While there has been legitimately founded fears on the impact of this year’s El Niño, the persistence of lingering economic trends, more than the weather event, could determine its end effect and its impact on economic activity.

The El Niño, which is defined by a prolonged warming in the Pacific Ocean sea surface temperatures, leads to effects such as prolonged droughts and crop destruction which causes slumps in farm output especially in South East Asia, the hub of the global edible oils industry. Countries most vulnerable to an El Nino effect include India, Indonesia, Malaysia and the Philippines.

This event causes a surge in prices of softs, especially the oils and could lead to food-related inflation in the affected countries.

This time around, prior underlying economic themes (e.g. the supply glut and stiff competition from soybean oil could see that the effect of this year’s El Niño could pass on in a rather quiet fashion, with even lesser dramatic changes in the prevailing demand and supply conditions, if only the event is not prolonged.

But climatologists are warning that this episode of El Nino, which is the first in as long as five years, could be longer than the average. If this happens and the dryness is extended, then prices could really rally.

“There is a greater than 90% chance that El Niño will continue through Northern Hemisphere fall 2015, and around an 85% chance it will last through the 2015-16 winter”, said the Climate Prediction Center and the International Research Institute for Climate and Society last Thursday.

While El Niño has been somewhat teasing the markets, (after showing signs last year, it refused to show up), the signals this time around, appear more serious, with certain meteorological indicators having been sounded off. Leading meteorological agencies (including in Japan and Australia) have warned of a longer and stronger than expected El Niño phenomenon.

“All of the Niño indices [have been] in excess of +1.0°C, with the largest anomalies in the eastern Pacific”, the institute said.

Although buyers of CPO (Crude Palm Oil) in the international market are having a field day due to the over supply of the product, in far away Nigeria, it is still a seller’s market.

The Nigerian CPO market has always been in a state of deficit, as local suppliers cannot meet demand. Around 35 percent of the total demand has to be met by imports.

As a result, the CPO game in Nigeria seems to be more about volume growth to fill the gap. When the gap is filled, then global CPO prices will start having more of a direct impact on local conditions.

As an evidence of this, for FY 2014 and Q1 2015, Presco, the leading CPO producer by land area and refining capacity, reported higher revenues on the back of CPO output expansion. Revenues rose 7.7 percent Y/Y to N9.1 billion while PBT grew 47 percent and PAT was higher by 95 percent Y/Y.

This performance is rather better than what the underwhelming global CPO prices would suggest.

Its peer Okomu saw its overall revenue fall on account of its rubber business, as rubber prices fell globally.

Interestingly, its revenue from local sales rose by 18 percent, while revenue from its exporting activities fell by a full 36 percent, its latest results revealed.

This shows that meeting the latent local demand is having more of an impact on their numbers than external factors, such as weather conditions in other world regions.

While the Nigerian CPO market continues to play catch up, if there will be any El Niño effect after all, it will be an adverse one for importers of the product, and not for the local manufacturers. Since a dollar’s increase in international CPO prices puts importers at a disadvantage of higher prices, compared to the local suppliers as a result of the Naira devaluation.

Investors should therefore pay more attention to local output expansion plans, rather than weather conditions in South East Asia.

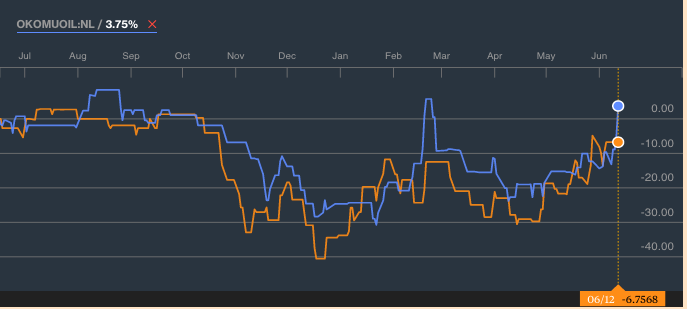

But as the chart shows, Nigerian traders and speculators are already fancying their chances.

Source: Bloomberg.

Key: Blue – Okomu; Orange – Presco

GIO

![[Analysis] Is El Niño a threat to Presco and Okomu Oil?](https://nairametrics.com/wp-content/uploads/2015/06/El-Nino-3-RF-CD.jpg)

[Analysis] Is El Niño a threat to Presco and Okomu Oil? https://t.co/pmmIcJvcPF https://t.co/dqUCrjgdvD

[Analysis] Is El Niño a threat to Presco and Okomu Oil? https://t.co/ZmIZAroh1r https://t.co/stPEMYZ8z0

[Analysis] Is El Niño a threat to Presco and Okomu Oil? https://t.co/zdMZuJFMwb https://t.co/P0GRlcOPoF

RT @ugodre: [Analysis] Is El Niño a threat to Presco and Okomu Oil? https://t.co/zdMZuJFMwb https://t.co/P0GRlcOPoF

[Analysis] Is El Niño a threat to Presco and Okomu Oil? https://t.co/ft828q3iXe

[Analysis] Is El Niño a threat to Presco and Okomu Oil? https://t.co/i6fA6itBE5

Is El Niño a threat to Presco and Okomu Oil?https://t.co/BPF3vYhQpI

[Analysis] Is El Niño a threat to Presco and Okomu Oil? – https://t.co/Nglul8p12S

[Analysis] Is El Niño a threat to Presco and Okomu Oil? https://t.co/32YKaLm81Y

[Analysis] Is El Niño a threat to Presco and Okomu Oil? https://t.co/qat4v8SPbk https://t.co/WSDT5EH38b

[Analysis] Is El Niño a threat to Presco and Okomu Oil? https://t.co/qat4v8SPbk https://t.co/cpegTxbqfW

[Analysis] Is El Niño a threat to Presco and Okomu Oil? – https://t.co/QzYgq5LiiX