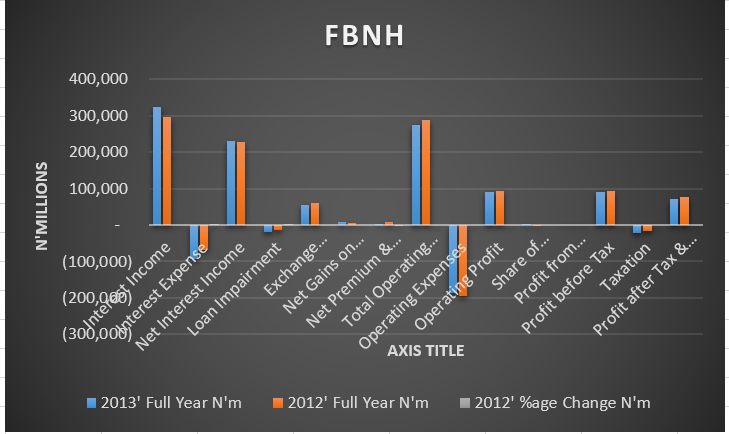

FBNH Plc the parent company of First Bank released its 2013 FY results showing an earnings per share of N2.25kobo an 8% drop from the N2.45 posted a year earlier. Other highlights of the results are as follows;

- Net Interest Income rose 1.5% only to N230billion compared to N226billion posted in 2012

- Net interest margin was 71% this year compared to 76.7% a year earlier

- Impaired loans during the year rose 61% to N20billion as the Bank claimed it had to write off loans to small and medium scale industries in other for it to take remedial actions against them. This allows the bank go after the debtors writing back successful recoveries into profits.

- First Bank has now written of about N70billion in loan losses since 2011.

- Income from commission and fees dropped 9% to N54billion much of which can be attributed largely to the reduction in C.O.T Fees. At N54billion income from commission and fees still remains one of the highest in the industry but the likes of Zenith is fast catching up having earned N52billion themselves in 2013.

- FBNH and its numerous subsidiaries does incur huge operational expenses. This year, thought operational expenses did drop 4% to N185billion (2012: N193.5billion). Thus N78 of every N100 in operating income is spent on opex alone.

- Profit after tax at the end of the period was N70.6billion an 8% drop from the N76billion posted a year earlier. FBNH is surely no more the dominant profitable financial institution it used to be as the likes of GTB and Zenith posted better returns despite not having as much total assets

- FBNH now commands a total asset base of a whopping N3.8trillion. It is only able to post a return of 2.6% on those assets again lagging behind Zenith (3.8%) and GTB (5.6%)

- Return on equity for the period was 19.6%, 10% the likes of GT Bank which posted 29%

- Cost to income ratio by our estimates remained stubbornly high at 63%

Sorry if I sound so lame or greedy, but the dividend is what matters right at this time. 😀