“Weapon no be groundnut, but deficit fit turn to debt” –

Goodluck The Jonathan, First of His Name

Preamble

Let us assume Omo Baba Olowo (OBO) earns N10m annually. He plans to spend N5m on a new car; N2m on rent; and wants to spend N1m per month on small things like buying champagne at Sip, presents for his supermodel girlfriend (Baby Girl), food, petrol in his car and other normal expenses. Since he budgets an income of N10m and an expenditure of N19m, you can say the budget has a deficit of N9m. Now, OBO needs to find N9m from somewhere, so he asks his father Baba Olowo for an advance on his inheritance and gets N5m, But the money is still not complete, so he goes to a bank and borrows N4m.

All is well, so OBO is calm and happy. In this case, OBO runs a budget deficit of N9m but carries a debt burden of N4m.

The following year, OBO now earns N20m, but since he doesn’t need a car, he moves to a bigger place that costs N4m and buys his baby Girl a N3m engagement ring. He still spends N1m per month so he can drink at Sip and post pictures on Instagram, and also spent N1m repaying part of the bank loan he took.

You can see that earning more money cannot be a bad thing; OBO now has a zero deficit budget, but owes N3m.

Now how does this affect the price of fish in the market? The Chairman of the APC Transition Committee, Ahmed Joda, suggested in an interview with Daily Trustover the weekend that the Federal Government is carrying a deficit of N7 trillion and not the N911 billion contained in the 2015 budget:

We were told at the beginning of the exercise that the government was in deficit of at least N1.3 trillion and by the end people were talking about N7 trillion

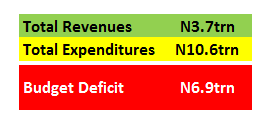

According to the previous government, the FGN expected to earn N3.7 trillion in 2015 and spend N4.6 trillion; like OBO, this means it needed to borrow N900 billion to fund the deficit. However, the government is already owing N11 trillion, so the additional deficit of N900 billion will now take the government’s debt to N12 trillion.

How Did We Get To N7trn?

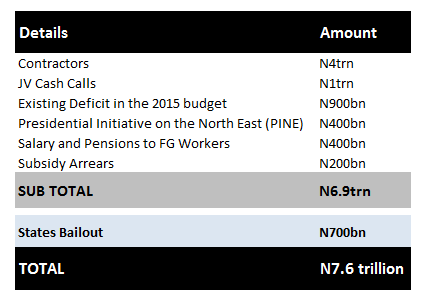

It all seems fairly simple, so where did the N7trn come from? According to the handover notes received from the outgoing government, the Chairman of the APC Transition Committee is suggesting the previous government suppressed the level of debt it carried and has now transferred those rotten tomatoes to the Buhari Government. He didn’t provide a breakdown, but my friend was a waiter serving drinks at the hotel where the committee met and he gave me some interesting details:

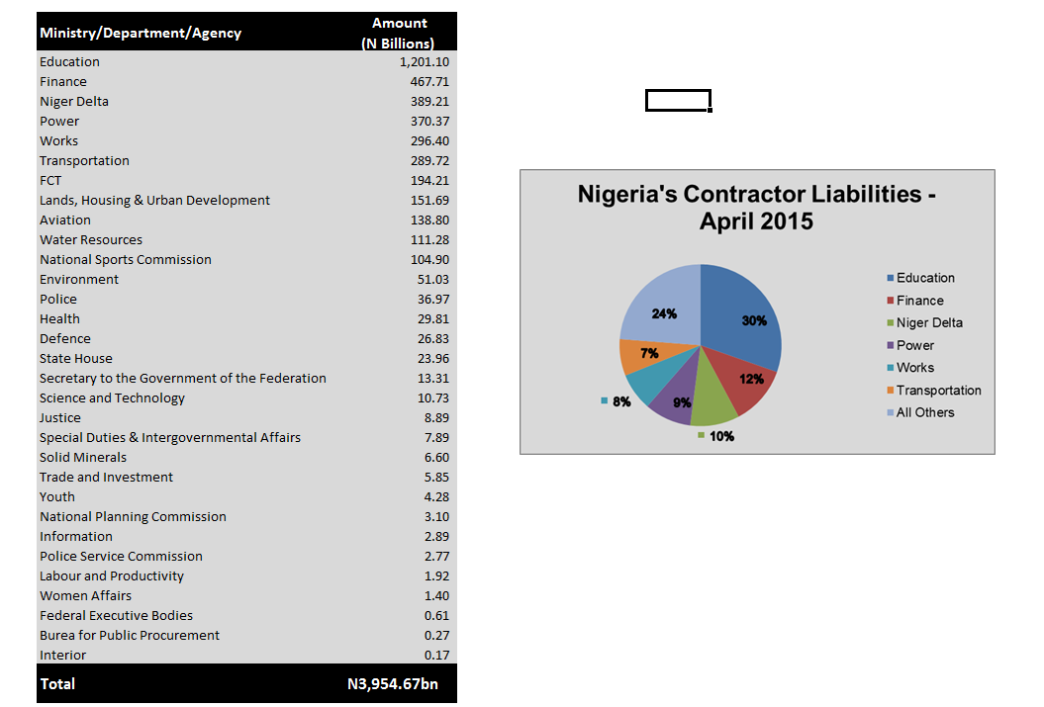

Ministries can duplicate costs, especially with the Finance Ministry.At first glance, you can see contractor payments account for over 50% of the total amount. Interestingly, the widely circulated interim report of the Transition Committee estimated N800bn was owed to contractors. However, as my sauce says this estimate was revised, using numbers submitted by the ministries in their handover notes.

