Flour Mills of Nigeria Plc (6 months ended September 2014)

- Flour Mills of Nigeria Plc (FMNL) released unaudited results for 6 months to September 2014, wherein revenues declined 1.5% YoY to N165.5 billion, while PBT and PAT declined 21% and 25% YoY to N5.8 billion and N4.4 billion respectively.

Agro allied segment drives topline recovery

- In contrast to the slowdown in FQ1 (-5.6% YoY), revenues rose 3.3% YoY to N81.6 billion (FQ2 15E: N82.8 billion). We believe this was largely driven by its agro-allied division with FMNL reporting 7% YoY contraction at its milling division. Notably, the revenue uptrend places FMNL among the few names in our consumer coverage which reported positive growth in revenues which, in our view, largely reflects improvements at its agro allied division.

Surge in other operating income bolsters operating margins

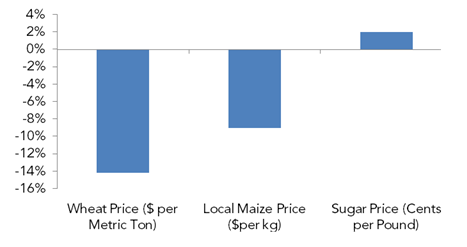

- FQ2 15 COGS tracked slightly slower than revenues, rising 3.2% YoY to N73.9 billion (FQ2 15E: N71 billion), resulting in a 4.2% YoY expansion in gross profits to N7.7 billion. We believe deviation from our forecasts largely reflects dampening impact of higher depreciation charges from Golden Sugar Refinery (GSR) on largely benign input cost trends: wheat (-14% YoY) and Maize (-9% YoY). Consequently, gross margins widened only marginally – 9bps YoY to 9.5%.

Figure 1: YoY change in mean commodity prices

Source: FEWSNET, World Bank, ARM Research

- FQ2 15 operating expenses climbed 16.3% YoY to N3.9 billion with S&D costs (the major driver) increasing 48% YoY to N1.4 billion (Q2 14E: N975 million) aided by administrative expenses which rose 3.5% YoY to N2.45 billion (Q2 14E: N2.37 billion). The higher S&D costs are in line with company guidance of higher route-to-market expenditure. Nonetheless, a surge in other operating income to N1.8 billion (Q2 14: N33 million) neutered the higher opex, resulting in a 37.4% YoY expansion in EBIT to N5.6 billion with related margins 1.7pps higher YoY at 6.9%.

Nevertheless, rising finance charges reverses gains again

- FQ2 15 net finance charges rose three-fold from FQ2 14 to N3.55 billion, reflecting the net effect of a jump in finance charges (+85.4% to N4.6 billion) and moderation in finance income (-26.4% YoY to N1.1billion). The increases in finance costs stem from higher borrowings (+49.3% YoY to N160 billion) in FQ2 15 which FMNL links to its agro-allied investments. Though FMNL reported share of profit from its cement associate, UNICEM, of N149 million as compared to a loss in FQ2 14 of N439 million, the higher finance charges resulted in PBT and PAT declining 15.6% and 29.8% YoY to N5.8 billion and N4.4 billion respectively. Correspondingly, PBT and PAT margins were contracted by 90bps and 80bps YoY to 3.5% and 2.6% respectively.

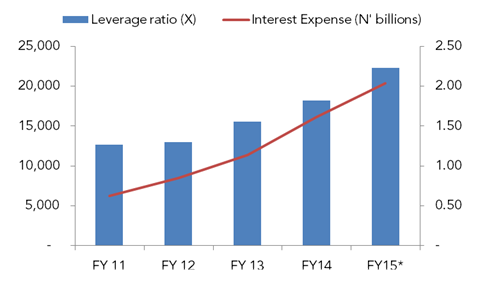

Rising leverage levels drive moderation in FVE

- Whilst recovery in revenues and largely benign input cost trends should buoy outlook for FMNL, the offsetting impact of rising finance costs on account of increased gearing constitutes a key source of earnings compression going forward. Admittedly, the higher leverage levels are linked to FMNL’s backward integration projects across rice, sugar, cassava, palm oil and soyabean which should result in higher topline growth over the medium term, nevertheless, management guides to higher debt levels with gearing ratio now at 2.23x.

Figure 2: Interest expense and Gearing

Source: Company’s data, ARM Research FY 15* — Annualised figure for FH1

Source: Company’s data, ARM Research FY 15* — Annualised figure for FH1

- Consequently, the elevated interest expense profile over our forecast horizon drives a moderation in our earnings expectations for FMNL resulting in cutback in our FVE to N59.85. FMNL trades at current P/E of 41.27x vs. 18.39x for Bloomberg regional peers with last trading price at an 8% premium to our FVE which translates to a SELL rating.

Source: ARM Research