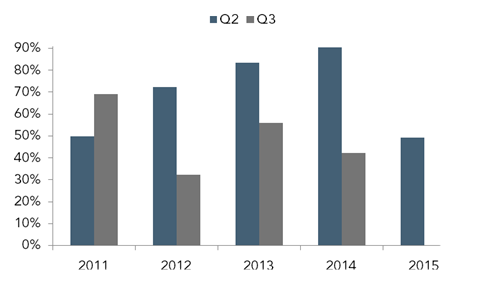

· Q2 15 COGS fell 29.2% YoY to N1.3 billion – well behind our expectations for a 25% YoY rise to N2.2 billion. We believe this possibly reflects deferral of cultivation to Q3 vs. Q2 in 2014. Consequently Q2 15 gross profit expanded nearly seven-fold YoY to N1.3 billion with gross margin rising 41pps YoY to 50.6%.

Figure 2: Trend in Q2 and Q3 COGS-Sales ratio

Source: Company’s financials, ARM Research

· Q2 15 admin expenses declined 19% YoY to N397million which more than offset distribution costs of N89 million (Q2 14: nil) leaving operating expenses largely flat (-0.9% YoY to N486 million) and driving 6pps YoY contraction in opex–sales ratio to 19.2%. Largely reflecting feed-through from gross profits (aided by 6% YoY climb in other operating income to N55 million), Presco reported EBIT of N849 million in Q2 15 vs. operating loss of N255 million in Q2 14.

Nevertheless, devaluation push to finance expense and plunge in valuation gains swings earnings lower

· In contrast to cut back in borrowings (-30% YoY to N3.8 billion), Q2 15 finance costs spiked 75% YoY to N168 million. Given Presco’s sizable foreign loan (48% of total loans), USDNGN devaluation drove an uptrend in borrowing costs. Furthermore, in tandem with declining trend in CPO prices, Presco recorded a 99% YoY plunge in biological asset to N18 million. Consequently, Q2 15 PBT and PAT fell 35.8% and 6.7% YoY to N699 million and N634 million respectively with corresponding margins 28pps and 10pps lower YoY at 27.6% and 25% respectively.

Higher cultivation activity and rising finance charges offset bullish revenue outlook

· Going forward, improved demand for locally produced CPO following CBN’s proscription of FX access to CPO imports together with higher output from maturing fields should continue to buoy revenue uptrend over the rest of the year. However, given management’s guidance of sizable cultivation over 2015 and a relatively quiet planting season in the first half of the year, higher cultivation costs over H2 15 should result in gross margin contraction. Furthermore, we expect financing pressures from two fronts. Firstly, Presco’s sizable foreign loan exposure should continue to leave the company susceptible to USDNGN devaluation. Secondly, recent media reports of a new N6 billion loan from Fidelity Bank suggest sustained uptick in the line item over the rest of the year, consequently weighing on earnings growth. On balance, higher planting and rising finance costs drive moderation in earnings outlook for the second half of 2015. Presco trades at a current P/E of 11.5x relative to peer Okomu at 15.9x. Presco shares have risen 27.3% YTD (NSEASI: -12.9%) with last trading price at an 11% premium to our FVE (N27.7) which leaves our SELL rating unchanged.

SOURCE: ARM RESEARCH