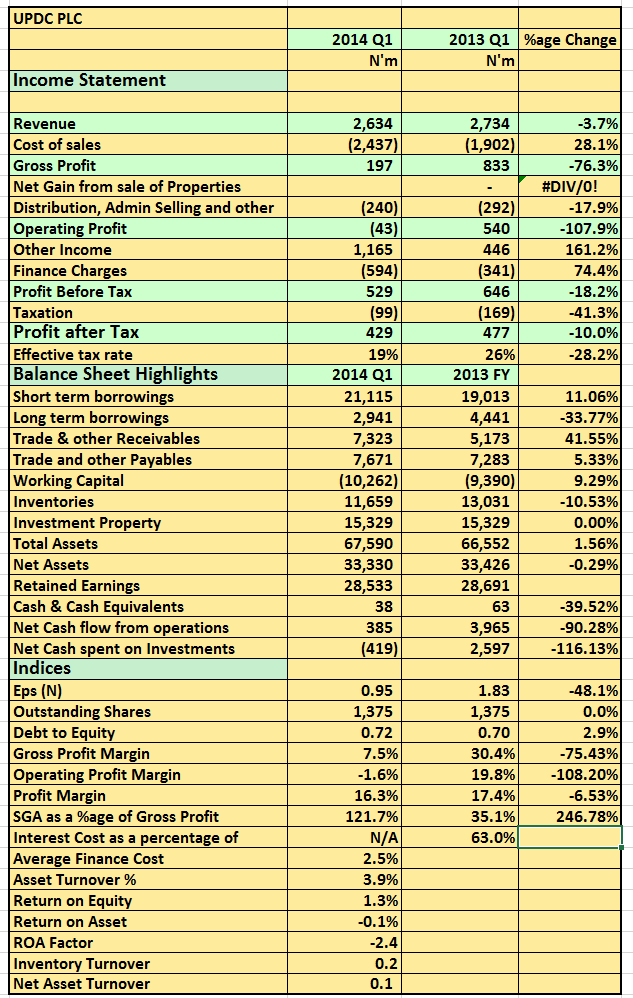

UPDC released its 2014 Q1 results showing a 3.7% drop in revenue to N2.6billion compared to N2.7billion a year before. Pre-tax profits for the period was N529million an 18% drop from N646million posted a year earlier. Key take outs of the results are as follows;

- Gross profits are down a huge 76% this quarter. This may suggest a rising cost in hotel operations. A margin of 7.5% is small by any standards

- Operating loss of N43million was a no brainer considering the drop in Gross profit

- As usual income from flipping of properties (the ones not in stock) came in handy. The earned N1.1billion from that helping the company achieve a pre-tax profit of N529million

- However, cash balance is very low at N38million, suggestive of a deal that is not backed by cash. No wonder trade receivables rose 41% to N7.3billion.

rrrrr