Dangote Sugar Refinery Plc. (6 months ended June 2015)

- Dangote Sugar Refinery Plc (DSR) released unaudited results for 6 months ending 30th June 2015 wherein revenues rose 3.1% YoY to N51.1 billion while PBT and PAT were 4.5% and 7.7% lower YoY at N9.8 billion and N6.3 billion respectively.

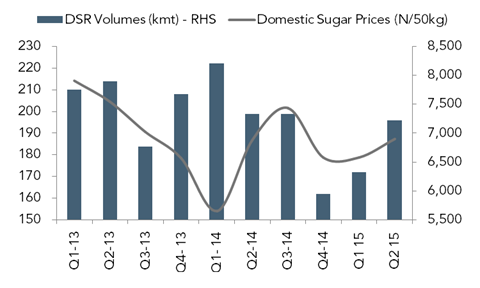

Price hikes offset volume weakness to power topline growth

- In response to the sizable naira weakness over 2015, DSR hiked refined sugar prices (+20.7% YoY to N6,900/50kg) over Q2 15 in a bid to pass-on higher raw material import costs. The price increases offset continued weak volumes (-3.4% YoY) resulting in revenues quickening 20.6% YoY to N28.6 billion (Q2E: N25.4 billion) – highest in 15 quarters. In addition to subdued consumer demand over period, DSR links volume pressures to distribution challenges caused by sizable traffic gridlock at the Apapa ports over the period when fuel haulage trucks blockaded the ports.

Figure 1: Domestic Refined Sugar Prices and DSR volumes

Source: DSR, NSDC, ARM Research

Price hikes and tamer input costs help offset devaluation pressures

- A second order impact of the price hikes was that together with extended benign patterns in raw sugar prices (-31% YoY, -11% QoQ), helped offset naira weakness over the period leading Q2 15 COGS to track slower than revenues (+19.3% YoY to N21.4 billion). Consequently, gross profit climbed 24.4% YoY to N7.2 billion with gross margin rising 80bps 25.1%.

- Q2 15 opex fell 28.5% YoY to N932 million (opex-sales ratio: -2.2pps YoY to 3.3%) as negative selling and distribution expenses—possibly reflecting over accruals in Q1 15—more than offset 32.4% YoY rise in admin costs to N1.24 billion—largely underpinned by DSR booking management fees in Q2 15 (Q2 14: Nil). Consequently, EBIT surged 39.8% YoY to N6.3 billion with corresponding margin 3pps higher YoY to 21.9%.

Notwithstanding higher finance expense, operating profit gains filtered through

- In tandem with a surge in ST borrowings (YoY: +24x, QoQ: 3x to N7.4 billion), finance costs rose nearly three-fold YoY to N203 million. Management links higher borrowings to financing working capital needs at its Savannah sugar plantation. Assisted by 97% YoY contraction in finance income to N7 million, the elevated finance charges swung DSR from net finance income of N147 million in Q2 14 to net finance expense of N196 million in Q2 15.

- Largely reflecting pass-through from operating profit (aided by 59% YoY contraction in other expense to N50 million), PBT and PAT climbed 33.6% and 28% YoY to N6 billion and N3.9 billion respectively with corresponding margins rising 2pps and 80bps YoY to 21% and 13.8% respectively.

Price hikes hold positive connotations for fundamental outlook,… but CEO departure raises some concerns

- Relative to our expectations, Q2 results positively surprised largely reflecting the impact of the refined sugar price hikes, a development we did not forsee due to the weak macro environment. Whilst the prospect of a demand pull back exists, the price increase, if sustained, should buoy DSR’s top-line over the rest of 2015. By extension, we see the combination of price hikes and bearish raw sugar price outlook as providing an offsetting effect to naira weakness creating scope for gross margin expansion. These gains should more than offset expansionary impact of recent surge in borrowings on finance costs to drive earnings growth. Beyond the broadly positive fundamental issues, the announcement of departure of CEO Graham Clark, after 23 months at the helm, comes as a surprise to us as DSR recruited him, from Africa’s largest sugar producer (Illovo Sugar), to lead their push to develop sugar estates across Nigeria in their ambitious goal to produce 2 million tonnes of raw sugar by 2020 under its ‘Sugar for Nigeria’ plan (Nigeria currently producers 70kt of raw sugar as at FY 2014—USDA). Parsing through commentary accompanying the release, Clark’s departure stems from differing views with DSR’s board over growth strategies, a development which, in our views, raises some concern over progress on the plan. DSR trades at a current P/E of 7.51x vs. 11.19x for Bloomberg regional peers with its last trading price at a 12% discount to our FVE (N6.74) which translates to a NEUTRAL.

SOURCE: ARM RESEARCH

![[Buy Sell or Hold] Dangote Sugar, After Half Year Result](https://nairametrics.com/wp-content/uploads/2015/08/Sugar.jpg)