I was chatting up with some friends a while back and we got talking about what we did with our very first salary as an executive trainee. The revelations were comical, regrettable and somewhat consoling as we reminisced on how far we have come. Here is some of what we did with our first salary starting with mine.

My first salary was about N17, 000 back in 2002 and I remember I spent a huge chunk of it on clothes, buying drinks for friends and fueling my mother’s car, which I took the work everyday. I also saved N5, 000 in a savings account following the advice of my big cousin. He told me to do that every month, which off course I hardly did after the first month. Since my salary wasn’t that much compared to my peers it was enough guarantee for me to buy clothes on credit. So, I started out with debt.

A friend explained his first salary was sent to his Father in the village, as was the custom after which his father returned half of it to him. He recalled having to borrow to get through the next month. He also started out with debt. Another friend who was from a rich family had a different experience. He used part of his first salary to buy the designer office shirts and shoes we all envied back then. He also remembered sending part of it to his girl friend that was still in university. He also spent it on hosting friends and family to celebrate his new job. He started out a spend thrift. The last but not the least said he divided his N35, 000 salary into three parts. He sent one part to his siblings in school, the other to his parents and retained the balance to get by the next month. He had to borrow to get by the next month.

Today, we look back in retrospect and agree we probably should have done things differently. Your first salary is your gateway into your financial independence and a foundation to how financially discipline you become. You have a choice of either making it a bitter experience or a giant step to financial freedom.

So, this is what you should do when you get your first salary.

Read through your pay slip: Your pay slip is a statement of how your take home pay is arrived at. Understanding, what is in there is a crucial part of financial discipline. In your pay slip you will find things like PAYE (tax deductions), pension deduction, NHF contribution and any other statutory deductions that may be charged to the debit (outflow) of your salary. To the credit (inflow) of your pay slip will be your basic salary and all the allowances due to you. The difference of what is debited to your salary and what is credited is your take home pay. Why is this important? The more you add to the debit side of your salary the lesser your take-home pay. So, you always want to make sure your take home pay is the most you can get out of your total package every month.

Open a current account: Most entry-level employees already operate one type of savings account or the other. If you do not have a current account then you need to open one to enable you pay in cheques from third party banks. Current accounts do not pay you interest unlike savings accounts but they open you up to a vast array of financial services that will benefit you as you begin your financial life. Current accounts often require high deposits to open one but surely there are ways around this.

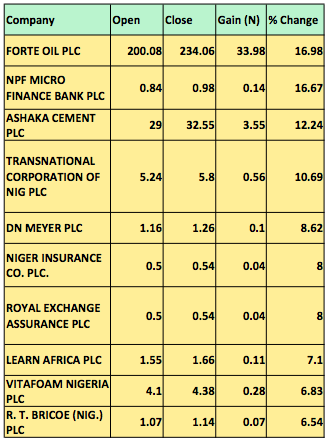

Open a CSCS Account: A CSCS Account is an account you open when you want to invest in stocks, bonds or treasury bills. It doesn’t’ cost much to open one and it remains with you forever. You can open one yourself or have your stockbroker do it for you

Open a Stockbrokerage Account- A stockbrokerage account is an account you open when you want to invest in stocks by yourself. It is also cheap to open one and requires a minimum deposit depending on the stockbrokers. You can give them a CSCS account if you have one or instruct them to open one for you.

Start Investing – No better way to begin spending your money than to start investing a part of it in your future. With your current account and your CSCS account opened, you can invest a portion of your salary in stocks, bonds, treasury bills etc. Trust me, the feeling that comes with ding that is fantastic.

Save and keep saving – Part of your first salary should remain in a savings accounts maintained by you. This is where you should keep any money you want to use to fund or part finance your first car, house rent or some of the things that help you start your life journey. This is your first seed.

Upkeep – Now that you have started earning your keep you have to fund your upkeep. You want to rely as much less as possible on family to help you get by. You should make sure that whatever is left of your salary after the steps above is enough to feed you and transport you to work everyday.