Bloomberg

Bloomberg

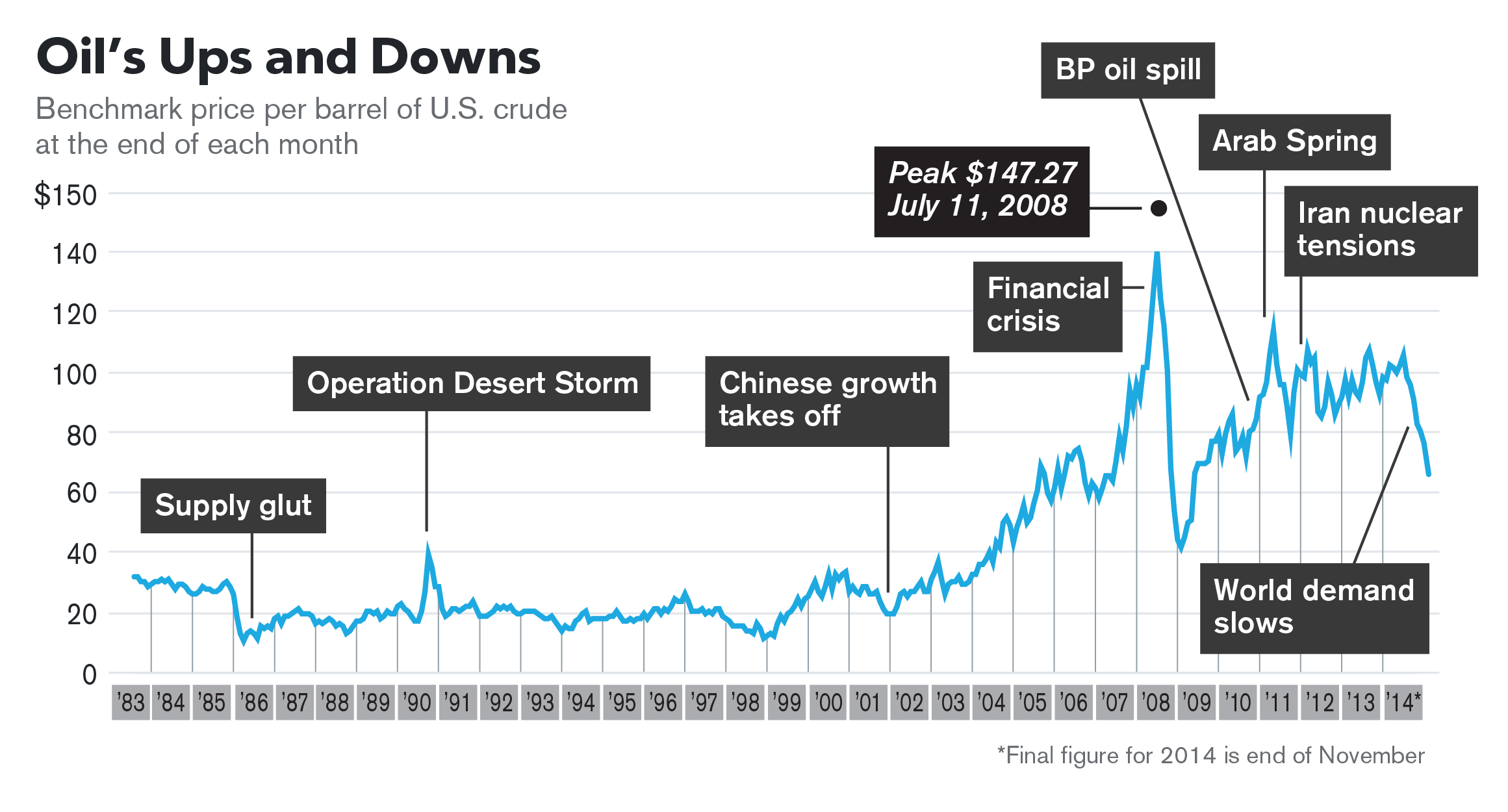

We started this week again with yet another fall in oil prices. Brent crude and West Texas Intermediate slumped to five-year lows amid concern that hedge funds and other money managers bet too much on rising prices. Brent for January settlement declined $2.88 to $66.19 a barrel on the London-based ICE Futures Europe exchange, the lowest since Sept. 29, 2009. The volume of all futures was 4.9 percent below the 100-day average. WTI for January delivery dropped $2.79 to end at $63.05 a barrel on the New York Mercantile Exchange, the lowest settlement since July 16, 2009. Volume was 13 percent above the 100-day average. How does this all affect you, me all of us?

How it affects us

The Government – The Minister of Finance has moved the benchmark oil price twice already in reaction to $65. It was first $78 and then they changed it to $73 and now $65 per barrel. Nigeria sells Bonny Light Sweet crude which is about $3 higher than the Brent Crude so we have to keep moving in tow with it or risk fooling ourselves

The Naira – The Naira has already been devalued and still climbing the last time I checked it was trading at N188. A fall in the price of oil only drums up more fear and will drive people towards speculation and dollarization (saving in dollars). So basically, the lower crude prices fall the higher the potential for a further depreciation of the naira

Your stocks – Stocks have been losing value since last week and have basically reversed the gains it made shortly after the announcement of a devaluation. Oil, banking and most blue chip stocks have lost huge values with the likes of FBNH, Zenith Bank, Dangote Cement, Access Bank, Seplat all hitting multiple year lows. If the Brent continues to fall, stock may react in kind.

Your money – Well, every naira you own is already worth less than it was two weeks ago. In fact, its increasingly worth less as the days go by considering that each day is another loss of value for the naira. Banks are also dishing out loans at 26-28% per annum higher the 22% it was lending for two months ago. These are all an off shoot of the pressure a falling naira is bearing on the Nigerian economy.