He was kind enough to share an interesting breakdown of the numbers with me (at great risk to his life). I have reproduced it without editing:

Points to note on the figures above:

- These were the numbers submitted to the Transition Committee in the handover notes. The outgoing government did not provide any ageing on the debts. That is, it is not yet known how old these liabilities are. This will determine how contractors are paid e.g being issued bonds to receive their payments in 24-36 months time when Nigeria’s finances are hopefully healthier.

- A detailed list of the contracts was also NOT provided so it is possible that there is some double counting going on in the above numbers.

- Some of the balances may also be disputed and some contracts may be cancelled or terminated. No documentation was supplied to show whether the contracts were executed to specification.

Debt or Deficit?

So, now we know where the figures have come from, we need to answer the second question; is this debt or deficit?

The position of the Government seems to lean towards an urgent need to clear these obligations within one budgeting period for a number of reasons. I heard one contractor laid 4,000 casual staff off, because he was being owed billions of Naira and unable to pay salaries. Therefore, the government believes paying contractors will not only keep people in jobs, it will reflate the economy, and ensure outstanding projects are completed.

Also, paying outstanding cash calls to oil companies is important if Nigeria wants to develop new fields, especially for the much-needed boost in gas supply. The other issues like salary payment, subsidy arrears and the North East redevelopment plan are immediate needs that need to be funded.

This means the FG will probably ask its Finance Ministry to prepare a supplementary budget that will look like this:

Remember, the country already owes N11trnand if we need to borrow N7trn more, it will take our total debt exposure to N18trn – roughly 18% of GDP.

So, to answer the second question, the APC Transition Committee is suggesting if the FG writes a new budget today, it will show a deficit of N7trn, which could increase Nigeria’s debt to N18trn, depending on how the deficit is financed.

While our debt/GDP ratio is not bad compared to similar countries, the real problem might occur when we work out how to pay these debts. Currently Nigeria spends over 20% of its income servicing debts; if we add another N7trn in fresh debt, this could mean we will spend over 30% of our revenues paying creditors.

Now, imagine OBO spending 30% of his next year’s income to pay his debts, it means things like champagne at Sip and that fancy apartment must be removed from his expenses. For Nigeria it means a lot of non-essential expense lines must disappear: fuel subsidy, huge legislative costs, bloated workforce etc.

If the three things noted in the caveat to the contractor debts above happen, the FG might reduce contractor debts from N4trn to N1.5trn (nothing suggests this is possible, but we are allowed to hope and pray a little).

If this happens, the deficit will drop to N4.4trn. Not bad, but still needs some work.

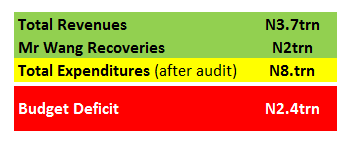

This is where yesterday’s post on Mr Wang is very useful. Imagine we have our own Mr Wang, who can either get corrupt people to lose their ill-gotten wealth through a transparent legal process or just come to submit those assets after being shown what a prison cell looks like.

If our version of Mr Wang does a great job, he might raise another N2trn for the government, leading to this type of budget:

If we end up with this type of deficit, then hope springs eternal. It means the government can now finance this using a number of available options:

BUDGET SUPPORT FACILITY: The government can take the planned budget support facility from the World Bank and African Development to shore up its funding gap. This facility was originated by the previous government, but I was told the lenders stalled on disbursement till the new Government was in place.

Result: $2bn or N400bn

NLNG Dividend: The NNPC claims the committee working on the alleged unremitted dividend from the Nigerian Liquefied Natural Gas Company. The Inter Ministerial Task Team has operated like a cross-breed between a tortoise and snail up till now, maybe the arrival of a new sheriff will quicken this reconciliation.

Result: $11bn or N2.2trn

Securitization: The government can release cash by pledging a portion of future payments from guaranteed revenue sources. For example, the government could pledge a share of guaranteed revenues from annual operational levy paid by GSM operators; dividend and taxes from NLNG; and a percentage of NNPC’s share of crude oil sales (remember those 445,000 barrels sent to domestic refineries?). Since these are guaranteed revenue streams, lenders will be quite pleased to provide debt upfront.

Result: $5bn or N1trn

Sale of Equity in Selected Assets: I’m no expert but those who know suggest NNPC/NPDC stake in those JV assets might be worth about $30 billion. The Government can sell 20% of its stake to investors and host communities to raise immediate revenues and also reduce the FG’s future cash call burden on these assets.

Result: $6bn or N1.2trn

Fiscal Responsibility Act: Section 21 Section 21 of the FRA states that: “Notwithstanding the provisions of any written law governing the corporation, each corporation shall establish a general reserve fund and shall allocate thereto at the end of each financial year, one-fifth of its operating surplus for the year.” Of course, most of the MDAs pretend this Act was never passed and continue to keep their surpluses in Ghana Must Go bags. If enforced, MDAs like CBN, NIMASA, BOI, NPA, TETFUND, FAAN, JAMB and WAEC can add some “change” to Government’s coffers.

Result: $1bn or N200bn

Conclusion

The options above can yield N5trn. But then, this is all on paper and reality will be far harder.

I certainly don’t envy Muhammadu Buhari, but if you’re his friend, perhaps you can whisper the words of Guiseppe Garibaldi in his ears; “a bold onset is half the battle.”

***

The above was sent to me by a mysterious sauce. I don’t even know how they got my email address but here we are. It’s a useful summary of where Nigeria currently is financially and where it needs to go.

As usual on aguntasolo.com, we like to thank people who contribute wisdom for the edification of the body politic (what does this even mean?), so join me in thanking them

FF

This is reactionary Analysis. Feyi (or whatever his name is) does not know what Joda meant. nor is he in contact with the man. For all you know, Joda meant debt and used deficit instead . here you are providing analysis to justify what you know nothing about. Debt is not deficit. if u like draw regression analysis it wont change that fact