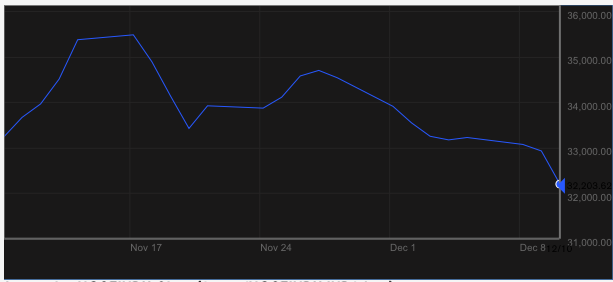

Nigerian stocks slid by a massive 2.21% on Wednesday as the All Share Index closed at 32,203.62 and by our estimates the lowest point this year. About 34 stocks lost today with most of the heavy weights all losing significant values. Todays fall was not enough for aa trigger that may have caused a halt in trading. All of Dangote related companies all lost value with Dangote Sugar and Nasocn falling below N7 and N7 respectively, Seplat also hit a new low of N341.9. Guinness also lost ground and so did Nestle. The latest fall in share prices suggest a combination of profit taking, weak sentiments, end of year portfolio balancing and a possible fear of global contagion.

Stocks around major world markets have also lost significant value this year as the world reacts continue to the continuous slide in the price of Brent Crude. Brent crude dropped to below $65 and OPEC lowered its projection for 2015 by about 300,000 barrels a day, to 28.9 million a day. Prices now are below what 10 out of OPEC’s 12 members need for their annual budgets to break even, according to data compiled by Bloomberg. Kuwait and Qatar are the exceptions. The MSCI All-Country World Index (which Nigeria is a part of) dropped 1.2 percent for a third day of losses. It was the biggest retreat since Oct. 10 and the lowest level since Oct. 30.

These are indeed tough times for investors. These are the official list of gainers and losers to download or view.