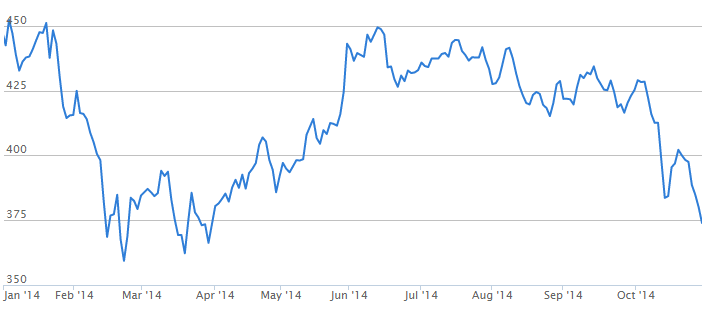

NSE BANKING INDEX. SOURCE: NSE

Following the directive of the CBN in October, Nigerian banks are seen slashing their dividend pay-outs as they seek to ramp up capital from retained earnings. In upgrading the Nigerian banking system to Basel2/3 by the CBN, banks will need to maintain adequate capital buffers to go with the increasing risk profile. The upgrade will mean that there will be significant changes to what is being regarded as qualifying capital by the banks. As a result, capital shortfalls have surfaced. In addition, the CBN has limited Tier-2 capital to only 33 percent of Tier-1.

The directive was issued “in order to facilitate adequate capital build up for banks in tandem with their risk appetite”. Being easier and cheaper to secure, the CBN is seen trying to push banks to rely more on their retained earnings (internal capital generation) rather than external capital generation.

The impact of the CBN directive on the stocks, prima facie looks to be harmless, when the CAR levels of banks are evaluated. Furthermore, the NPL ratios of most of the banks look to be in decent territory.

The third criteria, the Composite Risk Ratio, which measures the overall risk a bank faces, is however the key deciding factor as to whether a bank will pay dividends or not, or the degree of pay-out. Unfortunately, since neither the CBN nor the banks discloses information on the CRR ratings, making sure-footed decisions wouldn’t be easy.

According to RenCap, it is understood that the best rated bank is assigned a ‘Moderate’ risk rating, and a number of other banks are likely to be on a risk rating of ‘Above Average’ or ‘High’.

“The risk that a number of other banks’ Composite Risk Rating affects their dividend pay-out ratio is high, says Soji Solanke Banking Analyst for Sub Saharan Africa at Renaissance Capital.”

With this as the most likely case, RenCap “believes the case for lower dividend pay-outs from FY14E is supported.”

Hence, it is increasingly likely that a majority of banks will either not pay dividends, or pay to a lesser degree, given that they could have a heightened risk profile. This is already amidst the slow growth in bank earnings which have served to depress their stock prices.

Additionally, the banks that will not be directly affected by the CBN directive will be expected to also limit pay-outs in view of the difficult operating environment.

“We believe that this new directive in addition to the transition to Basel 2/3 combine to move the Nigerian banking system into an “era of lower dividend pay-outs”, says Soji further.

Since investors might not be benefiting from dividend pay-outs, they will expect to benefit from capital gains (rise in share price). However, from the capital gains perspective, banking stocks aren’t faring any better.

The NSE Banking Index (the index of Nigerian banks trading on the exchange, covering the share performance of ten major banks trading on the exchange) has returned -15.5 percent YtD (as at the time if writing), while the All Share Index has returned a less-severe -8.9 percent.

Worse still, share dilutions are seen as affected banks look to raise more equity. This of course, will result in reduced earnings per share, which will have knock-on implications for future share valuations.

The attractiveness of holding bank equity assets is therefore seen losing its appeal in the near term. The caveat however, is that since the NSE-ASI correlates strongly with the NSE Banking index, few stocks outside banking stocks will comprehensively outperform. The reduced dividend pay-out by banks could still compare favourably with other stocks.

NSI ALSI. SOURCE: NSE