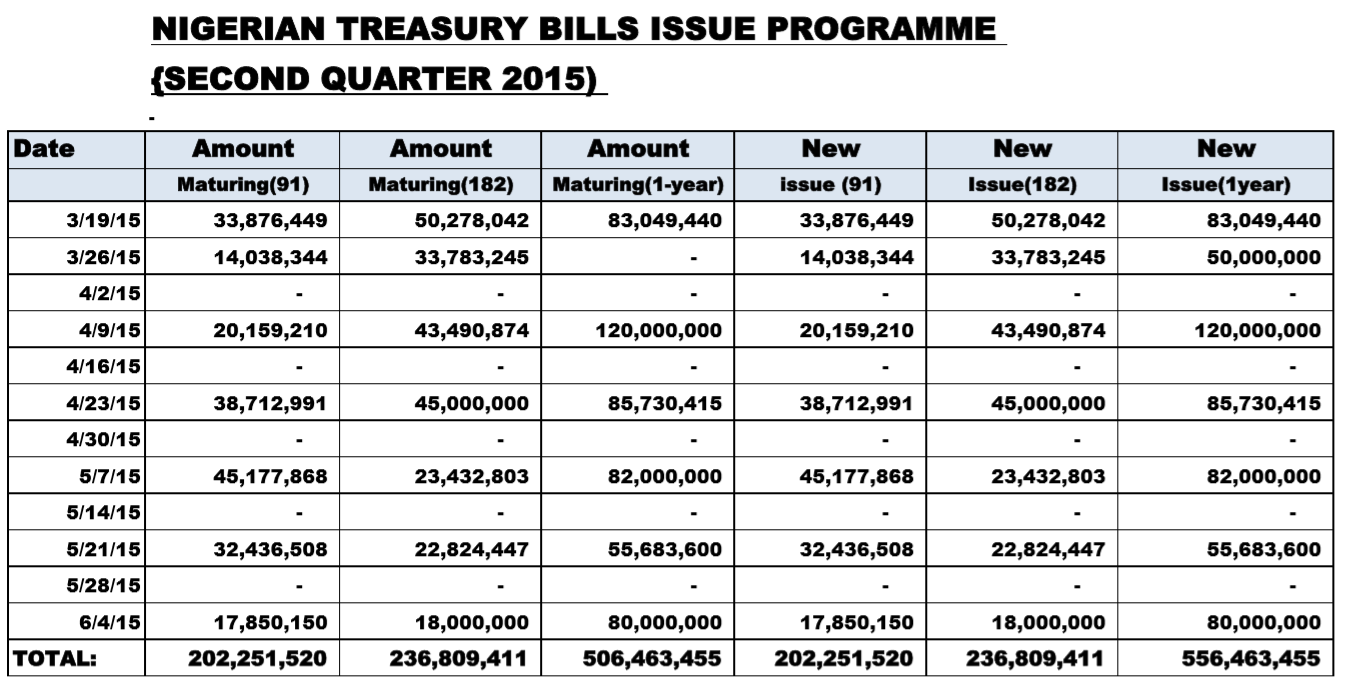

As we approach the end of a volatile First quarter for Treasury Bills, the time has come when the central bank issues a new calendar. The Central Bank of Nigeria just released its Treasury Bill calendar for the second quarter of 2015 which shows they will issue a total of N202.25bn of the three-month debt note during the period, and a total of N236.81bn worth of the six-month tenor; a total of N556.46bn worth of the one-year paper will be sold during the period.

According to the CBN, a total of N945.5bn worth of Treasury bills issued earlier will be due for repayment during the same period.

The central bank had on Wednesday sold Treasury bills worth N254bn ($1.3bn). The yields on the debt notes were higher compared with a previous sale on February 18.

The Debt Management Office data showed that the 91-day debt note worth N17.85bn was sold at 10.8 per cent compared with 10.75 per cent fetched at the previous auction. Also, the 182-day paper worth N15.03bn was sold at 14.85 per cent versus 13.70 per cent previously.

It added that a total of N222.08bn of the one-year debt note attracted 15.89 per cent against 15.25 per cent at the previous auction. |Punch/Nairametrics

See Treasury Bills Calendar below