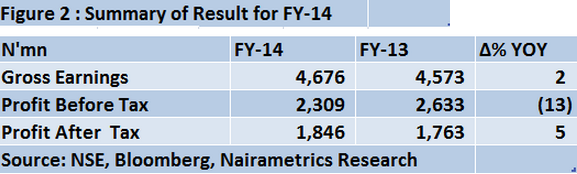

United Capital Plc, the company that focuses on investment banking, asset management, trusteeship, securities and insurance said profit rose 12.90 percent amid rising operating expenses.

Profit was N1.40 billion in the first six months through June, compared with N1.24 billion the same period of the corresponding year (Q2) 2014, the Lagos-based company said in an e-mailed statement on Monday.

Turnover increased 22.22 percent to N2.75 billion.

The company’s operating expenses however increased by 34.22 percent to N1.12 billion in 2015 as against N834.43 million the following year.

Operating expenses ratio was 40.42 percent which means United Capital spent 0.40 on expenses for every N1 generated in sales a situation that calls for cost reduction mechanism by management.

Low efficiency and spiraling costs

The investment house has not been efficient in using or deploying latest technologies in cutting down costs as evidenced by its increased cost to income ratio.

Cost to income ratio increased to 40.72 percent in the period under review as compared with 37.08 percent the previous year. It generally accepted financial practice that the less the ratio the more efficient a company.

Net profit margin, a measure of profitability and efficiency reduced to 50.10 percent in 2015 from 55.11 percent last year.

Share price performance

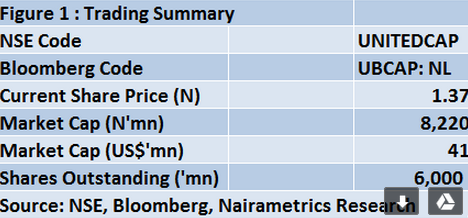

- The company’s share price has remained flattish to close at N1.37 on the floor of the NSE. The last time it rose to the highest was in March when it hit N2.91.

- Price to earnings was 3.95 times while price to sales ratio was 1.57 times. Market capitalization was N8.22 billion.

- Return on equity (ROE) was 14.97 percent in 2015 as against 13.70 percent while the return on assets (ROA) reduced to 1.28 percent as against 1.30 percent the preceding year.

![[ANALYSIS] United Capital profit up 12.90 percent despite rising Opex and low efficiency](https://nairametrics.com/wp-content/uploads/2015/07/United-Capital-4.png)

![[BU-HORROR] Bad Economy, Dollar now N242, Equities in red…here is why you should be scared](https://nairametrics.com/wp-content/uploads/2015/07/ATM.png)