Guinness Nigeria Plc. (3 months ended September 2014)

Revenue weakness continues

- Guinness Nigeria Plc (Guinness) released its unaudited financial results for the 3months ended 30th September 2014 wherein revenues contracted 6.1% YoY to N21billion – missing our expectations for flat YoY growth by a similar magnitude. Whilst the decline mirrors peer Nigerian Breweries (NB), which reported a 5.7% YoY contraction in revenues over the same period, the sales weakness is at odds with SAB Miller which reports 41% YoY rise in net producer revenues per hectolitre in Nigeria. In our view, whilst Guinness’ newly introduced value brand Orijin continues to gain traction across beer drinkers, current reading suggests volume growth continues to be impacted by shrinking contribution of premium brands.

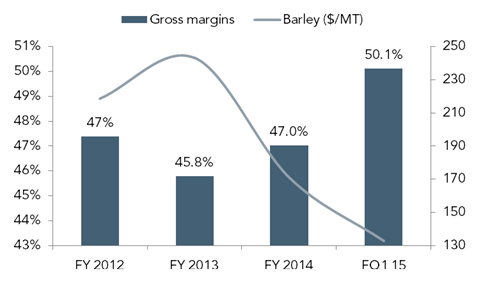

Softer barley prices underpin gross margin expansion

- For the fifth consecutive quarter, COGS declined faster than revenues (-12% YoY to N10.5billion) leading to 1% YoY rise in gross profits to N10.5billion. This largely reflects further declines in barley prices which were on average 33% lower YoY. Consequently, gross margins expanded 3.4pps YoY to 50% (FQ1 15E: 47%).

Figure 1: Mean Barley prices and gross margins

Source: World Bank, Company financials, ARM Research

Surprise moderation in opex enables pass through of input gains

- In contrast to guidance at FY 14 earnings call, FQ1 15 opex declined 2.4% YoY to N7.8 billion as a 4.8% YoY contraction in S&D costs offset a 2% YoY rise in admin expenses. Aided by a 2.7% YoY rise in ‘other operating income’ to N193 million, EBIT rose 11% YoY to N2.9 billion with related margins expanding 2.1pps YoY to 13.8%.

- Notwithstanding a 26% YoY rise in net finance costs to N907 million on account of higher finance charges (+45% YoY), FQ1 15 PBT rose 5% YoY to N1.9 billion with related margins 100bps higher at 9.3%. However, PAT declined 14.8% YoY to N1.5 billion on account of a 18pps YoY expansion in effective taxes to 24%. At the FY 14 earnings call, Guinness’ management guided to normalization in tax rates as one-off ‘innovation’ tax holiday expires. Consequently, PAT margins are 70bps lower YoY at 7.1%.

Tempered sales outlook and input cost outlook underpin moderation in FVE

- Amid dim prospects for more aggressive pricing strategy, we see increasing displacement of volumes of Guinness’ premium brands (Foreign Extra stout, Extra Smooth and Harp Lager) by higher volumes of its cheaper value segment (Orijin and Dubic) as driving further weakness in revenues in coming quarters. A similar pattern is playing out in peer NB which is reporting upward volume growth but lower revenue per hectolitre as share of value brands in total sales increases. Although management announced the launch of a route-to-customer initiative which should see Guinness gain greater control of its distribution, we think this is unlikely to translate into sales momentum in coming quarters and have lowered our revenue growth assumptions going forward. Although tepid barley prices have been supportive of gross margin expansion, price weakness has induced cutback in global barley production with International Grains Council forecasting 5% YoY contraction in global production in the 2014/15 planting cycle. The bullish barley price outlook has resulted in much tamer gross margin expectations. The foregoing, in addition to higher finance charges on account of elevated debt levels, moderates our earnings expectation and drives our FVE for Guinness southwards (-25%) to N156. Guinness trades at a current PE of 26.1x relative to domestic peers NB and International Breweries at 26.6x and 39.6x respectively. Although the stock has declined 11% (YTD: -32%) from our last update, last trading price is at a 4% premium to our FVE which implies an UNDERWEIGHT recommendation.

Source: ARM Research