One of the most respected emerging market investors Mark Mobius and executive chairman at Templeton Emerging Markets Group has predicted that Nigerian stocks will “probably rise after February Elections and if Oil prices stay low. He oversees over $40b in investments.

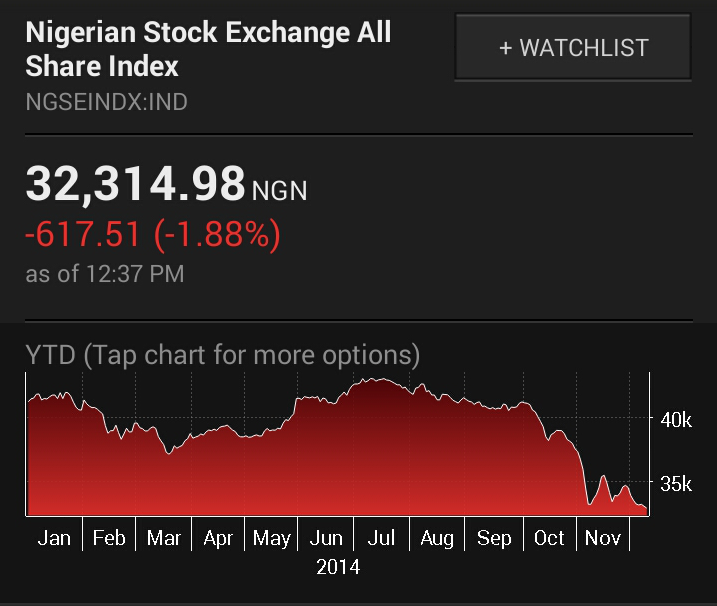

Nigerian stocks has been the world’s second worst performer this year after Argentina as the depreciation of the naira, election apprehensions and oil price slump has affected share prices negatively. Here is what he said as reported by Bloomberg.

“There’ll be a recovery next year, provided that the political environment gets better…..The problem has been the political environment. It’s quite bad.”

“All this spells a chaotic situation for anybody looking from the outside,” Mobius said. “That’s why it’ll be very important for the government to take strong action and get the house in order.”

Stocks in Nigeria, Africa’s largest crude producer have dropped 29 percent in dollar terms since September, the most after Argentina among 93 gauges tracked by Bloomberg. The naira has weakened 11 percent against the greenback, more than any African currency except Malawi’s kwacha.

“Nigeria, with the corruption problems, has a lot of leakage of oil money from the budget…….If they’re able to correct that, which I think they will, then even a low oil price won’t be a big problem.”

His Investments in Nigeria

Templeton Frontier Markets Fund hasn’t reduced its exposure to Nigeria, Africa’s largest economy, because of the recent downturn, Mobius said. The fund has a roughly 12 percent weighting for Nigeria, the most after Saudi Arabia, which is at 15 percent.

“Anybody involved in frontier markets will want to be involved in Nigeria,” he said. “On an individual company level, things are pretty good.”

Templeton’s main holdings in Nigeria include FBN Holdings Plc., owner of First Bank, the biggest lender, and Zenith Bank Plc.

“The only place we’ve found best value is in the banking sector,” Mobius said. “The other areas in Nigeria are pretty expensive. The cement companies and consumer-product companies are pretty expensive.”

Not sure this provides comfort to anyone but it a least provides a glimmer of hope and prayer. Time to take positions.

![[The Nigerian Economy Daily] FG has approved the closure of five foreign missions and embassies](https://nairametrics.com/wp-content/uploads/2017/05/nigerian-economy-today-1.jpg)